My Honest Ibotta App Review – Is it worth the time?

Today I want to give you my honest ibotta app review. We will look at the application together to see if it is worth the time spent for the cash ibotta give you back.

Today’s ibotta app review is reasonably short because ibotta’s process is just that simple. As I write this review, I keep scrolling through the ibotta app to find more to talk about. Simplicity is why I was thoroughly impressed with the overall process of getting the rebate deposited into my account.

The question is, “Was it worth my time?”

Spoiler Alert! Yes, it is very much worth the time. Here is why.

Who is ibotta (I bought a…)?

First, let us start off with a quick review of who ibotta is.

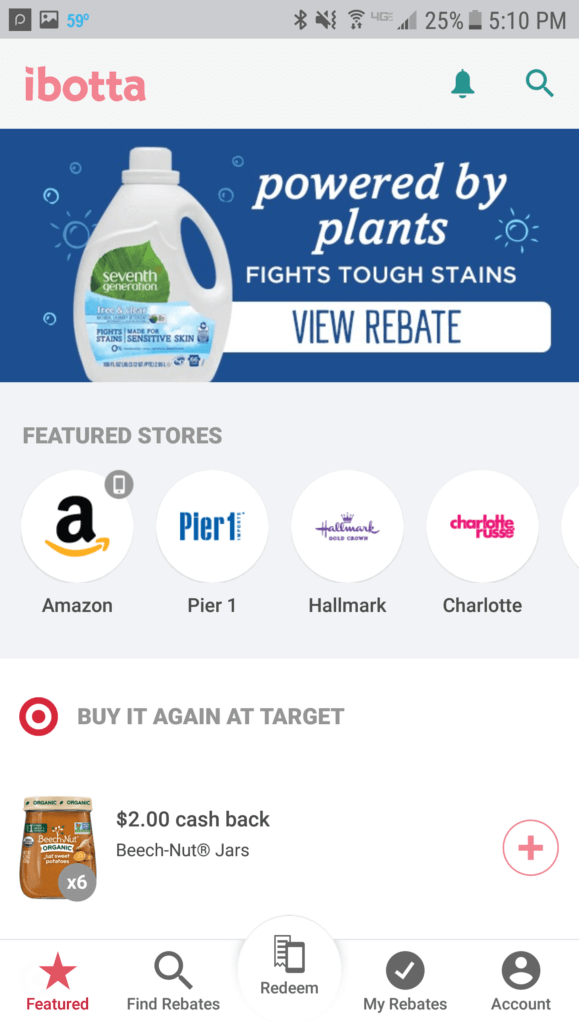

Ibotta is a startup based in Denver, Colorado, specializing in giving you cash back for purchases you make at particular stores. They have over 300 stores to select from, including Amazon, Uber, Target, Kroger, etc.

Ibotta makes their money from affiliate income from the stores they partner with. For example, a consumer goes to a store to purchase an item and redeems the rebate within the ibotta app. That store then credits ibotta for pointing the consumer to them. Ibotta also makes some money off of the little tasks you have to complete before adding a rebate (more up next).

Here is how that works. A consumer goes to a store to purchase an item and redeems the rebate within the ibotta app. That store then credits ibotta for pointing the consumer to them. Ibotta also makes some money off of the little tasks you have to complete before adding a rebate (more up next).

Ibotta also makes some money off of the little tasks you have to complete before adding a rebate (more up next).

How does the app work?

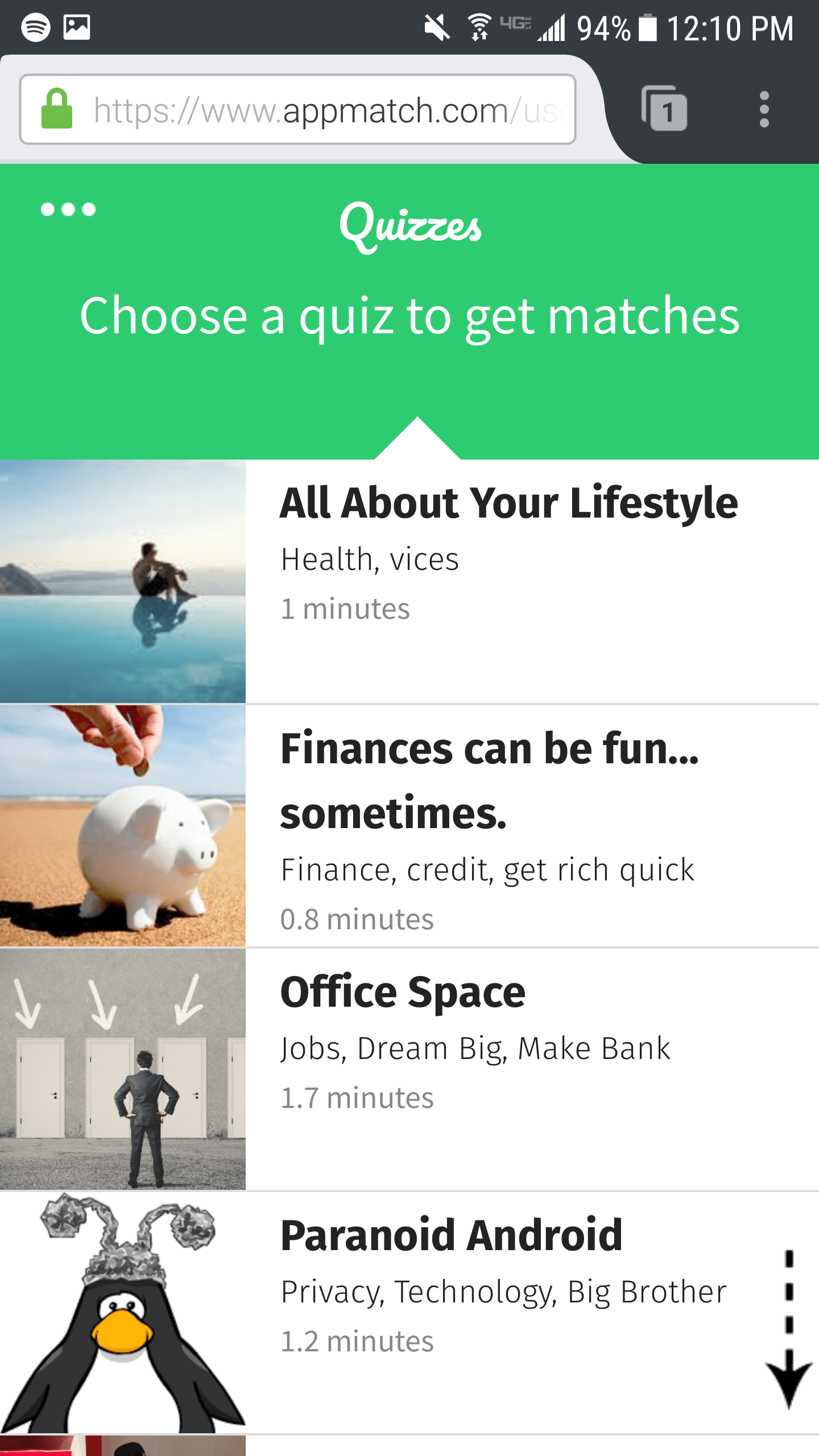

Within the ibotta app, you will want to add rebates from your favorite stores. In the ‘Find Rebates’ section, click on the plus symbol on items that interest you.

Every time you do add a rebate, you must complete a concise task. So far, all I have seen are one-question surveys. I am not sure if there are other tasks, though I have heard there are videos they have you watch. So far, these tasks have been straightforward.

There are three different ways to get money back through the ibotta app:

- By sending a receipt back to ibotta.

- You can link a loyalty card from your favorite stores.

- You can make mobile in-app purchases.

My favorites are the last two methods because they require essentially no work. We will walk through all three ways for this ibotta app review, though.

By Receipt

The process was pretty simple as it only consisted of four significant steps:

1. Find Rebates

You will want to hop into the ibotta app to search for rebates here. I like to go into the ‘Find Rebates’ section, which allows me to see my favorite stores that I bookmarked. Once I selected a

store, I started searching for any rebate that applied to what I needed.

2. Go Shopping

After getting the rebates locked and loaded, it is time to go shopping! Don’t forget to head to the store before the rebate expires.

3. Redeem

Once you get back from the store, it is time to hop back into the ibotta application. Here you will want to select the ‘Redeem’ button to take a picture of the receipt and the bar code of the product you bought.

4. Get Cash

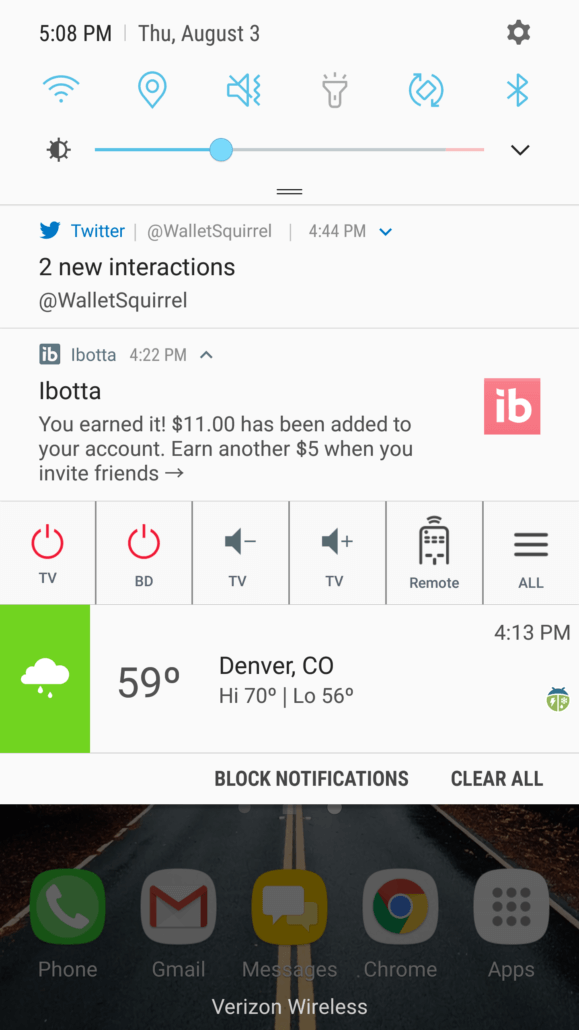

They promise you will get your rebate within 48 hours. Mine was dropped to me within an hour. I was impressed with how quickly I received my cash!

Link a Loyalty Card

This is my favorite method to gain rebates through the ibotta app. Here you only have to link up a loyalty card to your favorite stores, for me, King Soopers.

Here is what you need to do to get it set up:

1. Link Loyalty Card – Link your loyalty card from your favorite stores (in the ibotta network) to your ibotta account. You can either use your loyalty card number or phone number.

How cool is that?!?!

2. Find Rebates – Like in the ‘By Receipt’ method, head over to the ibotta app to search for rebates add the rebates you want.

3. Go Shopping – Head to the store you linked up to, using your loyalty card or phone number during check out. Because ibotta can see that transaction through your loyalty card, they will care for the rest.

4. Get Cash – Within 48 hours, you should see the rebate deposited into your account.

Mobile In-App Purchases

1. Find Rebates – Before heading to any of the mobile shopping apps that ibotta has partnered with, find the correct rebate for what you need.

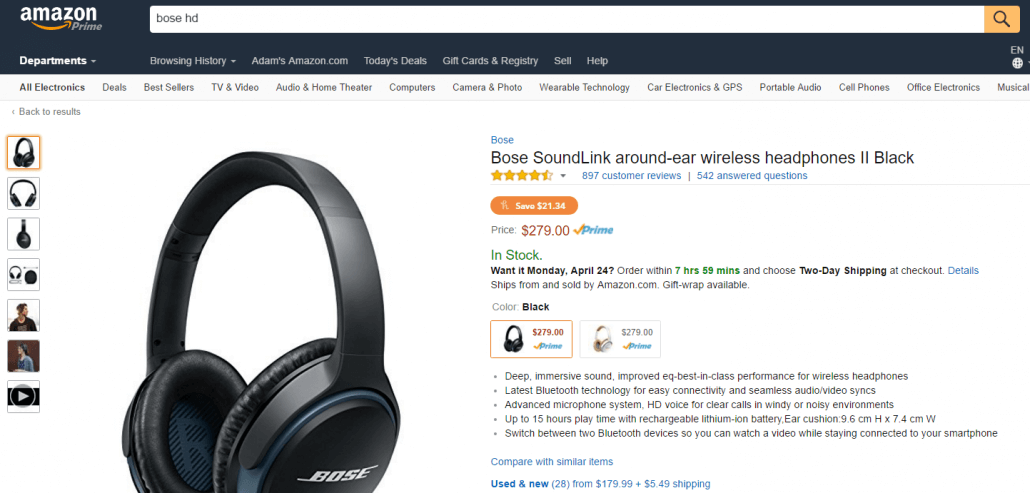

2. Launch App – Within the ibotta app, open up the mobile shopping app such as Amazon.

3. Go Shopping – Find the product you are looking for, and make sure it qualifies for the rebate!

4. Get Cash – Ibotta will confirm that the rebate is pending. Within 48 hours, you should see the refund deposited into your account.

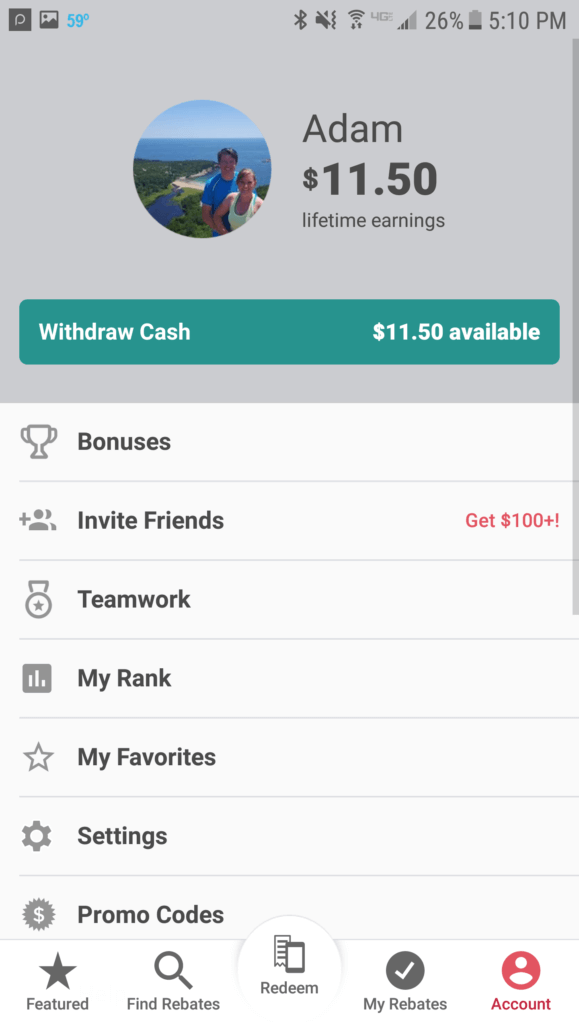

Getting Your Cashback

When I first set out to start researching for this ibotta app review, I thought to myself, “There is no way it is going to be this easy to get the rebate back.” Instead, I found from past experiences that most companies make you go through so many loopholes just to get paid.

To my surprise, receiving the rebate back was super-efficient. It was not 60 minutes later when I received my cash into my ibotta account.

There are many options to withdraw this cash to be able to use. They give you the option to deposit to your PayPal or Venmo account. There are also options to buy gift cards as well!

Sadly, there is one loophole you have to jump through. There is a $20 minimum before you can withdraw your rebate cash.

But, Hey! This ibotta app review could not be all positive news!

That is better than the $100 minimum the Stock Photography sites that I participate with have.

Other Helpful Tips

When I first launched the ibotta app for this review, it prompted me to find my favorite stores. Do not skip this step, as I enjoy having my favorite stores easy to find at the top of the ‘Find Rebates’ section. On the ‘Featured’ page, this will automatically pull any featured item from your favorite stores to the shelter, making it easier to find more awesome stuff.

Secondly, a teamwork feature allows you to link with friends through Facebook. This program will enable you to earn cash quickly. I have not tried this feature yet, but ibotta claims, “The bigger your team, the faster and easier it is to earn Teamwork Bonuses.”

Finally, check out the ‘Bonuses’ page under your ‘Account’ page. Here there are some more direct rebates from companies. For example, you might find something special for yourself.

My Final Thoughts

So, now that we have looked over all of the significant elements let’s take a final glance at this ibotta app review.

I like the app and its concept to the shopping front. Ibotta has nailed the process down to a science that provides a smooth experience. Because everything runs like a well-oiled machine, I do not see this company slowing down at all.

I am not sure that my shopping methods work well for ibotta or any couponing. My personal belief is that I do not need to go shopping just because I have a coupon. My wife and I make a menu for the upcoming week based on recipes we enjoy a lot. Then we see if there are any coupons for those recipes. Typically, there are not many.

Maybe we need to change our menus to revolve around the coupons instead.

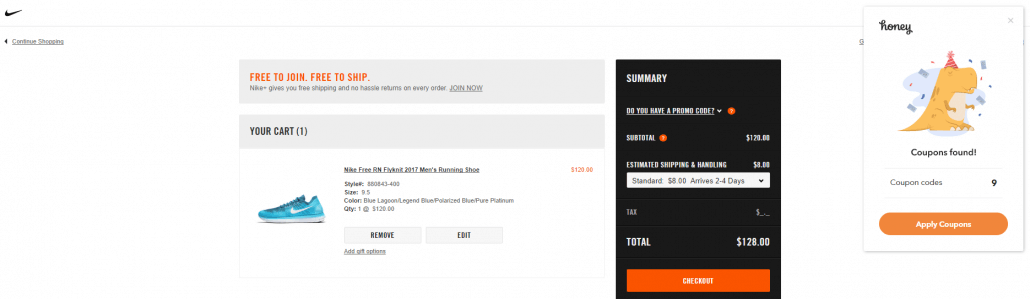

How do you handle coupons? Have you tried Honey yet?

Ready to Sign Up?

Does this review have you excited to get signed up for ibotta? That’s fantastic news!

Head over there now and sign up using our Affiliate Link. This helps us fund Wallet Squirrel to continue to bring more awesome reviews like this one.

More Ways to Make Money

Looking for more ways to make money for you and your family? Well, the search is over!

Head over to our Ways to Make Money page.

Here Andrew and I research, test out and review the different ways to make money, check it out yourself!

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!