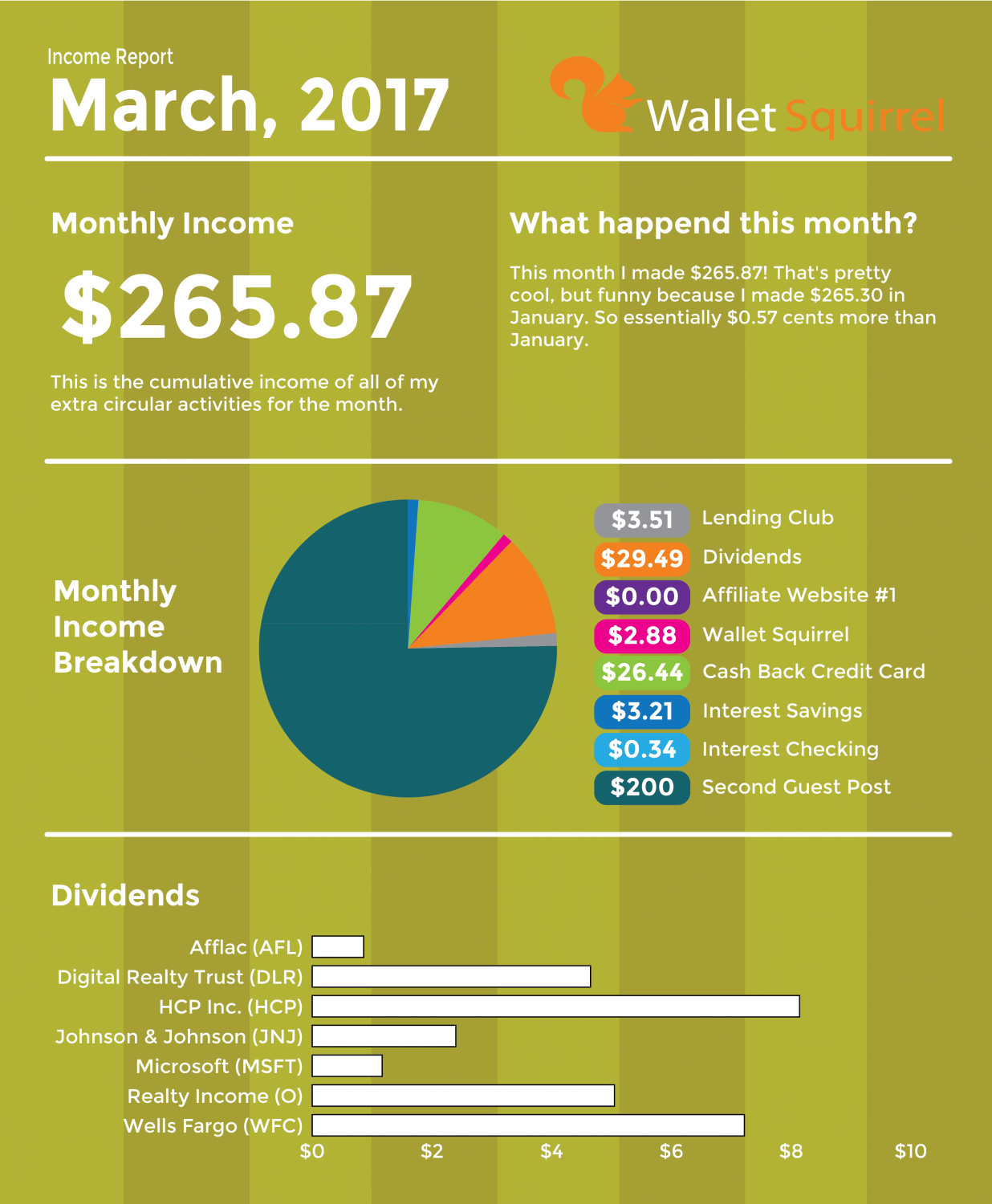

Income Report – March, 2017

Have you ever sold $6,000 worth of stocks at 7:40 in the morning while eating Captain Crunch? I have.

Following last week’s post on my Cost-Benefit Analysis, Invest my Tax Return or Pay Off my Car. I came to a decision. I will pay off my car.

I am using my $3,200 tax refund (plus $500) in addition to 3/4 of my stock portfolio to pay off my $10,312 car loan.

Why Am I Paying off my Car Loan Rather than Investing?

There were many heated discussions within Andrew’s pool of friends. I could invest my tax refund and make $1,000 more by October 2nd, 2019 or put the tax refund toward my car reducing the amount of months till I pay it off.

I decided to fully pay it off. This is why:

- I never thought I’d NOT have a car loan, so the idea I could pay it off is incredibly happy because I’ll then only have student loans! (albeit $50,000 in student loans left) #MoreFinanciallyIndependent

- I’ll now have $340 more per month to buy stocks! This means more in-depth reports on more stock buys and stock analysis.

- I free up $340 per month in monthly cash flow. 99% of the time I’ll invest that, but it leaves me open to do more side projects for Wallet Squirrel. I love experimenting on Wallet Squirrel and they usually result in earning more money or at least some great lessons learned. I’ll take that.

In the end, I’m very happy with my decision, but it’ll likely be the first and last time I ever pull money out of my stock portfolio.

What Happened in March?

If you recall from February’s Income Report, this was month (1 of 3) to test Wallet Squirrel’s newest contributor, Adam and MAN did he do well! He crushed it this last month by getting an article out every Monday at 1pm. While generating great content and increasing Wallet Squirrel’s SEO. Every blog needs an Adam.

Every blog needs an Adam.

- Most Popular Post – February’s Income Report. This proves that lots of people like to dive into how income is generated on Wallet Squirrel and how it’s being invested. Income Reports continue to crush it in web traffic (maybe it’s the infographics). Plus it was Adam’s introduction to Wallet Squirrel, which also made our most popular Tweet to date.

- Longest Post Last Month – 50 Amazon Affiliate Website Examples Making Money in a Niche. This post alone had 3,801 words and is quickly becoming one of our most popular post. It’s super helpful and motivating to anyone looking to start a affiliate website. Some of these sites make $20,000 per month.

- Wallet Squirrel is a legit company! – I shared a post Wallet Squirrel is now an LLC, but I’m not sure I did it justice on how excited I am about it! While the process was SUPER easy (read it), it’s a very empowering knowing that I now have an LLC to build my Squirrel Empire of side-hustles. Is it weird that I’m excited for taxes next year?

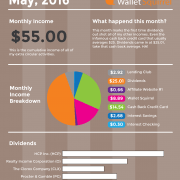

March, 2017 Income Report

This month I made $265.87! That’s pretty cool, but funny because I made $265.30 in January. So essentially $0.57 cents more than January. Lol

The big factor was I did another sponsored post which I charged $200 . It’s great that doing a sponsored post can cover the cost of the website expenses and contribute to future side-hustles, but I feel odd putting other people’s content on my site. The only bonus is that I’m reviewing each post before I publish it and making sure it’s interesting. I reject A LOT of sponsored post.

Even though I’ve done 2 sponsored post so far, I have no idea how to charge for them. Does anyone have a pricing table?

I’m thinking I’ll charge $500 or $1,000 for the next one. If people won’t pay that, then I guess I won’t do any more sponsored posts for a while. Works for me. =)

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

I have always struggled with the idea if paying of my mortgage or investing. To me investing in dividends is like giving myself a pay raise. If I sold my dividend stocks is be losing my pay raise. This is the only way I can try to explain why I’m saving instead of paying it off.

Hey Diligent Dividend!

It’s definitely not something I see myself ever doing again. It feels nice to free up that $340 per month, but I won’t likely pay off my Student Loans earlier. They are $500 per month in student loan payments, but it’s not worth it paying $50,000 from my portfolio. This will likely be the only time ever I tap into my portfolio.

It’s not always a good option, but it worked for me in this instance. Plus I have more capital to buy more stocks now each month =)

It’s really interesting getting to read through your sources of income!

I just reviewed all of my expenses for the first quarter recently on my blog and while interesting and worthwhile, I dream about the day I can write about my income which is currently nonexistent.

Hey Sean,

I totally get it, but once you get those first few bucks it all starts to snowball. Start by looking at an interest checking account or a cash back credit card (if you use credit cards). Those were my first ever income generators besides my job. Then started with a few hundred dollars in a stock portfolio and started experimenting how stocks worked.

Then it’s all about saving what you currently make and continuly invest. Good luck!

-Andrew

Thank you for sharing your sources of income! $265.87 is a nice extra chunk of passive income and side hustle money in one month!

The choice to invest or pay off debt is a tough decision. I think it’s important to always be saving and investing because it’s a habit. However, I can see the benefit of freeing up additional cashflow. I am currently making the decision to focus on both. I’ve got roughly $10,000 in student loan debt left, which I’m paying about $240 a month towards. I also make sure to save at least 10% of my income to get compound interest working for me.

In regards to sponsored posts. I’ve published two of them on my site for comparable prices. One was cool in that I got to write the post myself, but they sponsored the post for posting affiliate links. That one earned $275. Another one that I did not write earned $150. That said, I’m still learning about rates and prices.

Thanks for sharing the post! Looking forward to reading more of your blog in the future.

Hi Graham,

This is a great comment! In fact I have a post coming out later today (1:00 PM MTN) on what makes a great comment, wish I could have used this for an example. =)

Thanks for stopping by, investing vs paying off loans is always a tough choice. I agree, investing is a habit and one you should continue to grow. In your case of your student loans, $240 a month isn’t much to pay monthly at all! I would continue to invest unless you have 21% interest on those loans (not likely). Otherwise investing is a great option. I just paid mine for the $340/mo cash flow so I could do more on this blog. I’ll likely not pay off my student loans early.

You’re crushing it with your sponsored post! It’s funny, my first sponsored post was $150 and the second they asked me to write. In my case, I didn’t WANT to write a sponsored post, so I told them I’ll charge an insane $1,000 if they wanted me to write it. This is fun for me, and if it becomes work, I’ll charge that amount. They ended up getting someone else and offering $200 for me to post it. lol

Thanks for sharing, this is really helpful for considering future sponsored posts!

-Andrew

As always, it’s nice seeing your varied sources of income for the month. Getting paid by solid dividend paying companies, P2P, sponsors, interest, whatever. It’s all good. I understand you wanting to pay off the car. One less bill coming in is huge and as you said you can now put those monthly car payments towards future stock buys and keep building that passive income stream. Great update. Thanks for sharing.

Thanks DivHut!

That means a lot from a veteran of dividend investing such as yourself. I’m trying to vary my incomes as much as possible to diversify. Usually, all the money I make goes directly into my dividend portfolio anyway. The only exceptions are my Lending Club Experiment with $300. =P

I’m stoked to have the extra cash now to purchase some more stock each month! Thanks for visiting.

-Andrew

Hi WalletSquirel,

Your monthly income is so inspiring. I am a newbie in blogging. Just now Google Adsense has approved my application. Now I’m totally dependent on Adsense for monetization. I’m focusing on Affiliate marketing as I find it is very lucrative. No doubt, I’m interested in affiliate marketing too.

Thanks

Happy Saturday my friend. Where have you been and what have you been up to? Everything okay over there my friend? 🙂

In reference to income reports and side hustles, I’m definitely a personal believer that timing is everything because it’s a good idea to work on your side help your business while working for your narcissist employer. This way, when and in fact your narcissist employer gets you wrongfully terminated, your plan B is already intact for your job security backup.