The Ultimate SEO Strategy for 2017

It is time to formalize Wallet Squirrel’s SEO Strategy for 2017. This strategy will help get the website to rank higher within Google and Bing. Over the next 12 months we will give you updates on how the process is going, where we rank, and where we still need improvement.

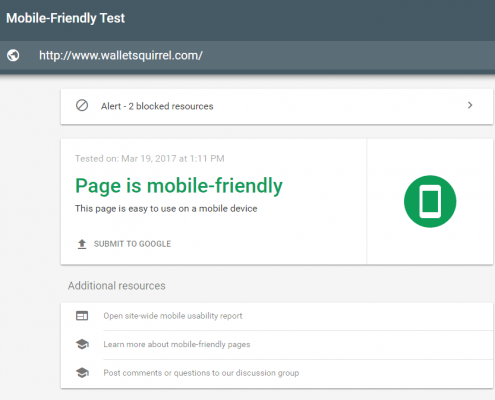

Andrew has done a nice job over the last couple of years by laying down a solid foundation for Wallet Squirrel and its SEO strategy. The most important thing he did is he built the website using a highly responsive Enfold WordPress theme. Google gives Wallet Squirrel a score of 99 out of 100 in their Website Mobility Testing Application. This is great news because if he did not do this, we would be redesigning the website to meet this criteria.

Google’s Mobile Friendly Tester helps our SEO Strategy for 2017 by ensuring our site is mobile friendly

Another nice thing Andrew has done is create some great backlinks. About 70 percent of the links he has created are dofollow links as well. This seems like a healthy balance between the two. A lot of the research I have found shows that you want a balance between Do Follow and nofollow links. In case you do not know what those two types of links are, I will explain.

- Dofollow links allow juice to travel from their site to your site giving Wallet Squirrel more power/authority. Nofollow links do not allow that juice to flow from site to site. Simply put, dofollow links allow humans and the search engine to travel to Wallet Squirrel through the link but nofollow links only allow humans to do so.

- Nofollow links do not allow that juice to flow from site to site. Simply put, dofollow links allow humans and the search engine to travel to Wallet Squirrel through the link but nofollow links only allow humans to do so.

SEO Strategy Starting Point

Before we begin to dig into what our new SEO strategy for 2017 is I must disclose some information. Since neither Andrew nor I are SEO experts we have done a lot of research to come up with a plan. We chose the tips on this page because they were consistently talked about throughout our research. Also, Google and most other major search engines have never formally disclosed what makes a website rank higher. They have hinted at things but they like to keep this information a secrete just like the Coronal’s Famous Crispy Chicken Recipe. So everything below are educated guesses as to what makes for a great SEO Strategy.

Focus on topics for Wallet Squirrel’s audience

We need to find what our audience is really looking for. The main question we need to ask ourselves is, “What do you, the audience, want to read?” If we take Wallet Squirrel down a path of topics that people do not care about then we will not receive any interest. This simple question seems like common sense but it can be an easily overlooked part of SEO.

The process is fairly easy with a little bit of practice and increase of knowledge as to where to search. During this phase of our SEO Strategy we will look for five to seven broad topics to look at. These topics will not be our keywords, those come in the next step. They will be for defining the broad ideas we write about.

Defining Topics

To be able to define these topics we need to do a lot of research as to what current trends are. Our main goal during this research period is to find the readers pain points. What do they need to know about? For example, credit cards. Now a days pretty much everybody has one. These little pieces of plastic control the lives of many people. Within this topic there are dozens of articles that could be written about. Some include how to choose a credit card, how to properly manage payments, how to payoff that debt, tricks to earn more awards, and so on.

As I mentioned before, finding these pain points can be tricky. We will need to search around the web for trending topics as to what is being talked about. This can be on the news, demographic profiling tools, social media, or any other creative place you can find. I personally like searching through social media with hashtags because it is the most current. Another source I have been using is the application Flipboard. This news application allows you to customize content based on topics. It then pulls in trending articles. Looking through those articles I was able to find some patterns to help identify some broad topics.

Find Keywords Within those Topics

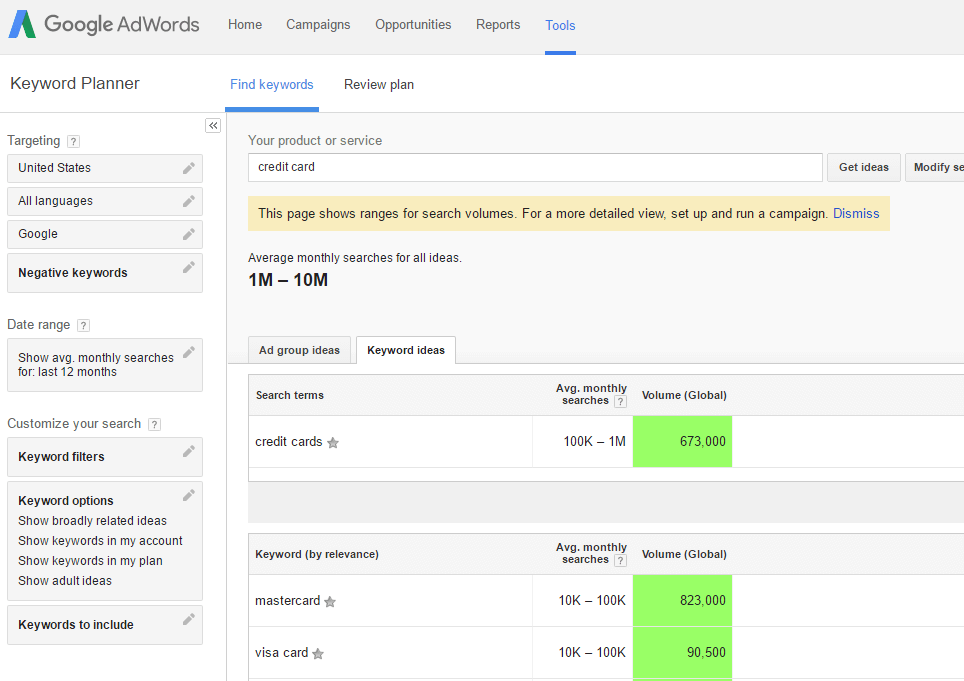

Now that we have found the topics that the audience is looking to read about, it is time to find keywords to create content around. This is where Google’s Keyword Planner comes into play. Here is how I gathered keywords for each topic.

To-Do:

- Firstly, I opened up a new blank Excel document and named it “Topic Keywords”.

- I created new tabs for each topic and named them accordingly.

- Next I went over to Google’s Keyword Planner and signed in.

- I opened the “Search for new keywords using a phrase, website, or category” section and typed in one of the topics to search for such as “Credit Card”.

- After hitting search, Keyword Planner takes you to the next page to show you all of the keywords that would fit under that “Credit Card” topic.

- Next, I selected the “Download” button and selected “Excel CSV” for my export.

- In the new Excel CSV that I downloaded, I select everything in “Keyword” and “Avg. Monthly Searches” columns.

- I copied and pasted those columns into my “Topic Keyword” Excel file under the “Credit Card” tab.

- Now that I have retrieved all of the “Credit Card” topic’s keywords, it is time to grab to the rest of the keywords for the remaining keywords. To do this, I repeated steps four through eight.

- After all of the topic tabs are filled out, the real fun can happen (sarcasm). It is time to clean up our new keywords list. This is done by deleting out irrelevant or poor keyword choices. Also, we will lay out a priority list by marking higher priority keywords with a certain color and lower ones with another color.

Loose Guidelines

Phew, now we are done with finding keywords! We do not have to follow these keyword lists to the dot. There will be other topics that we will want to be write about. This list is a nice guidance to keep us focused on those broad topics but it is there to help with content ideas. It is time to move on to the next step in our SEO Strategy for 2017, creating lots and lots of content.

Create Lots of Excellent Content

Google’s Algorithms are said to rank good solid content higher than poor content. What does this mean? You should create content that is written to the highest standards. It should be highly readable and informative for the reader. The content should also have a lot of substance. The days of writing short 300 word articles are over. Any article should be 1,000 words or greater. So grab a cup of coffee, find a comfy seat, and start writing!

Our articles should be based on a keyword that is searched for monthly. It does not need to be a ground breaking keyword with 100,000 searches per month. Anything with 100 searches a month is a great place to start.

We also need to make sure to do internal linking. Creating deep links from the home page and throughout the website allows for the Google Bots to crawl throughout the website easier. This helps provide more page authority and domain authority to more fresh content.

Build strong Headlines and Titles

During my research I found that building strong headlines and titles for each article does help it rank better. For last week’s post, Way #73 – How to Earn More Money in 2017 – The Achievement App, I used an application I found off of Money Lab. The Headliner Analyzer Tool by CoSchedule analyzes the phrasing and word structure of the soon to be headline or title. It gives it a simple score between 1 and 100. The higher the score the better.

When reading, it sounds like a score around 75 is pretty darn awesome so I shoot to get something around there. I consider something below 60 as pretty low but what do I know. The application also gives you a breakdown of word types used within the headline. I try to get a healthy balance between all four of those types. This tool will be used when we go through to update older yet high performing posts (see last step below).

Define Our Competitors

Many of you reading this post are friends to Wallet Squirrel so do not be hurt by this headline. Defining our competitors is not us putting every financial blog in our cross hairs rather it is about something else.

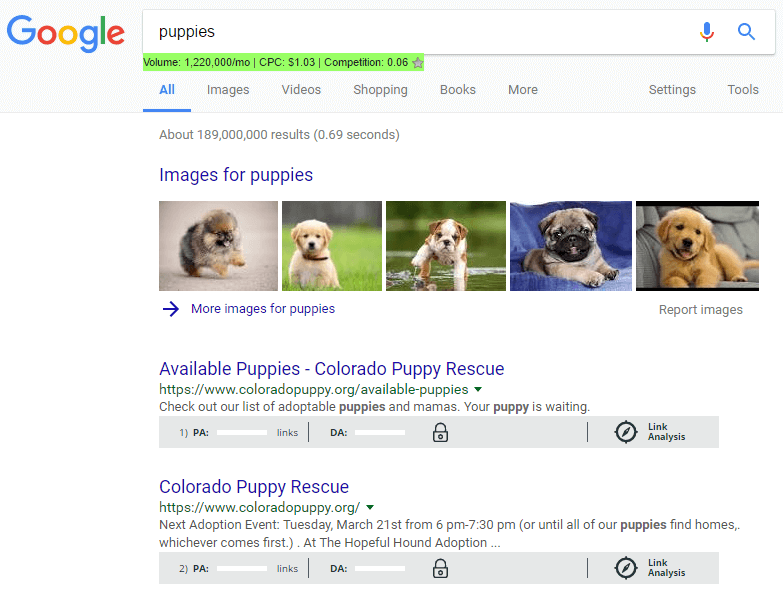

When we write a brand new blog post, we choose a keyword for that post. For example, this keyword could be puppies. Who doesn’t love puppies, right? After publishing this new article about puppies over on the blogroll we will go see who the article’s competitors are. Within Google’s search bar, or any other search engine preferred, I type in the articles keyword, puppies. Every website that pulls here are our competitors for the blog post on puppies. Next, we will look into how we can copy the backlinks they are getting as well.

Spying on Our Competitors

After defining the competitors, we need to spy on our competitors to see what they are doing. Chances are they have a lot of referring links coming in from people who wrote about their article. Here might be an opportunity to see if those people will want to link to our article as well, especially if it has better content. Here is what we need to do.

- After defining our competitors we need to go to Backlink Watch and enter in the exact URL of your competitors page. This is the exact URL that competes with your keyword.

- Backlink Watch will bring up a list of referring sites pointing to the competitors page.

- Click on each link and contact the site owner/author about the new blog post we just posted that focuses around the keyword.

Backlinks

During my research I keep reading that backlinks are not as important as they use to be for ranking. I personally do not think you should take backlinks lightly for several reasons. Firstly, as we compete against several other blogs out there, these backlinks might just be enough to take Wallet Squirrel above and beyond. Secondly, Wallet Squirrel has been around for a couple of years now so it is not exactly young in the internet world. It is very immature with its reach though. These backlinks can help with exposure to the site as we try to broaden our reach around the internet.

We will make sure to post to credible websites that provide backlinks to each new article. These can vary from other blogs, social platforms such as StumbleUpon, social media, and others. There will not be a set list of sites to post on for each post. This is because each article will be about something different and the previous backlink sites might not fit properly.

In the past, on a previous website, we have paid for backlinks. My research has consistently told me that this might be a waste of money now. We will try not do this and see where it takes us in 2017. What do you think of purchasing backlinks?

SEO Strategy Extra Points!

After completing all of the above steps we still need to use the little remaining time we have on these remaining SEO Strategies for 2017. These are more advanced SEO Strategies that will take a lot more time (not sure where that is going to come from). It will be interesting to see how we can fit these techniques within the overall strategy.

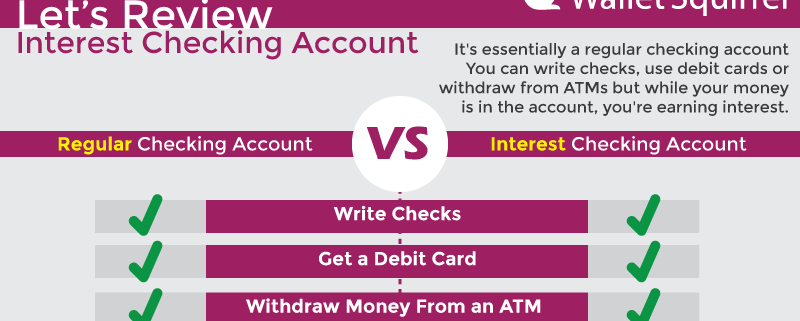

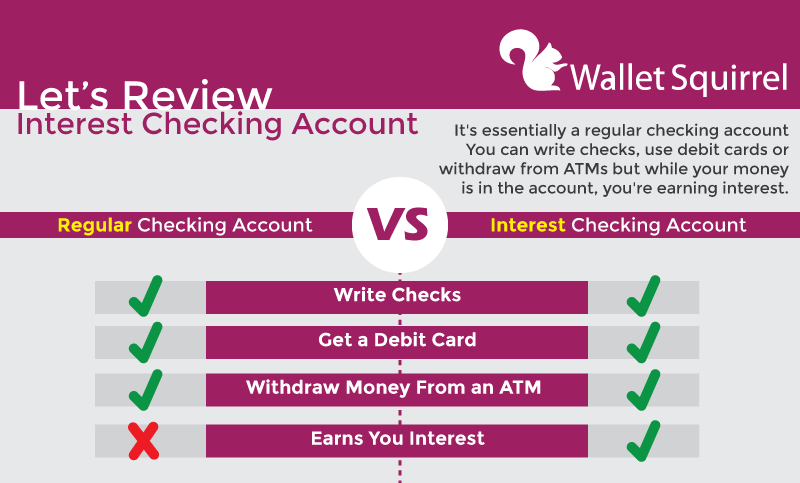

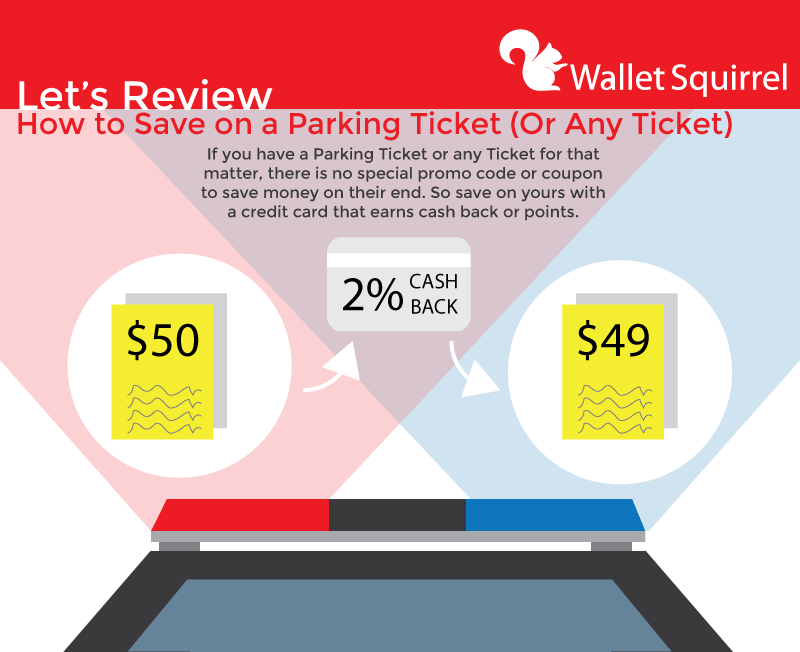

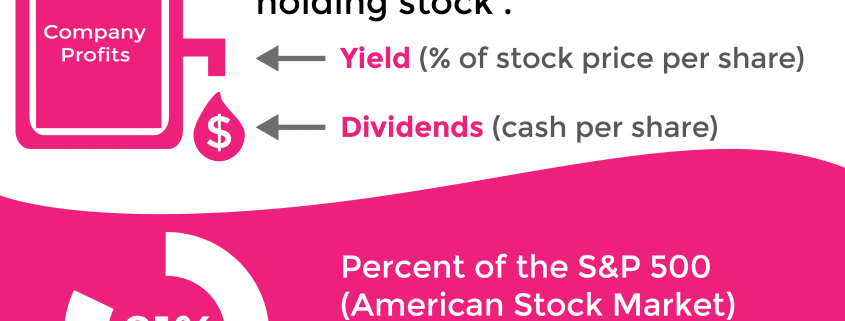

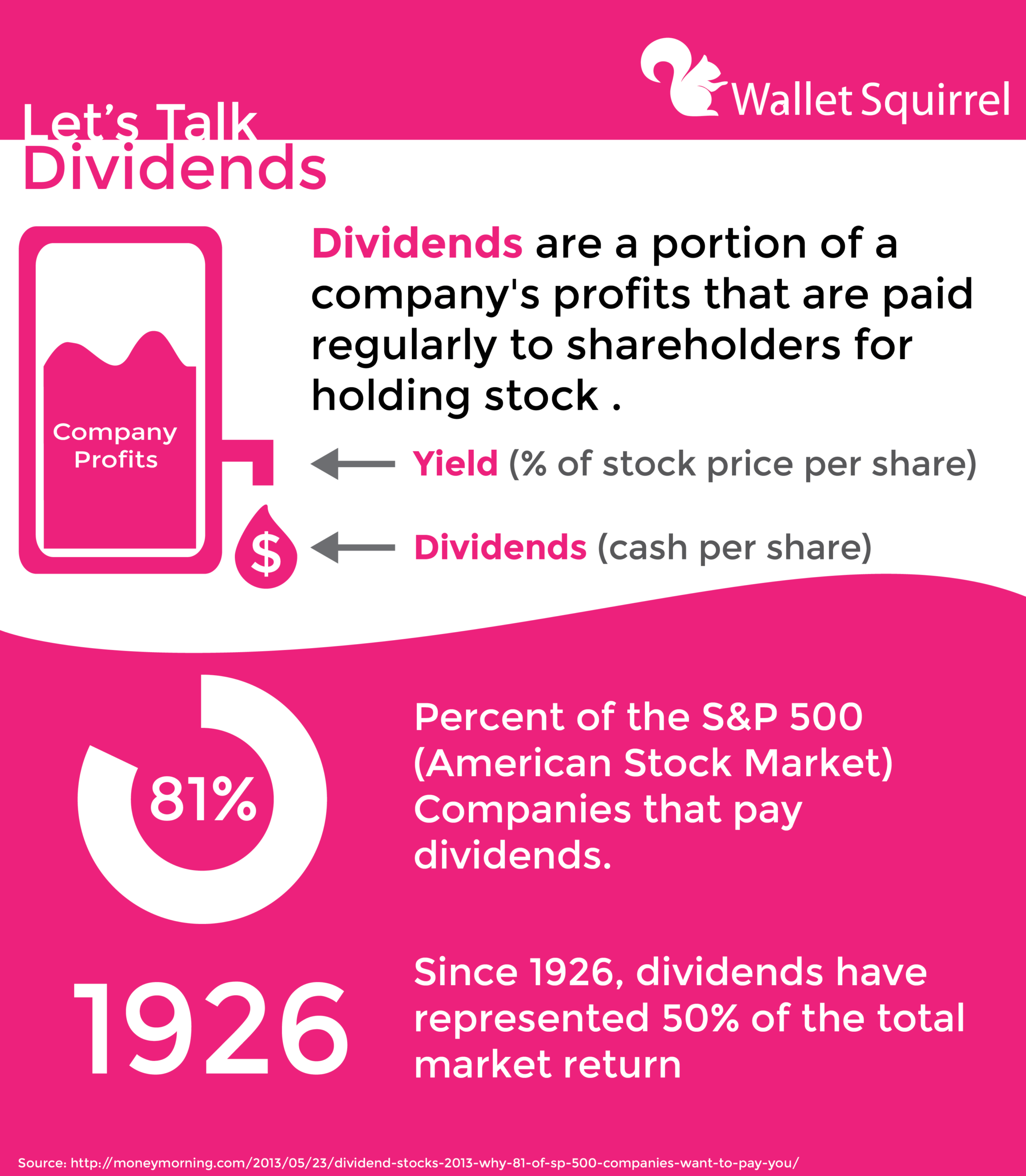

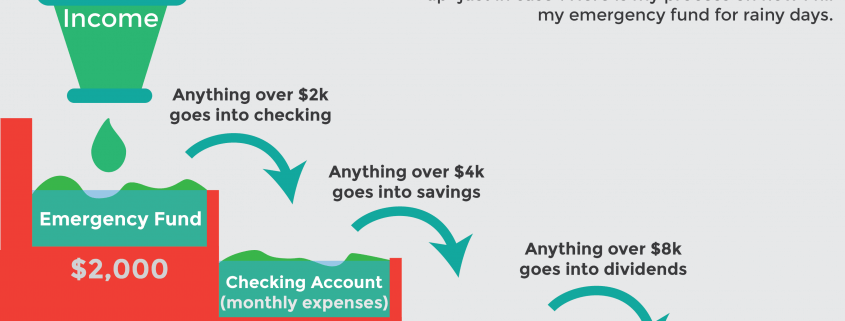

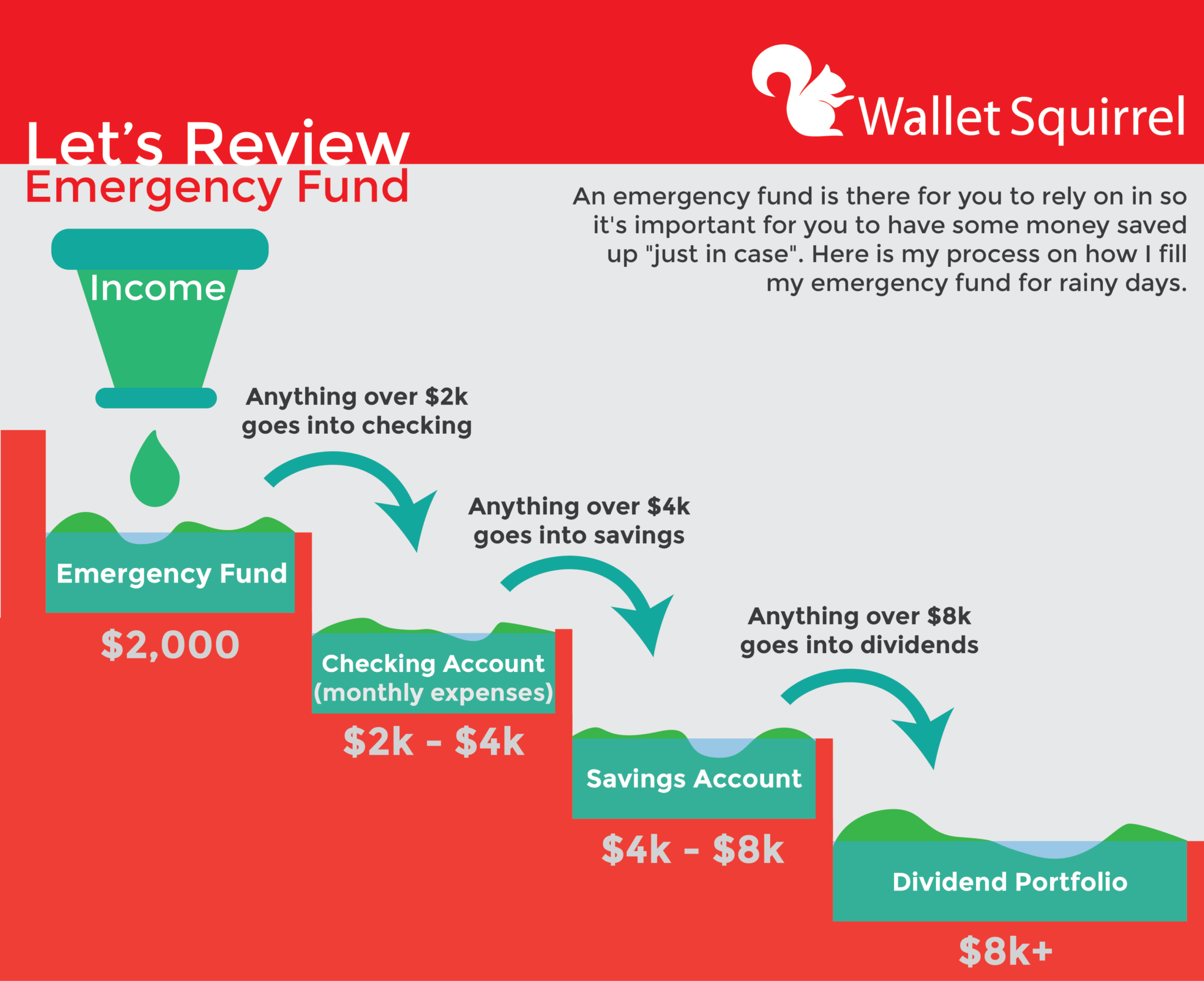

Infographics

Infographics are becoming more and more popular. Luckily we have an immensely talented guy on our team to make gorgeous infographics, Andrew. If you have not seen his What Happens To Debt When You Die – Infographic, you need to head over there next. Plus, the other dude on the team, Adam, wrote his Master’s thesis on Data Visualization. So we should have no excuse to make amazing infographics for Wallet Squirrel’s audience. They have a great potential to bring in a lot of traffic to Wallet Squirrel.

We want to make sure our infographics can be found. Submitting to infographic directories will help gain more exposure for each one. Though this will be time consuming, it should be worth it in the long run. The article by Modern Marketing Partners provides twenty sites that we can submit too.

On top of this we want to make it easier to share the infographics from Wallet Squirrel. Making information easy to share for our readers will increase the likelihood of it being spread across to broader audiences. We have not figured out this method yet but once we do, I am sure we will keep you posted. Ideas?

Guest Posting

We will continue to jump on any guest post opportunity that comes our way. Some people are nervous about doing guest posts because you are creating other content for your “Competition”. Then your “competition” gets all of the viewership and affiliate links. I will be challenging us, Team Squirrel, to not think this way. Other financial blogs are not our “competition” but rather friends and colleagues who are also reaching for financial freedom.

I personally think guest posts can work be very effective! They help spread our voice across the internet to other audiences. Essentially, I see it as putting in a little work for some easy advertisement to the blog. We will want to be somewhat picky as to who we guest post for. It will be important to make sure that the other blogging website has a similar vision and morals. It would not be good to guest post for a website that could bring negative feedback to ours.

Story Time

Trey Ratcliff, who is the photographer that inspired me to get into photography. About five to seven years ago he was doing something most other photographers were not doing on the internet. He was uploading high resolution photographs without a watermark to a downloadable site, SmugMug. He would put his content under the Creative Commons Non-Commercial license. Everyone was saying he was crazy to do this. People kept saying “bad” people could take his work and use it illegally. He thought so what, at least my photography is getting out there and viewed. Trey is now one of the world’s most popular photographers. He even has work in the Smithsonian! I believe he made it to where he is today because he let the leash loose on his photographs allowing his viewership to expand even more rapidly.

SSL Certification

Google helps promote websites with the newish SSL certificate. I have read in several locations, including Moz, that this certificate is really important now. You can tell if a website has the SSL certificate when its URL starts with https://. Wallet Squirrel does not have this certificate…yet. Adding the SSL certificate should be a fairly easy item to check off our SEO strategy for 2017 list.

Slow Website Speeds

Research tells us that Google will ding websites with slow loading speeds. When running tests on the Wallet Squirrel, the site fails miserably. I will work on trying to figure out what is causing this slow down. Firstly, I will check with our web hosting provider Bluehost about what might be going on. They have amazing customer service so I am sure we can get to the bottom of the issue.

There are several other ideas that could be slowing the site down. The first item I will explorer is checking to see if the images are too large. Secondly there is a possibility that there is too much JavaScript and CSS code. This code could be imbedded into the WordPress theme that we use. I really hope Bluehost is able to help us because I do not want to go digging through code.

Let me know in the comment section if you have any other ideas?

Index the pages

We need to make sure that our pages are being indexed on Google and Bing. This can be done on Google Webmaster Tools as well as Bing’s Webmaster. This is a very easy process of making sure Google or Bing Fetches the website or blog post.

Another tool recommended by Neil Patel Is the Ping-o-Matic. The application will allow us to ping high authority search SEO service directories. According to Neil, this allows Google’s bots to crawl the website a lot quicker and easier.

Use Authoritative Social Platforms

There are several social platforms include websites such as Slideshare, Blogger, Quora.

Our goal will be to create a document on each site that can push more visitors to Wallet Squirrel. This is obviously easier said than done but is not out of the question. First we will want to pick one of the social platforms to create a new document such as Slideshare. We will want to pick a trending topics that relate to Wallet Squirrel. We can use GrowHackers.com or Google Trends to help us search for those trending topics.

After finding an awesome topic to create a slideshow about it will be best to do research on how to make it spectacular. Luckily, we can look at the what other slide shows are doing themselves. Looking at what those authors did we can figure out what works and what does not work to create something jaw dropping. Creating well written content within the slide share will help engage the reader but more importantly we will want to add images. Adding a visual dynamic will create a more well-rounded presentation to keep our audience roped in.

Return to Old Blog Posts

We do not want older but popular articles to go stale. Google does not like stale content and will lower its ranking within search results. So every three to six months we need to examine older articles to refresh them a bit. First it is best to find what the best performing articles from that time frame are. One example for Wallet Squirrel would be Andrew’s Review of the Robinhood App.

- First we went to Google Analytics

- Under the Behaviors Tab I found what the top posts were three to six months ago.

- After finding the top three or so posts are we can go ahead and update them.

Updating old but high performing posts every three to six months is an extra point item to our SEO Strategy for 2017

There are several ideas as to what to update. One thought is to update the headline or title of the article. This would be another great opportunity for us to use the Headline Analyzer talked about earlier. Also, as time progresses we usually learn more about that particular subject. We can update the article to include this new information.

Measuring Progress

So I have decided on a few metrics that we will use to measure the progress of our new SEO Strategy for 2017. All numbers are current as of March 16, 2017. We will update them as the year progresses.

- Alexa Ranking – 3,609,825

- Sites Linking Into Wallet Squirrel (by Alexa) – 30

- Moz Domain Authority – 18

- Avg. Weekly Views – 329

SEO Strategy Resources

To put this SEO Strategy together, I looked all around the internet for consistent recommendations from credible sources. I must give credit to the sites that gave me each idea first. I wish I could name all of the sites that confirmed these ideas but that would be too long of a list!

Cheers!

-Adam