Top 22 Warren Buffett Quotes the Internet Can’t Get Enough Of

Warren Buffett, CEO of Berkshire Hathaway, has a net worth of over $78.2 billion and is known as one of the greatest investors of all time. So when he speaks, people take note.

Here are some of the top 22 Warren Buffett Quotes the internet can’t get enough of.

Top 22 Warren Buffett Quotes The Internet Can’t Get Enough Of

Here are some of the top Warren Buffet quotes found on every list of Warren Buffet quotes around the internet. These quotes range in wisdom on investing to regular life. I try to live by these quotes on my own investment portfolio.

Warren Buffett Quotes

1. Rule #1: Never lose money. Rule #2: Never forget rule #1

One of my favorite Warren Buffet Quotes. The fastest way to grow your money is to never lose it in the first place. This applies from saving on your groceries to focusing on less risky stocks of well established companies.

2. It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently

Think about the Wells Fargo or Equifax scandals. It takes years to build enough trust for someone to have brand loyalty. Warren Buffet quotes it takes 20 years, but it takes 5 minutes or less to destroy all that goodwill you’ve built. People are quick to revolt if you’ve done anything to betray their trust.

It is infinitely harder to build trust than destroy it.

3. Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing.

Multiple studies show that diversification in the stock market will help protect you against market falls. Or it could be summarized in the old proverb “Don’t put all your eggs in one basket”. Unless you have insider information that a stock is going do really well, maintain a diversified portfolio to protect you. No one knows what they’re doing all the time.

4. If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio’s market value.

Unless you’re a day trader (I will never be), you should only be investing in the stock market with the intention to hold those stocks for a long time. You can do really well as a beginner if you’re buying stocks and not planning on selling till you retire. Those are where you get the best returns. Warren Buffett is infamously known for rarely selling stocks.

5. It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

When you buy a stock, you should think of it as owning a piece of that company. You should be looking at wonderful companies that have a competitive advantage in the industry. Those are the companies that will do well over the long run. You may find a wonderful price on a mediocre company, but really what are you getting? A mediocre company that will likely be edged out of the market by a better company.

Many of the famous Warren Buffett quotes are about investing in strong companies with a competitive advantage and strong brand loyalty rather than cheap companies where you think you can make a quick buck. Warren Buffett is never into buying a company for a quick buck.

6. Be fearful when others are greedy. Be greedy when others are fearful.

During the 2008 financial crisis when investors were all exiting the market, Warren Buffett invested in a few large companies even though their stock prices were falling. Those deals made Warren Buffett over $10 billion dollars when the market stabilized and it’s continuing to show dividends. When the market goes upside down during world events, politics, market forecasts, those are the times when everyone else is fearful, that Warren Buffet sees an advantage when the markets crash.

Think about it this way, the New York Stock Exchange has been around since 1817, it has always recovered. Chances are, minus a world apocalypse, that the market will always bounce back. Those who capitalize on those downturns are usually rewarded.

7. The difference between successful people and really successful people is that really successful people say no to almost everything.

One of my favorite Warren Buffett quotes because it has so many applications. You will see many opportunities in your life and you may want to jump on everyone, but it’s ok to be selective and say no. You’ll burn yourself out if you say “yes” to everything. This also applies to going out on a Saturday night with friends drinking. It’s ok to say “no” to save a few dollars or have a night to yourself to finish your article on Warren Buffett quotes. =)

This also applies to going out on a Saturday night with friends drinking. It’s ok to say “no” to save a few dollars or have a night to yourself to finish your article on Warren Buffett quotes. =)

8. Develop and build the habits you admire in others.

Remember all those times that your parents wanted you to hang out with those “good kids”. The habits of the people you surround yourself with rub off you on, consciously or unconsciously. When you find people like Warren Buffett, the Oracle of Omaha, who is one of the greatest investors of all time. You should find out what makes him so successful and learn those traits to improve yourself.

9. Passive investing will make you more money than active trading

Oh my goodness, fees are the WORST! Active trading requires more work and more fees, so more of your money will be paid to your broker. Yet studies have shown over and over that passive investing where you set your money and forget it are far more successful for growing wealth. I don’t plan to ever touch my stocks currently making dividends.

10. There seems to be some perverse human characteristic that likes to make easy things difficult.

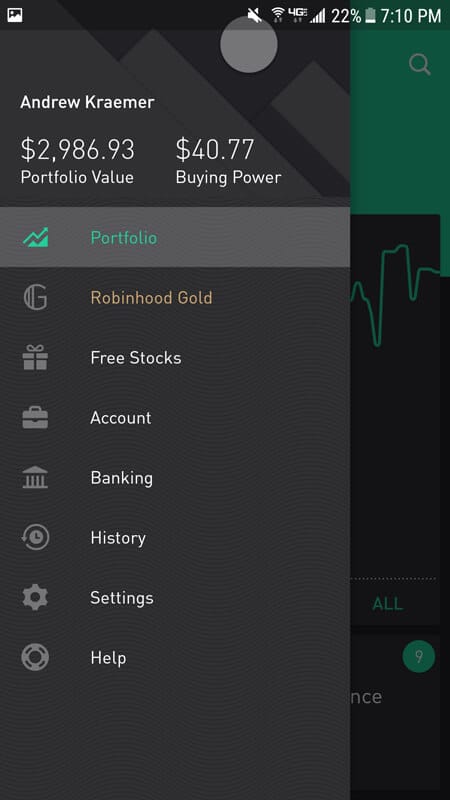

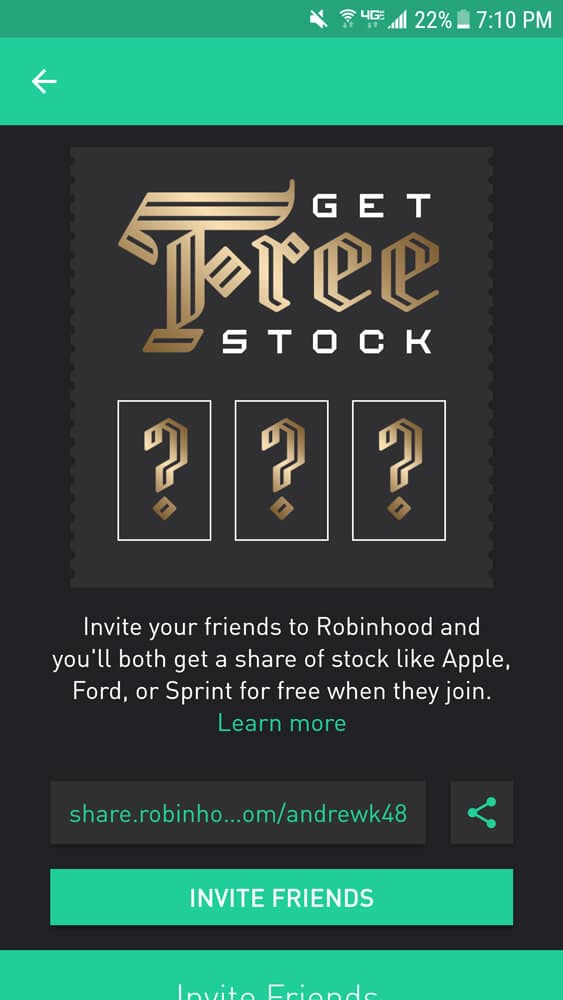

Great quote, people always imagine things are more difficult than they really are. When I first considered starting investing, I thought there were so many hurdles and financial experts I would have to pay. Yet, when I finally decided I wanted to start investing in the stock market, I just downloaded the Robinhood App and started investing. It took 10 minutes to sign up and buy my first stock when I worried about investing in the stock market for over 5 years. Things are often more simple than you think they are.

11. Tell me who your heroes are and I’ll tell you who you’ll turn out to be.

This is similar to the Warren Buffett quote “Develop and build the habits you admire in others”. If you want to be an entrepreneur, start joining local meetups of entrepreneurs. You learn SO MUCH MORE when you surround yourself with the people you want to be like. You can learn A LOT in a book, but you’ll learn even more by surrounding yourself with people you admire.

12. We have long felt that the only value of stock forecasters is to make fortune-tellers look good.

No one can predict the stock market, no one. Not even Warren Buffett. Anyone who says they know exactly how the market works is trying to sell you something. You can lump stock forecasters being as accurate as the carnival fortune-tellers. You know the ones with 3 teeth, crystal ball and you’re going to die in 2083.

13. When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.

If you invest in an outstanding company, even if the stock price goes up, why would you ever sell it? No matter when you sell it, outstanding companies will continually do better and better. Don’t sell until you absolutely have to, otherwise, you’ll just be losing money in the long run. Many of Warren Buffett Quotes are like this, they are all very Anti-Day Trader.

14. You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.

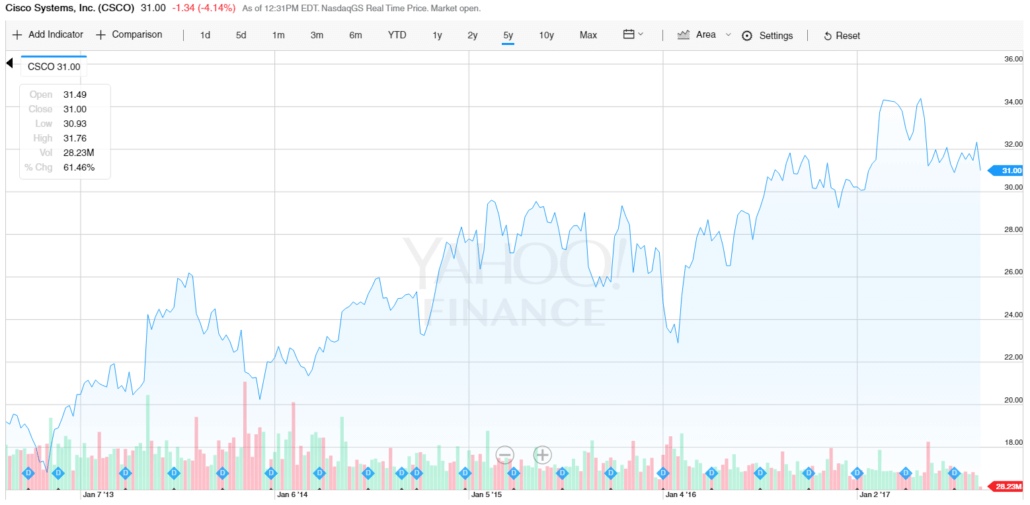

If you follow the basic principals of Warren Buffett and buy outstanding companies with strong competitive advantages like Apple (AAPL). You don’t have to be a genius. Just buy and hold forever, you literally don’t have to do anything until you sell.

Many Warren Buffett quotes are similar to this because he stresses that anyone can invest in the stock market. The simplest way is just to invest in index funds that follow the market. Set it and forget it. The market sees an average increase of 7% per year and that’s WAY better than a savings account.

15. I try to buy stock in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.

Look for companies to invest in that are so strong that they can weather any storm because soon enough they will have to. Think about Apple (AAPL), as long as they keep pushing out iPhones it doesn’t matter who runs the company, they’ll continue to do well. People were worried when Steve Jobs passed because they didn’t know the future of the company, but Tim Cook stepped in and maintained the same Apple legacy. As long as Tim Cook sticks to the secret Apple recipe, they’ll be in good shape.

16. Buy into a company because you want to own it, not because you want the stock to go up.

If you see a company that you think is going to do well or heard will do well, don’t buy it unless you’re willing to hold it for awhile. If something goes wrong and the stock dives, you’re stuck with a company you don’t believe in and will likely sell at a lower price to get rid of it, ruining the reason you bought it in the first place.

17. Wall Street is the only place that people ride to work in a Rolls Royce to get advice from those who take the subway.

This is just a funny Warren Buffet quote.

18. Charlie and I have not learned how to solve difficult business problems. What we have learned is to avoid them.

I’m sure Warren Buffett and Charlie Munger have learned how to solve difficult business problems, but the best way to navigate murky waters is to avoid them all together. The more problems your business can avoid, the better shape you’ll be. You can avoid a lot of problems from being proactive instead of reactive.

19. Long ago, Ben Graham taught me that “Price is what you pay; value is what you get.”

Ben Graham, Warren Buffett’s mentor had this popular quote. I always think about it simply. Price is what you buy a stock for and Value is what you sell that same stock for.

20. It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.

If you can’t tell, Warren Buffett believes in surrounding yourself with the right people. He credits much of his success from surrounding himself with smart, good people.

21. If past history was all there was to the game, the richest people would be librarians.

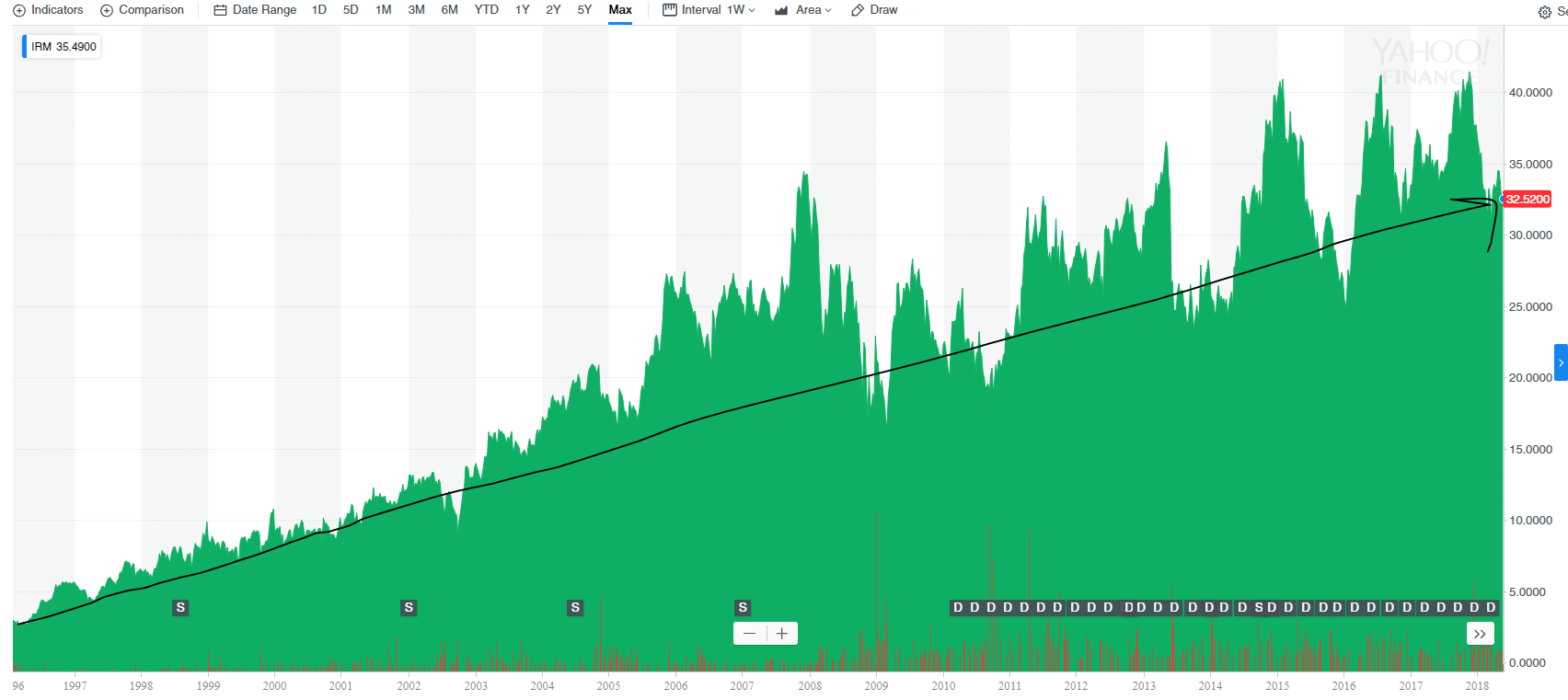

When you analyze a stock based on its historical performance, it’s called technical analysis. Yet past performance does not necessarily mean future performance. Just because you know what the stock has done in the past doesn’t mean it’s going to follow that same trend.

22. You only have to do a very few things right in your life so long as you don’t do too many things wrong.

It’s ok to mess up, focus on learning from those mistakes for the next time. It just sounds cooler when Warren Buffett quotes it. Or you can take this as no matter how many mistakes you’ve made in the past, you always have a chance to do more good. It’s one of those life quotes that can go many ways.

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!