How Much Does It Cost to Invest in 2021? Here is What You Need to Know

In this complete guide, we will discover all of the costs associated with investing to give you a thorough understanding of how much is needed to start investing.

Types of Investing Costs

From tools to get you started if you are a complete beginner to the costs associated with having a brokerage account, it is worth knowing the facts before you go in.

How Much Does It Cost to Invest: Costs Before You Start Investing

Before we dig into the fees of a running brokerage account, there are optional costs you may consider, especially if you are new to investing. Here are five things to consider:

How Much Does It Cost From Your Monthly Budget?

It’s essential to have a monthly budget before you start investing. The main reason is that investing is a long-term play. So bSo by having a clear budget and way to manage your expenses, you will make sure your investments stay invested.

Using a budget like the 50/30/20 budget will calculate how much you can afford to invest every month. For example, your monthly investment could be as much as 20% of your monthly income after taxes if you have an emergency fund.

If you struggle to stick to your monthly budget, it’s worth looking into banks like Starling, which have built-in spending categories to help you see where your money is going each month.

Takeaway: Look at your monthly income and expenses and work out how much you can realistically invest each month. Treat investing as a monthly bill/fixed cost.

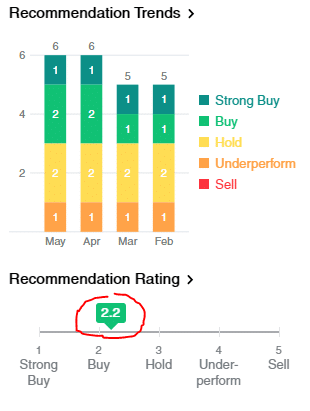

How Much Does It Cost for a Stock Advisor Service?

Putting investing fees aside, you may be concerned with the costs of losing money on the stock market by investing in the wrong stocks. This is where a Stock advisor service comes in handy.

If you are starting and are not sure which Stocks are worth investing in, then it’s good to get tips from experts.

An example is Motley Fool’s Stock Advisor, which you can expect to pay $99 for a year’s subscription. Depending on how much you plan to invest in the stock market and your free time to research stocks, this could be a cost that gives you a return on investment.

Here are some of the benefits of a stock advisor service like Motley Fool:

- For example, Time-saving – The Motley Fool comes with 15 starter stocks that Motley Fool invests in and knows to be good long-term investments. This is a great way to get you off the ground with your first stocks instantly.

- Up to date advice from experts – Each month, you get various stock picks based on what is going on in the market so you can invest at the right time.

- They tell you when to sell too – If you go with their advice (which you should if pay for the service), they will also tell you when it’s time to get out of a nasty stock.

- The Motley Fool Stock Advisor service at the time of writing delivered 566% in returns since 2002, so if you want some guarantee of success, then this could help you.

How Much Is Needed to Start Investing?

Many people think investing is just for the rich, and whilst this might have been true in the past, investing can be for everyone in today’s world of technology.

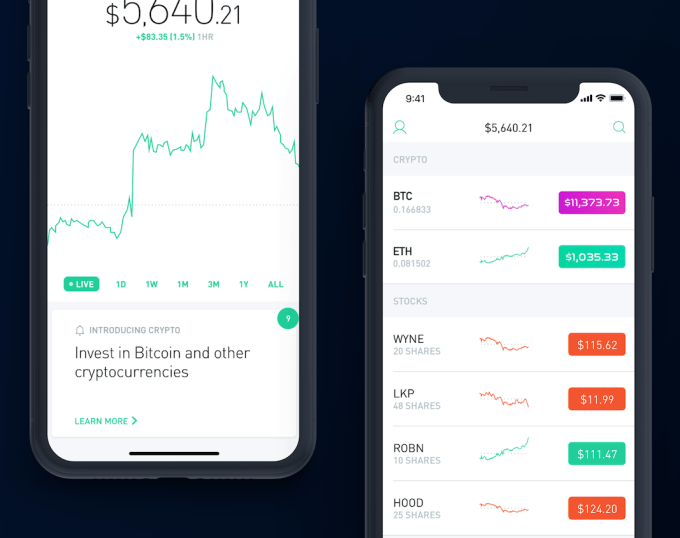

With the rise of platforms such as Robinhood and Trading 212, you can invest from the comfort of your own home.

Apps like this offer you the opportunity to start investing with as little as $1! That’s by investing in what is known as fractional stocks, where you buy part of a whole stock.

Of course, just because you can invest with $1 doesn’t mean you should. So it’s good to understand the fees involved before jumping in.

How Much Does It Cost to Invest: Common Investment And Brokerage Fees Explained

You may need to pay several different fees when investing, so we’ve broken down the most common ones below.

Platform/Brokerage Fee

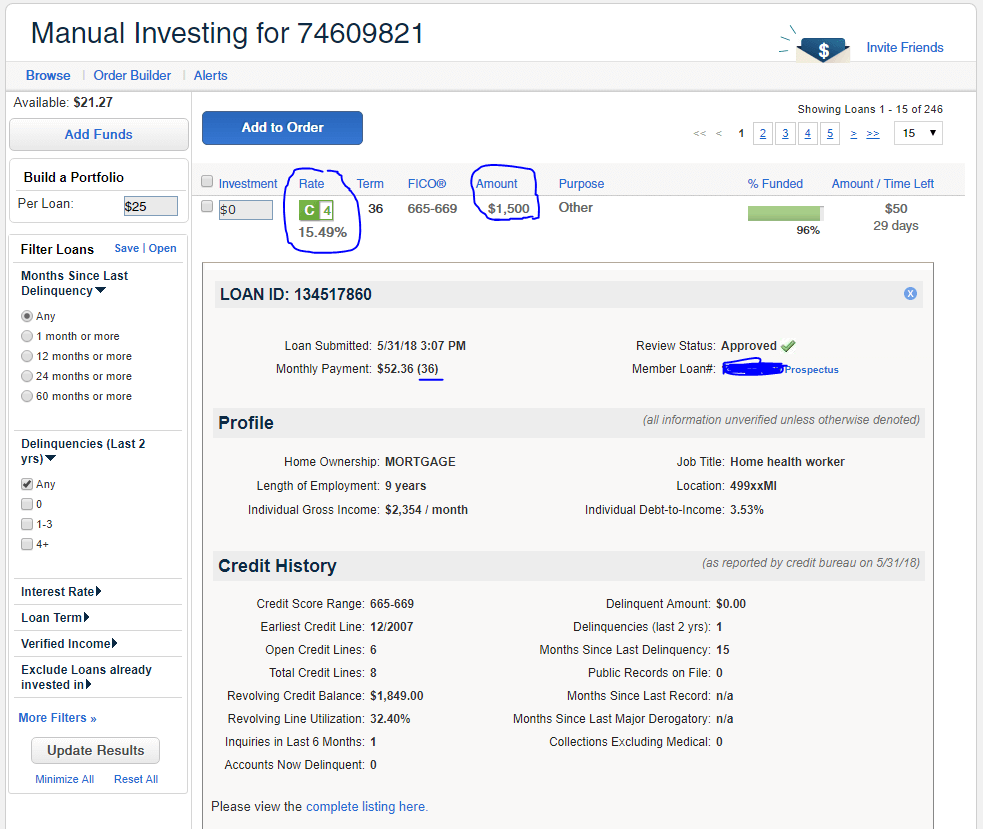

Brokerage fees can come in different forms, so it is good to research your broker before committing to any account.

Here are some of the typical fees that you should look into before committing.

Account Maintenance Fee

This can be in the form of either a monthly or an annual fee. In addition, you are charged for the maintenance of your account Or any subscriptions for premium research or investing data.

You can even be charged for inactivity, so good first to understand how often you plan to invest.

You can generally avoid brokerage account fees by choosing the right broker.

Trade Commission

This is also called a stock trading fee, and this is a brokerage fee charged when you buy or sell stocks. You may also pay commissions or fees for buying and selling other investments, like options or exchange-traded funds. Some platforms now offer 0% commission fees, but the investment rate isn’t always as good.

This payment goes directly to the broker. This cost usually ranges from $1 to $5 per trade and, in some cases, will be waived if the investor reaches an account minimum.

Sales Load

This is not often in most cases, but it still does happen. A sales load is paid on some mutual funds sold by the broker who sold you the fund.

It would help if you were wary of these charges as most mutual funds today don’t have these, and remember, the broker is trying to sell these to you because they get a commission. So be sure to make sure the fund is right for you!

Mutual Fund Transaction Fee

Another brokerage fee, this time charged when you buy and sell some mutual funds.

Expense Ratio

This is an annual fee charged by mutual funds, index funds, and exchange-traded funds as a percentage of your investment in the fund. The charge is to manage the fund.

Management or Advisory Fee

Typically a percentage of assets under management, paid by an investor to a financial advisor or Robo-advisor.

401K Fee

An administrative fee to maintain the plan, often passed on to the plan participants by the employer.

Ways to Minimize The Costs Of Investing

With all of these different costs involved, you are maybe wondering if investing is worth it. But, for many people, it is, if done correctly, investing can be an excellent way to beat inflation.

Here are some tips to help you minimize some of the costs of investing to turn over more profit!

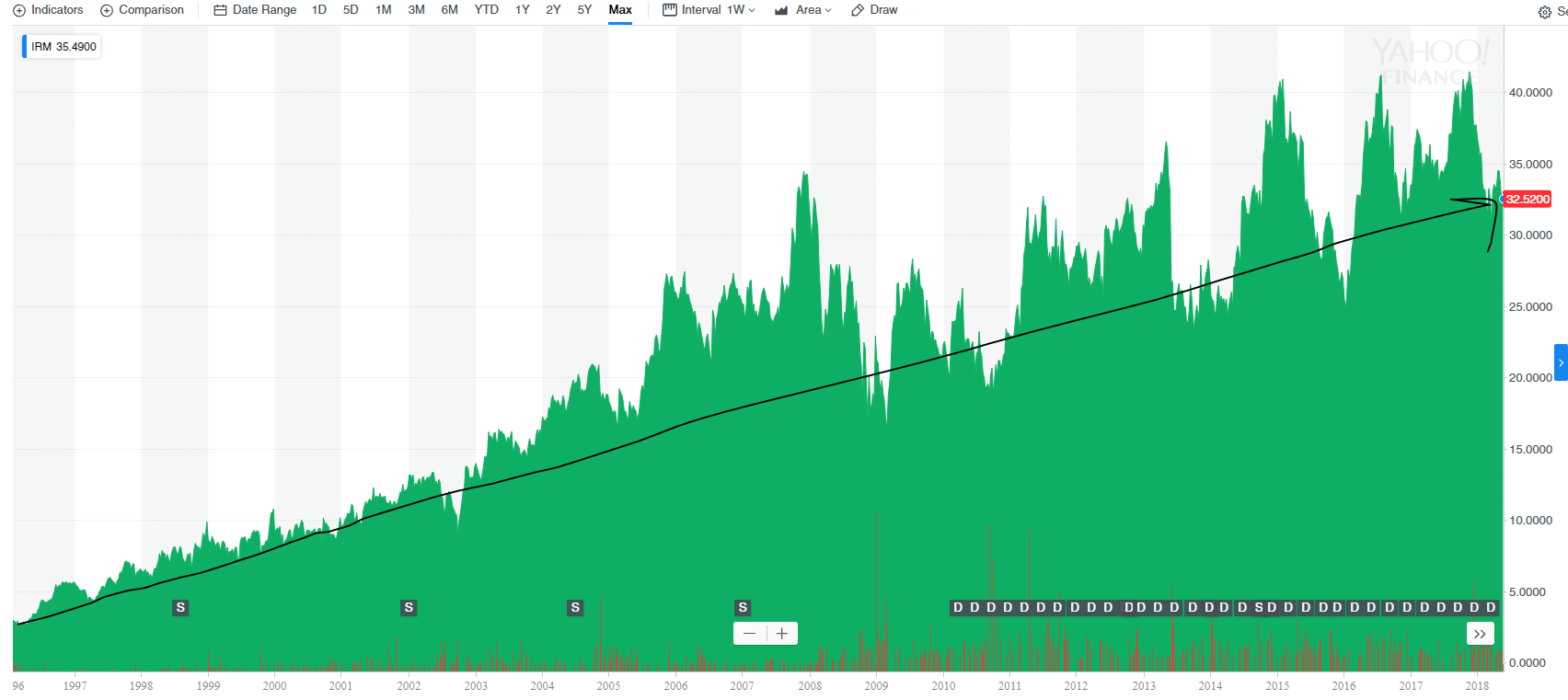

Invest Long Term

If you are constantly buying and selling stocks, then you will no doubt have high commission fees.

Avoid these by doing proper research before buying stocks and hold for the long term. Take the steer from successful investors like Warren Buffett, who has held on to stocks of Coca Cola for more than 30 years.

What does long-term investing mean? Well, according to Investopedia, you should be looking for investments to stay put for at least five years if you want to ride out infatuations in the market.

If you are unsure what to put your money into long term, then considering a stock advisor service could be a good option. Think of it to offset the costs of buying and selling investments all the time.

Get Tax Credits

No matter where you are in the world, tax implications can impact your investing profits.

Short-term capital gains are taxed as ordinary income. These rates range from 10% to 37% again, depending on your income and filing status. You can find out precisely what percentage of long and short-term capital gains tax you’ll pay by visiting FactCheck.org.

Sign Up To 401K or Companies Retirement Scheme

The reason many people decide to start investing is for longer-term financial security. But before you begin investing freely, making sure you take advantage of any company retirement scheme, especially if your investment goals are retirement.

This is because many employers will contribute if you contribute, meaning you can make more money! As long as you don’t withdraw before 59.5 years old, this account is also tax-deferred. Tax-deferred accounts, which safeguard investments from taxes as long as the assets remain untouched

Cheaper Platforms Don’t Consistently Save You Money

When it comes to investment companies, it’s important to remember that the cheapest isn’t always best and that you will often get what you pay for. For example, a company might be more expensive, but it could have a website that is easier to use, has telephone support, and even sends research out to make decisions that you feel confident about. Conversely, other providers charge lower fees for a more basic service.

You need to weigh the fees (and the reasons for them) when choosing where to put your money. Either way, make sure you aren’t paying too much for the service you receive – after all, high fees will eat into your returns over time.

How Much Does It Cost to Invest: Bottom Line

You may have heard that investing is a great way to top up your income, but it isn’t free. Make sure you do your homework and pick the right platform for reaching your financial goals. If you are looking at investing in stocks, bonds, mutual funds, or ETFs, make sure you understand how these investments work before deciding which one to buy into. The key takeaway here is don’t invest without doing your research first!

While some investments may obscure their costs in the fine print, anyone can quickly get to the bottom line with the wealth of information available online. Use reviews and comparison sites to find the right broker that fits your investment goals.

This post originally appeared on Your Money Geek.

Mary Elizabeth is a self-taught finance nerd and money master. At the age of 21, she bought her first house, and by the time she was 30 had paid off all student debt and saved 100k. She founded MeMoreMoney.com to help others achieve their own financial goals with uncomplicated advice that works for everyone from just starting out to those who have been saving for decades.