How To Sell Something on Craigslist and Make Money

I’ve never sold or bought anything off Craigslist before. This is my first experience from registering on Craigslist and selling a guitar. Here’s how to sell something on Craigslist and make money.

1. Go to Craigslist

Start by googling craigslist and your city (Denver for me). Your first google result will be the right Craigslist page. You can also go to Craigslist.org and select your city, but I find google did it faster for me rather than navigating their website. When you first get to their website, keep in mind its set up for buyers. You’ll be given options to search categories like “for sale items”, “housing (apartments)” and “jobs” and others.

2. Post to Classifieds

- You’ll see a “Post to Classifieds” on the top left of the website.

Craigslist Homescreen

- You’ll be asked “What Type Posting is this?”. This is to categorize your posting, should it be a “Job Wanted”, “Apartment Vacancy” or “For Sale by Owner”. Since I am selling a guitar, I choose “For Sale by Owner”. You can also choose to give things away for free in lieu to sell something on craigslist.

- You’ll then be asked what type of item you’re selling. Again this is to help Craigslist decide where to place your ad. I choose “musical instruments- by owner”.

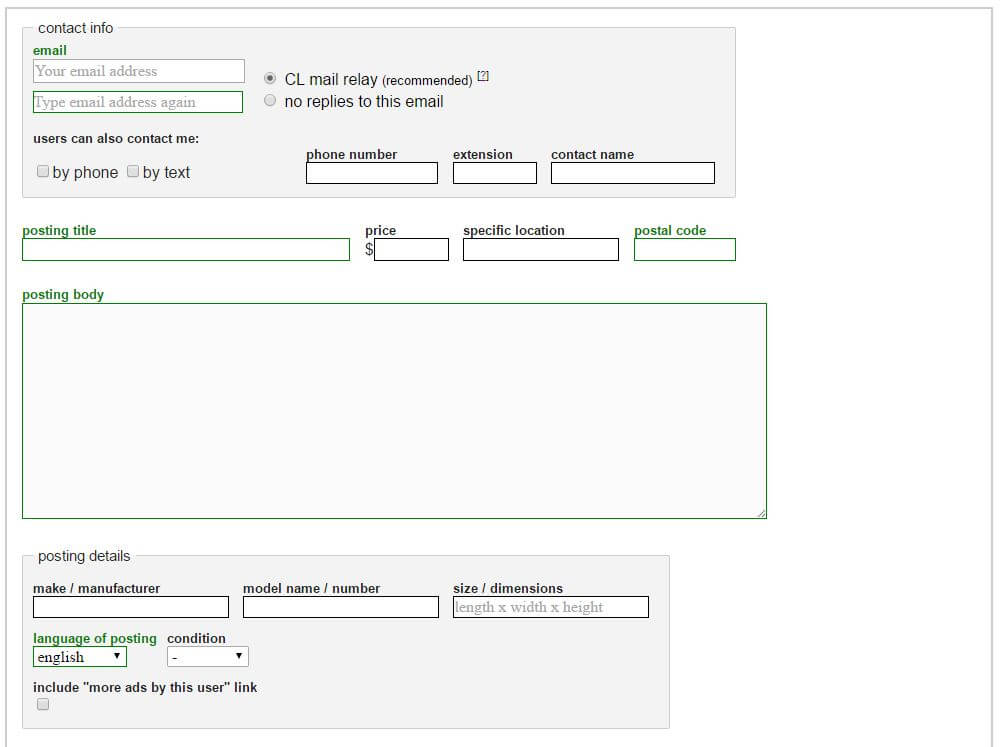

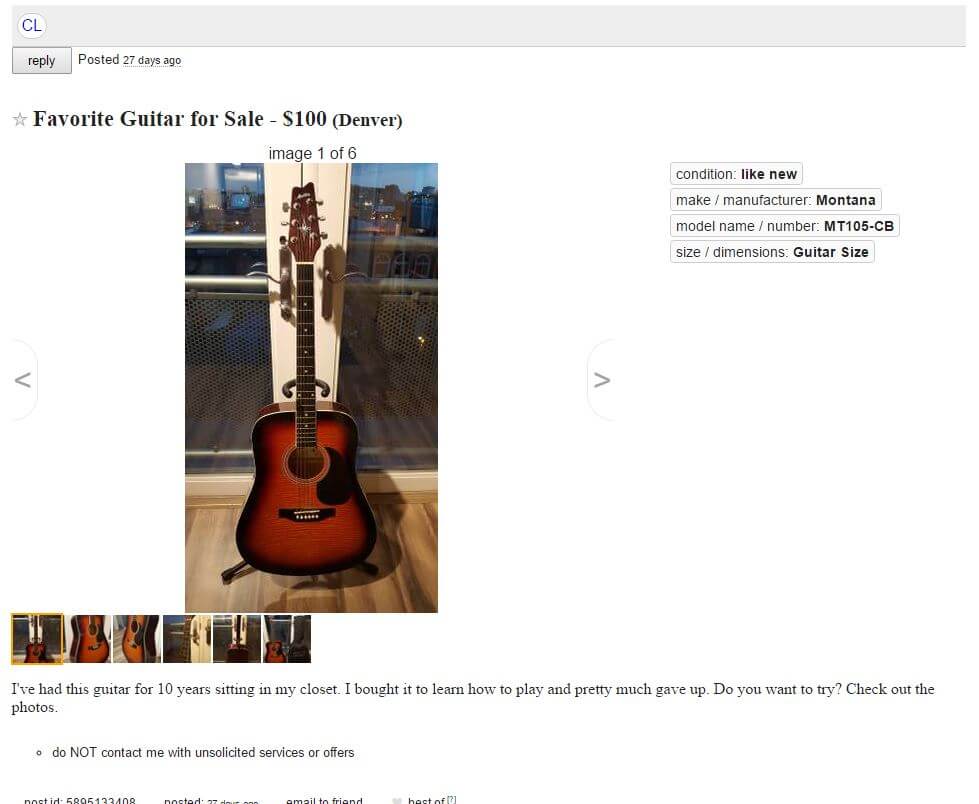

- Now enter your contact info and product description. This will be different for different items you sell, but same general idea.

- Contact Information – You really only need your email. They ask for your phone number, but I didn’t provide it. I figured if anyone wanted to get ahold of me, they can email me. It’s the same as texting which pretty much everyone does anyway. Especially anyone using Craigslist.

Craigslist does a neat email thing where whenever someone sends you an email through Craigslist, it goes through a Craigslist server and hides the sender’s actual email. You’ll see a long string of characters for their email. When you reply, it’ll go to the right person, but this way, you can communicate without people seeing your email address and them seeing yours. Craigslist calls this “CL Mail Relay”. I used this option. (See email screenshot below) - Product Description – Personally I kept this short and simple. People don’t need a long description. My entire description, as you can see from the screenshot below, is pretty short. Just make sure you use the “Keywords” you think people will be searching for, in your product title and description.

You’ll also want to add a product price. Just do a simple search for what your item currently sells for new and compare its condition and what others are selling similar items for. I listed $100 for my guitar. Remember people use Craigslist to find bargains.

- Contact Information – You really only need your email. They ask for your phone number, but I didn’t provide it. I figured if anyone wanted to get ahold of me, they can email me. It’s the same as texting which pretty much everyone does anyway. Especially anyone using Craigslist.

How To Sell Something on Craigslist and Make Money

3. Responding to Potential Buyers

I had 6 people respond by email that they were interested. These 6 people responded within the first week it was posted. It seems after a week, your ad will get buried by newer post.

- One person just sent me an email telling me I was dumb for selling my guitar. I deleted their email.

- Three people just had simple questions about the guitar and that was it.

- Two people wanted to meet to see it in person. (email below)

Potential Customer Email

4. Meeting with a Potential Buyer

Everything I’ve read online, always meet someone in a public place. You don’t want to be creepy and don’t want to meet creepy people.

After emailing back and forth with a potential buyer, we had to reschedule once because of her work schedule. It was a girl because her she signed her email with her name, Jennifer. She was buying the guitar for her mother. That seemed neat. I suggested meeting in the lobby of my apartment building downtown. It’s a nice lobby and public place so she would feel comfortable.

She arrived with her mother and daughter, either because she felt more comfortable with someone else or because the guitar was for her mother. Her mother inspected the guitar, had a few questions which I answered honestly. Then after 10 min of chatting, she asked: “what was the lowest I’d sell it for”. Which was an interesting haggling tactic to see if she could get it cheaper? This could potentially work, but I just said the advertised price “$100”. She then provided me a $100 bill.

I could have been skeptical of the large bill, but it looked legit and I had no reason think it wasn’t. That was it. I went upstairs with my $100 bill and they left with the guitar. The entire process was akin to selling a fruit roll-up to a classmate in the school cafeteria. It was easy.

Final $100 Bill

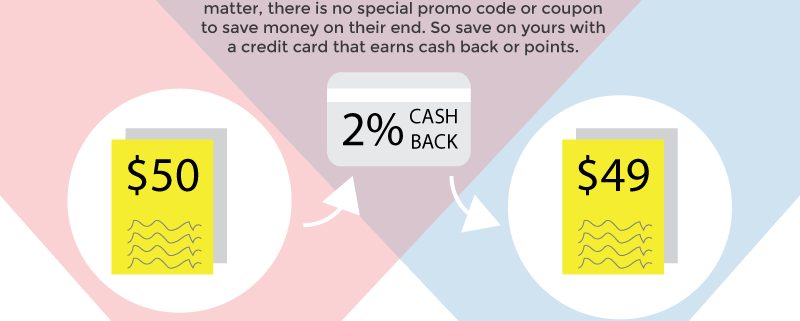

What Happens if You Invest that $100

Since Wallet Squirrel is all about earning extra money and investing it, let’s see what would happen over 20 years if you invested that $100 in dividend stocks. Let’s assume 7% Market Average with a 3% dividend.

Hopefully this helped to explain how to sell something on Craigslist and make money. Will I do it again? Hell yea, it went so smooth and hassle free that I want to sell more items. I have a whole box of Pokémon Cards, anyone want them?

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!