9 Useful Financial Planning Tips For 2018

The following is a guest blog post by Adam (different Adam), the editor for content, from Financial Planning Platform.

I’ve always been passionate about financial planning. I love using my knowledge and skills to craft plans that can work for others. As a financial planner, I’ve seen first-hand the benefits that a sound financial plan can bring. At the same time, I’ve also witnessed the problems that can occur due to bad advice or inadequate planning.

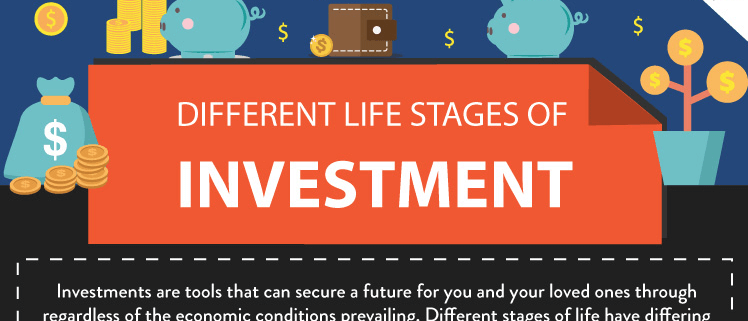

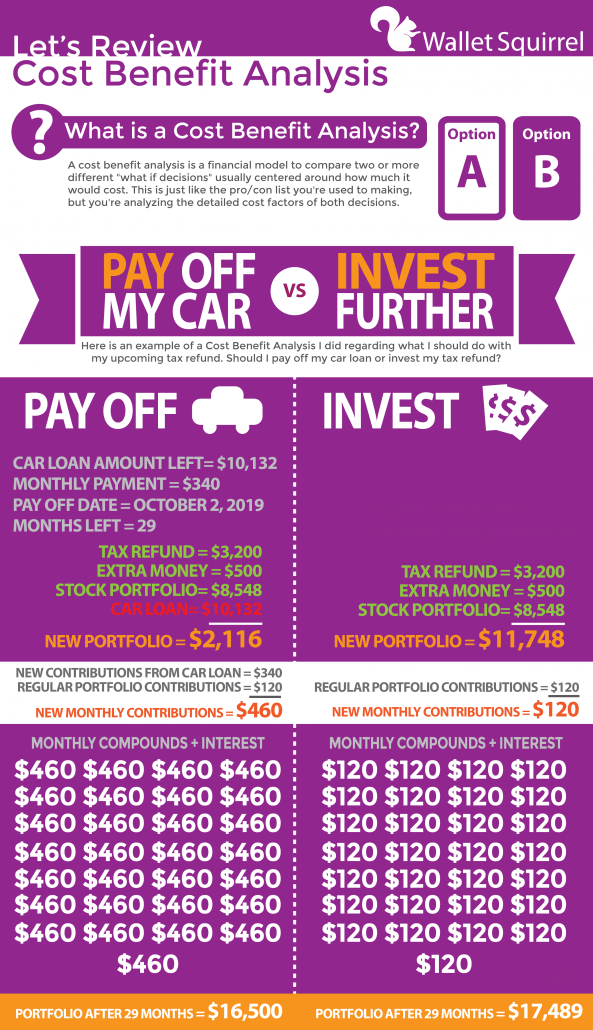

In fact, when I was younger, I set up college accounts for my children. But I didn’t realize that these financial plans would become inadequate with the changing times. In order to keep any financial plan current, there is plenty of follow-through needed. In situations such as these, it is essential to read as much as you can and stay updated with current trends. For more information on the different stages of financial planning, take a look at the infographic below.

Please include attribution to financialplanningplatform.com with this graphic.

Here are 10 useful financial planning tips to help you start the year on a good note. They will help you create a roadmap to balance your current expenses and plan your economic future.

1. Assess Purchases by Cost Per Use

You may think that you’re saving money by buying a trendy low-priced t-shirt, rather than a more expensive, basic shirt. But by doing this, you may be forgetting the quality aspect. A good thing to ask yourself when deciding whether to purchase an item of clothing, tech toy or kitchen gadget is how many times you’re likely to wear it or use it. You could even take this a step further when it comes to experiences by considering cost per hour.

I prefer a capsule wardrobe with a limited number of core, high-quality pieces. This way I can mix and match these quickly to put together outfits.

2. Manage Your Debt

It is necessary to have a strategic debt management plan to put an end to accruing debt that you can’t get out of. One strategic approach to debt management is paying off the most expensive debt first. Get rid of any credit card debt first and then begin paying off your personal loans, student loan debt, and housing debt. In order to avoid future liabilities, look for areas to cut back on spending and learn to spend smarter.

I used to find myself ordering in for dinner or buying a coffee every day. I put an end to this cycle by buying a coffee machine or cooking more often at home (or how Andrew saves money with PBJs). Doing this helped me save tons of money in the long run.

3. Save In Tax-Efficient Ways

The money you save is more important than the money you earn. Whether you’re saving for retirement or to withdraw the money at a later date form your accounts, always opt for tax-efficient ways of saving. With the help of a financial planner, determine how to save to meet your various objectives. Given all the different types of investments, products, and accounts you can use, it is important to choose the right saving methods.

4. Try Not to Tap into Your Retirement Account Early

Unless you absolutely must, do not dip into your retirement funds. Doing this will affect your financial standing dramatically. You will negate all the hard work you’ve done saving so far and prevent the money from being invested. Secondly, you’ll be charged a substantial penalty for early withdrawal. Additionally, you’ll have a tax bill to deal with for the money you take out. Keep all these factors in mind and make cashing out early your last option.

Only dip into your savings if you have one of the following emergencies occur: you lose your job, your car needs repairs, you have medical bills, your home requires emergency repairs, or you have unexpected funeral expenses. Otherwise, just say no, if you can’t afford it.

5. Have an Emergency Fund

You’ve probably heard this one many times before. But it’s wise to keep this in mind. No matter how much debt you’ve built up in the form of student loans or credit card bills, it is important to put some money aside every month. This could be a small amount, but it will serve as your emergency fund. It can get you out of any financial tight spots and keep you out of trouble. You will also be able to sleep better at night, knowing that you have a backup plan. To get into the habit of saving money, start treating it as a non-negotiable monthly expense. By doing this, you’ll soon have enough money saved up and may even be able to take that long-overdue vacation.

I didn’t just hide my emergency fund under my mattress. I put it away in a high-interest online savings account to ensure that inflation didn’t erode the value of my savings.

6. Direct Deposit to See Your Money Grow

If the money you set aside for your savings, never comes to your checking account, you probably won’t miss it. Even though you know the money is part of your paycheck, it will make you feel like it comes out of thin air. You may even be pleasantly surprised by how much your savings grow over time. This is also an excellent way to get your emergency fund started.

7. Don’t Forget Your Estate Planning

Estate planning for families is an important aspect of comprehensive financial planning. In the case of premature death, there must be enough assets to take care of expenses and family needs. The amount of money necessary and the amount that needs to be liquid will be determined by the time frame of these requirements. To provide for the needs of your family, there are different types of savings you can consider such as life insurance policies, personal savings and employee benefits. Your will, beneficiary designations and individual assets must be reviewed periodically to ensure that your family needs will be matched by the funds available.

8. Discuss Money with Your Loved Ones

Couples sometimes hide their finances from their partners, and this can have a negative impact on their relationships. Take the time to talk to your partner about your plans for the future and financial goals. Come up with a shared vision of what you want your future to look like. If you’re a parent, spend time teaching your children about money. They pick up on money messages based on how we handle money whether we teach them deliberately or not. Even a small conversation can go a long way.

9. Stay Motivated

Most of us experience some amount of stress when it comes to our financial situations. When this stress is money-related, it can feel overwhelming. Find ways to deal with these feeling and stay motivated no matter what. One way to do this is by writing down the various reason why you’re stressed out. Focus on the problems that are bothering you the most and try to find solutions for these. For instance, if you’re stressed out that you never pay your credit card bill on time, try setting a reminder on your phone or opt for automatic payments.

Conclusion

You don’t need a particular educational background or fancy degrees to be able to manage your finances well. Do your research, stay aware of changing trends and consult a financial planner if necessary. If you follow the tips mentioned in this article to manage your finances, you can find stability and prosperity. So, get started now to secure your future financial wellbeing.