Robinhood App Review: I saved $420 in trading fees in 6 months

While I have recently updated this Robinhood App Review, it still holds true that the Robinhood App has saved me $420 in trading fees in my first 6 months of buying and selling stocks on the stock market.

However, our article is now updated to reflect 5-years later those savings have grown to over $1,631 in trading fees saved!

Since my initial review in 2015, the Robinhood App has grown into a wildly popular stock trading platform and their $0 trading fees have become industry standard. Companies such as Charles Schwab, Fidelity and more have all moved to $0 trading fees simply to compete with the Robinhood App now valued at $8.3 Billion (source). With all these companies reducing their fees, the average customer is the real winner, thank you Robinhood.

Nowadays with every brokerage platform offering free trades, Robinhood still holds a competitive advantage (especially with millennials) due to how simple it is to buy and sell stocks.

That’s what we’re going to look at today!

What is Robinhood?

Robinhood is a mobile app (plus now website interface) that allows anyone to buy and sell stocks on the stock market. Plus recently, users also have the opportunity to buy and sell cryptocurrency.

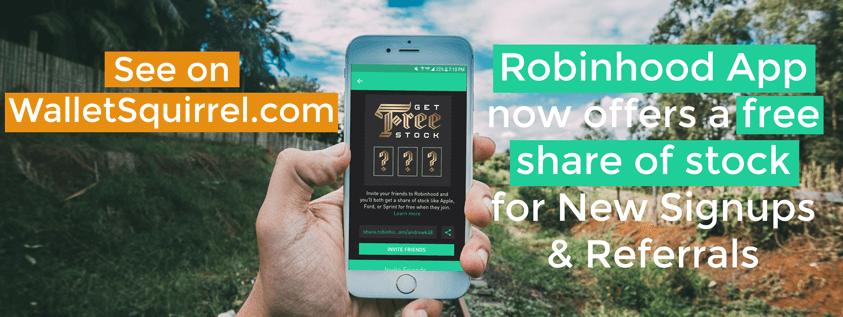

Robinhood offers $0 trading fees

Initially for this Robinhood App Review, Robinhood’s biggest claim to fame was that it had $0 trading fees. This was a big deal because at the time most brokerage accounts charged $7 – $10 per trade. Meaning if you wanted to buy 1 share of Apple (APPL) or 50 shares of Apple, most traditional brokerage accounts would charge you $7 – $10 in addition to the stock price for the privilege of purchasing that stock. Plus another $7-$10 whenever you sold it.

This obviously sucked because those fees would add up and drastically cut into your profits, especially for younger investors who could only by 1 share of stock at a time.

The Robinhood App wasn’t the first start-up to offer $0 trading fees, but they are one of the most well-known to have done it successfully. So much so, that it became industry standard. If you’re wondering if they don’t offer fees like other brokerages, how do they make money? I’ll explain below in a moment.

Incredibly Easy To Buy/Sell Stocks For Beginners

The target audience for Robinhood is the millennial investor, around the average age of 24 who recognizes the benefit of buying a stock like Amazon (AMZN) but intimidated by the often mysterious process of purchasing a single share of stock.

Robinhood wanted to make the process simple, easy, and fast, so they designed an elegant and intuitive process for buying stock. Simply find the stock ticker you want and hit “buy” and confirm with a swipe.

I have personally used other brokerage accounts in the past and grown headaches for the unnecessarily complex design and clunky software. Those experiences have produced a deserved fondness for the ease of Robinhood. Since then, many of my friends have switched to the app.

It’s worth noting that Robinhood has received some negative press over some individuals who have lost a significant amount of money on Robinhood because they say Robinhood makes it “Too Easy” to buy and sell stocks. While I feel terrible for those individuals, I can not fault Robinhood making such a successfully simple solution for people wishing to invest in their own financial future. We should encourage these simple solutions to complex problems, like the iPhone, Internet, and Indoor Plumbing all making our lives easier.

This ease-of-use has allowed me to build my own stock portfolio now worth over $10,000 that we track here on Wallet Squirrel.

How Robinhood Makes Money

If you ever want to understand a company, understand the way they make money. Nike and Gap use child labor to make a higher margin. I’m not here to judge, just a shining an example of why you should understand the fundamentals of how profits are made. For our Robinhood App Review, we have to look at the finances.

Robinhood makes money by:

- Collecting Interest from the cash you have lying in your brokerage account that isn’t invested. For example, if you have $1,000 in your account and haven’t yet bought any stock. The Robinhood App gains interest off that $1,000 similar to how you would gain interest on a savings account. You won’t ever lose money sitting in your brokerage account, but it’ll simply be there gaining interest for Robinhood, so invest it! This is a pretty common practice for most brokerage accounts.

- Robinhood Gold is an additional subscription ($5 monthly fee) that gives you additional research tools, larger instant deposits (typically any deposit up to $1,000 is instant, otherwise you need to wait 3 days) and margin investing. I typically don’t recommend this for beginners and use Yahoo Finance for all my investing research.

- Rebates from Market Makers and Trading Venues this means when you buy certain stocks, ETFs (Electronic Traded Funds) and options. Robinhood sometimes recieves a rebate (money back) on the back end if they have a relationship with some of the companies they purchase stocks, ETFs or options from. It’s like getting a rebate on a cell phone, but instead of a discount, Robinhood gets to pocket that money. It doesn’t affect you, but it’s a nice little boost to Robinhood’s profit line.

- Stock Loan Income meaning Robinhood Securities earns income from lending stocks purchased on margin to counterparties. This is more for advance users.

- Cash Management is the debit/credit card that Robinhood started. It earns fees from your card like a typical bank would see.

All in all, these are a nice way to help Robinhood make a profit without charging you additional money. It’s pretty clever.

Robinhood App Review: My experience

I initially signed up for Robinhood because they have a great deal when you use this Robinhood App Referral Code, you will automatically receive one random share of stock. I am happy to say that our referral code won a free share of Apple (AAPL) now worth over $400. It’s worth signing up for the free money. One of our favorite ways to make money.

Signing up: Pretty simple. I downloaded the Robinhood App from the Google Play store on my android phone (also available for iPhones). You will fill out the same info you would open a bank account. You will have to give your social security number, so be warned, but this is the same info you’d give to any brokerage account. It just feels weird because you’re doing this all over the phone.

Once you register and sign in. You don’t have to use your email and password every time. You can set up a 4 digit pin for security or a fingerprint if you prefer for quick access.

Connect your bank account: Everything is electronic, so you need to connect your bank account. Both traditional brick & mortar banks, as well as virtual banks, will work. I connected both my Wells Fargo account and Ally bank account. Keep in mind, when you sign up, you won’t be able to trade right away. There is usually a 5 business day waiting period once you sign up. This is usually just for Robinhood to verify that your money (a few cents) can be sent to your bank and back.

Is it weird doing everything over an app? There is definitely an adjustment period where you need to get comfortable trading over the app. I’ve never traded over anything before this, but it turned out quite easy. There aren’t many buttons, so for our Robinhood App Review, it was pretty straight forward.

- Search for your stock ticker

- There is a large buy button, click it

- There is a verify screen, where you must swipe up to verify. This removes people who accidentally double-tap from making mistakes.

- Done.

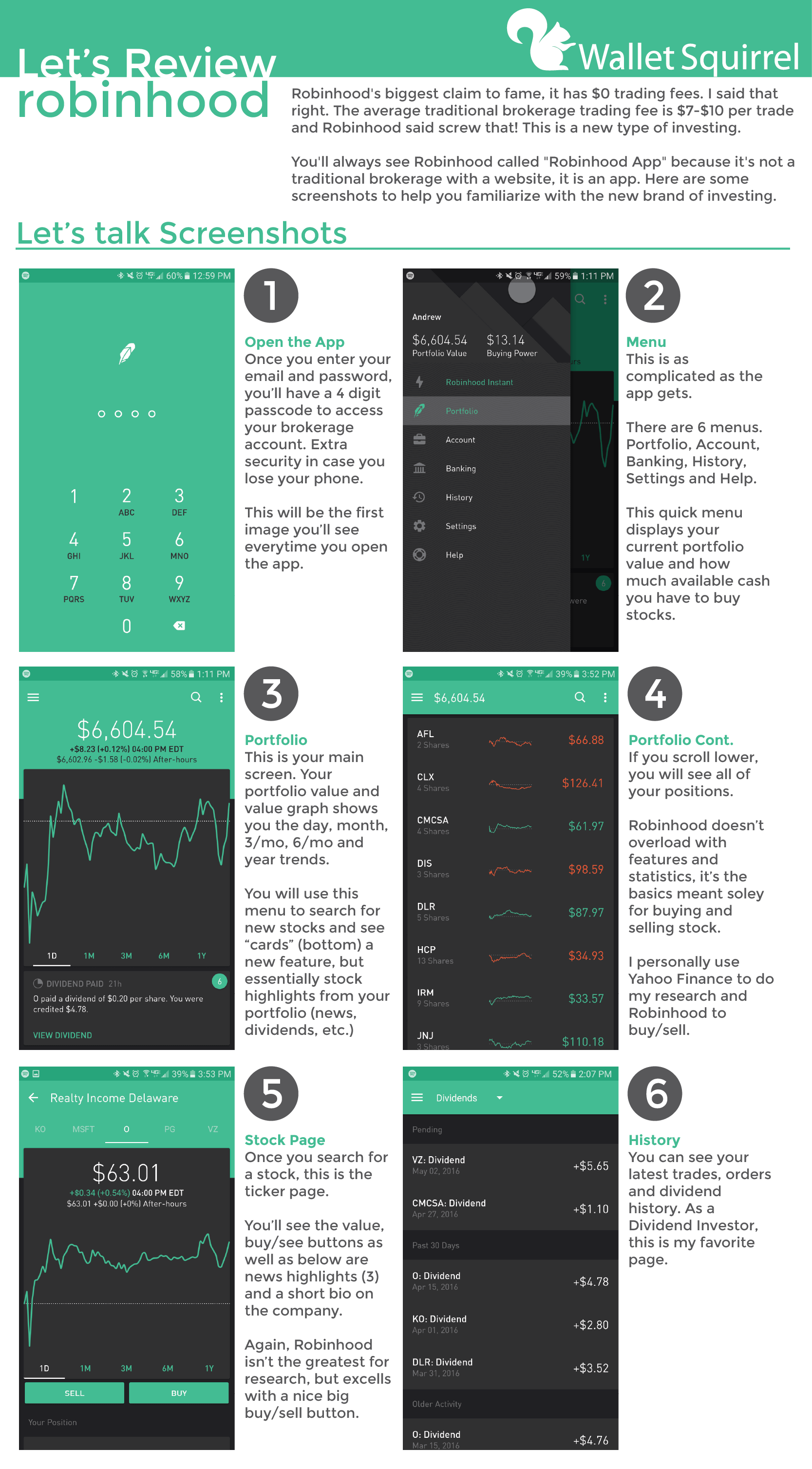

Here is a look at what the Robinhood App looks like.

What I Like About the Robinhood App

In the past 5 years, I have done over 233 trades. Most of these are buying a single share of stock at a time because that’s all the money I have to invest.

For me personally, I buy stocks that offer dividends because this matches my dividend investing strategy. I like the idea that I can regularly earn money from a stock without ever selling it by collecting the dividends they produce for stock shareholders. This way I rarely worry about the stock market going up or down because I constantly am collecting dividend payments. Here are all the dividend stocks I own.

Since I did mention earlier it’s easy to buy stocks on Robinhood. Here’s an example.

I can receive a notification that Realty Income (Stock Ticker “O”) has decreased in value over 5% and immediately open the app, hit buy, select the number of shares I want and swipe to confirm. All within 10 seconds I can buy stocks whenever I feel with absolute ease. I’ve done this during work meetings, walking in the park, and eating out with friends.

All investing should be this easy and free to use.

What I Don’t Like About the Robinhood App

- The biggest issue with Robinhood is the three business day wait period. If you transfer money to your Robinhood brokerage account on Monday, it won’t be available till Thursday. If you sell a stock, you won’t have that cash available to you till 3 business days. Yes it sucks, but I have more time than money. Easily worth $0, but worth sharing. Just wait till Robinhood Instant is revealed to everyone.

UPDATED 9/22/2017 – There is no more wait period for Robinhood Instant. It’s open to everyone, so no more 3 day wait period for your investments. This is awesome! - There is no website to access your stocks whatsoever. That means I can’t connect it to Mint (my money manager). Mint as consistently stated that since Robinhood doesn’t have a website, it can’t connect to the brokerage account. So my true financial worth isn’t provided. This does kind of suck.

UPDATED 11/1/2017 – Robinhood now has a website interface so you can check your stocks on your computer. Plus it now integrates with Mint, one of my favorite apps. - There is no in-depth analytics to analyze stock values. It gives the basic info, but I usually use Yahoo Finance to do my research and just use the Robinhood App for pulling the trigger. With so many great analyzing tools on the web, this isn’t the biggest loss.

UPDATED 9/29/2016 – Robinhood launched Robinhood Gold with additional research tools however, it cost $5/mo. I still prefer using Yahoo Finance. It’s free and a great tool! - I would be remiss if I didn’t mention the recent glitch Robinhood had. I once woke to find that Robinhood glitched out and didn’t display my portfolio value. In total shock, I absolutely froze from fear. My balance went from $6,604.54 to $8.14 (which was my available cash). I immediately noticed that I still had all my stock positions, but it simply wasn’t totaling correctly. I knew since it was displaying my available cash instead of the portfolio value, this was a glitch and pulled the wrong info. Customer service was promptly reached and they fixed the issue in a couple of hours.

UPDATED 8/11/2020 – This hasn’t happened since.

Notice how all those negative comments have been fixed over time from the original Robinhood App Review?

Robinhood is constantly growing and improving. They still have a start-up mindset by listening to customer’s feedback while being large enough to have an $8.3 billion evaluation. I use this app daily and simply haven’t found a better investing solution.

Would I Recommend the Robinhood App, Yes.

How great is Robinhood that when you signup, you get a free random share of stock? We won a free share of Apple (AAPL) with the referral code.

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

Wallet Squirrel,

Thanks for sharing this! I have also been using Robinhood for a while now. It is a great feeling to not worry about commissions. You can literally by a share of a company whenever you have enough for one single share! Couldn’t have wrote it better myself. I look forward to Robinhood Instant!

– The Dividend Mogul

Thanks Dividend Mogul!

I completely agree, when I have $54 in my account, I expect to buy $54 worth of stocks. I know a lot of Dividend Investors like Scottstrade and DRIP investing, but I’m good with reinvesting those dividends in other stocks that I choose and not paying $7 – $10 per trade.

I am EXCITED for Robinhood Instant, currently 51,397 of 241,662 in line. It’s going so slowly though. No worries, I’m good with the 3 business day wait times for now.

I used Robinhood when it was in beta. I liked the app, however I stopped using it for now. I’m trying to build up a portfolio with one broker so I can sell covered calls. I cannot do this with Robinhood, so it’s not what I’m using today. I do like the service though. I’m hopeful that they will auto DRIP and add more features in coming years. Thanks for the great review.

Ha ha ha I just had to look up “selling covered calls”. I didn’t know about this. I’m still wrapping my head around all the options we have as investors. I’m still on simple buy and hold which Robinhood has worked perfectly, but that sounds cool!

I think with the way Robinhood is growing, they will soon add other options such as auto DRIP following their Robinhood Instant roll out. Hopefully, other brokerages will try to compete and make their features more cost effective. That’s the way I see the future of brokerages going at least.

WS,

Thanks for sharing and putting me onto Robinhood! Its always nice to save where you can. Keep in touch

LOMD

Always great to read a review from someone that actually uses the product. I always say that if I was starting out today I would go to Loyal3 or Robinhood. It’s great not having to pay a commission as you can place very frequent and very small dollar value trades. In all, I can’t complain. My current commission schedule is $2 a trade with Sharebuilder from a legacy deal they had for Costco members. Thanks for sharing.

I’m excited to share the new tools I find. Hope you like it! I’ll definitely continue to use it and enjoy $0 free trades.

Thanks for sharing. I don’t know much about the service but it looks interesting. I jumped on Motif and plan to build up that portfolio before I get another broker. If Robin Hood ever gets a DRIP program, I’d be very interested.

$2 is the cheapest I’ve heard of from any dividend investor. Way to go!

I might try/write a review about Loyal3 in the future, we’ll see. I think the biggest thing it has going for it is the opportunity to invest in IPOs. I just don’t like the limited amount of stocks you can buy. Thanks for commenting!

It’s a pretty interesting business model. I think it’s definitely a contender for beginner dividend investors. I’m hoping they get DRIP in the future, but I’ve never been a big fan of the DRIP program. I personally like being able to reinvest my cash from dividends into new stocks.

Maybe since I talk/think/write about dividends all the time, I’m pretty active in reinvesting them right away. =P

Hey there, nice review, I definitely learned a few things. I don’t think this is in Australia yet, it will be interesting to see if they do.

I do hope the big firms take note of how much cheaper it is to do investing through this and then lower their fees.

Tristan

Sadly Robinhood hasn’t arrived in Australia yet. I can’t wait to try it out.

I use Motif as well as Firstrade for dividend investing. The lack of DRIP for these accounts is actually a plus for me: I only like DRIP for ETFs or mutual funds. Motif has a few drawbacks, but not much, and it’s only a headache around tax time :). Robinhood seems like a very attractive app, but not being able to link it to Personal Capital is too bad.

My question with Robinhood is: what’s the endgame? Let’s say you manage to accumulate a large portfolio $30 at a time. When you finally own 100 shares of 20 companies, does Robinhood still make sense? Or will you basically have to transfer to another institution/platform?

I will probably stick with Robinhood up to $500,000 (max insurance rate for most brokerages) and only for dividend investing. If I ever try out day trading or options, it doesn’t make a lot of sense with the 3 day wait periods after selling or transferring money into your bank. It really only makes sense for beginning investors in my opinion.

As for the end game, I think they are starting small and growing. They are currently looking for a web developer and I’m curious to see if that means they’ll soon have a website brokerage. If so, you’ll be able to link up with Personal Capital (or my favorite Mint) in the future. Overall, I think Robinhood has a lot of room to grow and will start loading up on more and more features in the future. I’ll let you know when I start seeing these come to fruition. =)

They are currently rolling out in China, maybe they’ll start making their way south afterwards =P

I think since it doesn’t cost the big firms much to make trades and they make a lot ($7 – $10 per trade) from us as investors, they’ll likely hold out as long as they can, but eventually they will come down in price. Like Elon Musk says, others people margin is my opportunity. I think that’s pretty close to what he said at least and Robinhood is definitely trying. All other free trade platforms have failed in the past, but these guys have a good management crew and a couple well known investors who are vested in their success.

Maybe they’ll make their way down to Australia after their current roll-out in China. =)

PS. I love Australia, I did a study abroad there once. Awesome place! I hope you guys get it soon.

Wallet Squirrel,

First – amazing review, I love how you do it and I love the chart/picture template you have for what it looks like – i.e. please do this when you do more reviews! And you see from the comments – it definitely is attractive and informative, plus it has your point of view.

I will wait for the Robinhood Instant to see if there are further features – 3 being: DRIP, Quicker Money Transfer, and to see if it will branch into IRA type accounts.

Great review and I’m excited you saved so much money!

-Lanny

Aww Dividend Diplomat, you’re making me blush.

Thanks for the feedback. I was really impressed with the app and even more with the savings. I’m now 32,035 of 228,050 in line for Robinhood Instant! So it’s definitely possible to move up. I’ll let you know if I find any of those features in the future.

As far as making things look pretty with graphics, you got it.

I have too many investment accounts as it is, and I’m looking to consolidate. Robinhood seems like a great idea day-to-day, but I’ll have to find out how easy it is to transfer shares out of Robinhood.

If it’s easy, I’m in: my strategy would be to incrementally build my positions sans fees, then when they reach a certain size (say, 50-100 shares), transfer them to another brokerage with more capabilities.

I’m in a very similar boat as you are, and with the exception of my Dodge & Cox fund (which I think is worth it), I hate fees with the white hot passion of a thousand burning suns.

Answered my own question: you can’t move shares into or out of Robinhood. Per their FAQs, they don’t support ACATS at this time. That’s a real shame.

Sucks about your find of moving shares out of Robinhood. I haven’t given it a lot of thought but that should definitely be a consideration.

However wanted to ask, what is a Dodge and Cox fund? Sounds like nasty game of middle school dodgeball.

Haha, that sounds like the worst game ever.

They’re a mutual fund company. I have their large-cap fund in one of my 401(k) accounts, and it has a massive investment fee (like 1.05%), but their track record and stability are better than anything else in that 401(k) lineup.

Every fiber in me says that high fees aren’t worth it. I certainly wouldn’t invest in something with that high of fees in a taxable account.

Hi, I didnt read through the comments to see if this was addressed. – Robinhood Instant is here which allows for cash available instantly when you transfer from bank or sell shares. This was the biggest cons and now that has been addressed.

Hi Aadithya, thanks for visiting! I just made the update to the con list. They do allow for up to $1,000 in cash to be deposited/withdrawn instantly now which is perfect for someone like me who only does a few hundred at a time.

Thanks for the reminder. =)

I’m not inot investing or buying stocks but all about that affiliate marketing, blogging, and the side hustle! 🙂