I Started Investing 3 Years Ago, Best Decision I Ever Made

In the beginning of 2015 I paid off my credit card debt for the first time and started to learn about investing.

It was terrifying, but so totally worth it!

How I Perceived Investing As A Kid

Up until 3 years ago (I was 28), I knew NOTHING about investing. To me, investing was some insane, chaotic spree that made rich people rich and the middle class poor. I didn’t know how it worked, but I knew tons of people who lost money during the recession.

If you’ve ever watched any movie that talks about Wall Street or Investing, it’ll have your brain swimming in confusion trying to understand it. Were they just trying to make it look hard and impressive? (Yes).

I was terrified of investing, I just shut down anytime someone talked about investing and assumed they were a financial genius if they owned stock. Someone who had enough money to pay their bills, live their life and put something extra away investing for retirement was a financial god to me.

I Started to Learn About Money On My Own

Like I said before, at the beginning of 2015 (3 years ago) I paid off my credit card debt after paying countless $70 monthly payments. So once I paid it off, I wanted to use that $70 for something else, something reasonable.

I will admit my company did have a financial planner come into our office and talk about our 401(k) plan. While the company plan was pretty awful, the financial planner did a great job at terrifying me to death.

I will always remember their words “Running out of money in retirement is worse than death”

Well f*&k, that was more terrifying than Halloween. So I started to learn more about money and how it worked.

I started reading finance books like “Total Money Make Over” by Dave Ramsey. I consumed it in a day.

I started listening to finance podcasts. Not the hardcore stock analysis ones, but the more Investing for Dummies type of podcasts like “Listen, Money, Matters”. I LOVED that podcasts and in my mind, being surrounded by those announcers talking about money and finance as a regular thing, I began thinking of money in a different way.

After reading books and listening podcasts. I started to view money not as static thing to sit in my bank account, but more as income streams.

Understanding how much money I had in my bank account mattered less than how much I had coming in each month. That’s why investing became a fascination because it’s one of the most common income streams for people.

I Tried Investing $100 To See What Happens

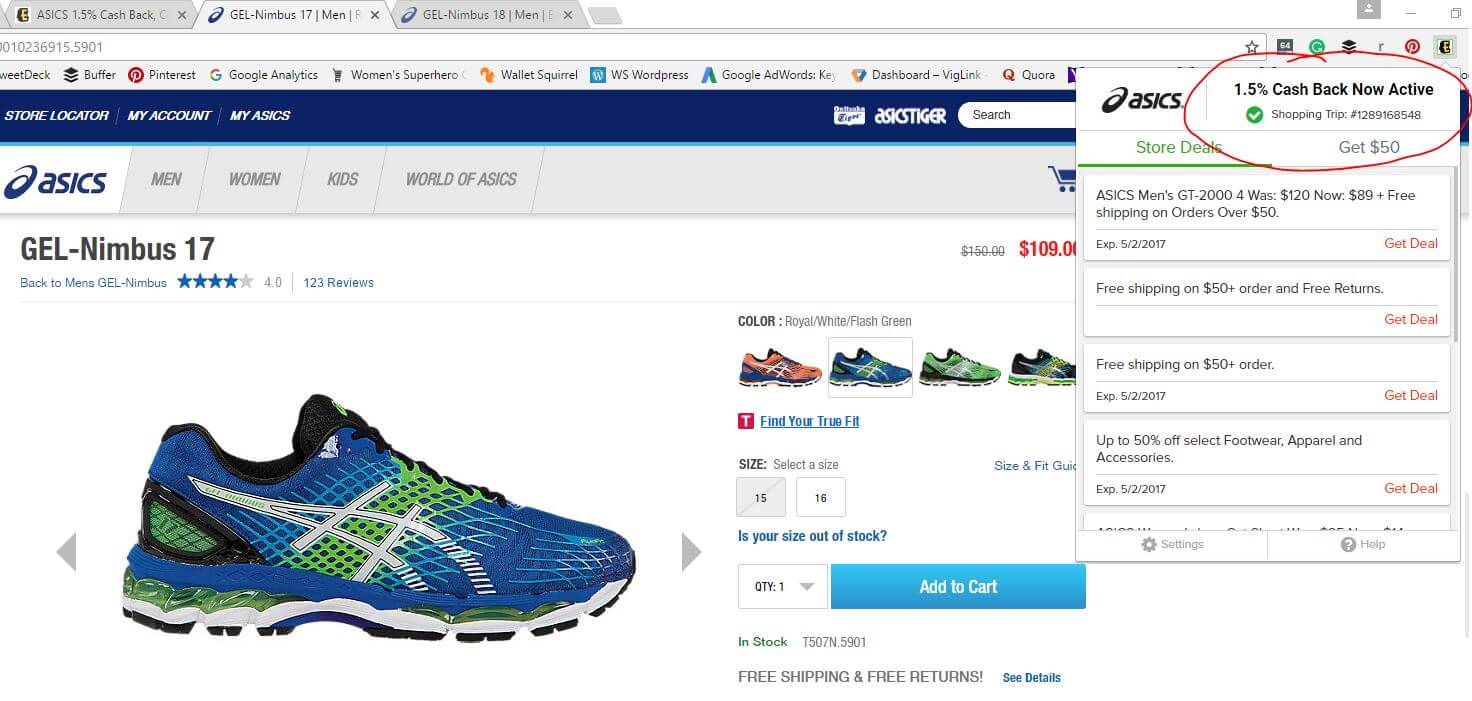

On the podcast “Listen, Money, Matters” they raved about the investing app “Betterment” (Adam uses Betterment and did a review). They brought the Betterment team on the podcast and explained it and how it’s meant for people who know nothing about investing but want to start. That was me!

I remember how nervous I was signing up. I had to put in my info and social security number. I was convinced that I would immediately lose all my money straight away and because they knew my social security number, the IRS would start to hunt me down.

This was a legit fear I had.

Since I had so much anxiety, I only invested $100 to see what happened. I invested in a “moderate risk” portfolio which they automatically invested for me. All I did was put in $100 and waited to see what happens.

They say not to check it daily, but I did. Oh my goodness, for the first week I checked it hourly. I wanted to see EXACTLY how the stock market worked. After a week I limited myself to daily. So for 5 months, I checked my Betterment account every day, scruitinizing everything that happened.

However, I found that my money fluctuated. One day it went down to $99 then up to $102 and slowly kept rising. This helped me understand how the market moved (at least during those 5 months), how it worked and it slowly became less mysterious.

In fact, I started to notice little things like every once in a while, I would receive extra lumps of change in my account. Just a few pennies, but they were dividends. I received money just from owning certain stocks. I couldn’t tell which stocks with Betterment because it doesn’t show that amount of micro detail, but it was a great feeling.

Then I started to invest more and look at other stockbrokers (companies which you need to invest) like the Robinhood App (I still use Robinhood, here’s my full review on how it works). With Robinhood I could start to pick my individual stocks and it was amazing! I chose stocks that were on the safe side such as Apple, Realty Income and Johnson & Johnson that were well known and established. I knew if these companies tanked, there was something seriously wrong with our economy, so I felt comfortable.

I Wasn’t Addicted, But I Was Obsessed

After I learned how the stock market worked, I felt comfortable but wanted to see more gains than the couple of cents I had been earning. So I could have gone in two different directions. I could have started to invest in risky stocks for bigger gains (don’t recommend) or find new ways to earn money so I could buy more stocks. I did the latter.

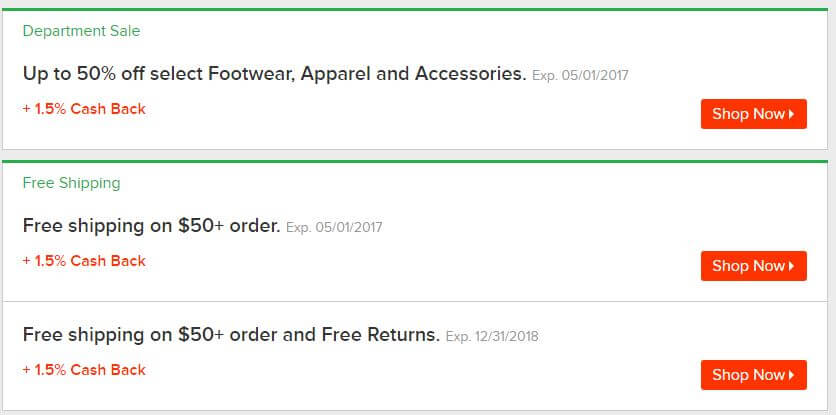

Now I write articles online for money, use interest checking accounts, sell stock photos, sell things on Craigslist, use a cashback credit card and more to earn extra money each month and invest it!

Today, It Absolutely Was Worth It.

I’m not advocating for a certain investing approach, but I do want you to see money as income streams rather than a lump sum. It absolutely changed my life.

Before I was happy with $2,500 in my bank account. It was more than any of my friends had. I now keep $4,000 in both my checking and savings account as an Emergency Fund and invest the extra money each month in my investment portfolio.

Knowing I have the extra money and extra streams of income each month gives me SO MUCH more confidence to know I’ll be OK if an emergency comes up or I want to go on a vacation. That piece of mind is one of the greatest feelings ever.

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!