Oh My Goodness I Hate Tipping, It Ruins My Budget and Anxiety

Then exactly how much too much and too little for a tip? Common restaurant adequate says a tip should be 15%-20% pretax, but then why does every restaurant leave the anxiety for the customer to decide how much to tip?

Let’s face it, an extra 20% of a $60 check is still a lot on your budget. That’s $12 the menu doesn’t mention.

This History of Tipping is Murky

From what I found in the Business Insider and Washington Post (and it’s a murky origin story) tipping originated around 17th century England where the word T.I.P. meant “To Insure Promptitude”. The upper class provided extra “allowance” to servers (lower class) to be given faster service.

This practice made its way to America after the Civil War when wealthy Americans started traveling back and forth to Europe. So we can blame them, and I do.

Tipping Today Just Allows Restaurants to Pay it’s Servers Poorly

Because servers receive tips, the federal tipped minimum wage for tipped workers is as little as $2.13 an hour because they receive tips to supplement the difference (source).

That’s kind of ridiculous, right! Restaurants are allowed to only pay their servers $2.13 an hour and expect servers to get the rest of their income from tips. So when you pay your bill, you’re essentially paying for the food/environment with your bill and your tip pays the waiter’s salary.

If you’re a waiter, the customer is actually your boss since they’re the ones that pay you. So every day, every hour, you have a different boss. Yikes.

How Much Do You Pay Your Server Then?

According to Google, yes I googled “How Much Should I Tip”. You should be paying your server 15%-20% of your pre-tax bill.

This Is Where The Anxiety Starts

Which one is it? Do I tip 15% or 20%?

What If The Server Was Bad?

If my bill is $100, does the server get an extra $20 just because they took my order and walked food back from the kitchen?

What if they were awful? We’ve all had bad servers who ignored us. They took a long time or brought us the wrong items with a rude attitude. Is that when you tip them 15% instead of 20%?

What about if the food was awesome but the service was terrible? ugh

Should I feel both angry at my server for bad service but feel guilty since they’re paid so poorly? How should I feel?

I recall a study conducted found that bad servers still received 15%-20% regardless of how good the service was because people felt it was the socially acceptable thing to do. No one wants to be a bad tipper, but should I tip poorly to save a bit of money and prove a point to the server? Would a bad tip even make a difference?

What if the server was awesome?

You plan to spend a certain amount of money eating out and even account for a 20% tip. Do you exceed your budget further if your server was fantastic? Should your server’s awesomeness impact your planned budget? Should they be worthy of more than a 20% tip of that you’re still paying off student loans?

Damn it Janet, you were so great that now my tip for you exceeds my monthly food budget.

Are you a bad person if you don’t acknowledge their above and beyond service or will they quit trying harder if people don’t tip more for the great service?

What About Tipping During Group Meals?

Now imagine eating out with a group of friends, each pays their own bills and it always ends with everyone deciding the tip for themselves. All while each of you judges each other’s tips. If you only tipped 15%, does that make you a jerk if everyone else tipped 20% – 25%?

On the other hand, are you a jerk for tipping more than everyone? Are you considered flaunting your money because you can spend more money than everyone else or does it make you more generous or charitable?

This Is Why I Hate Tipping!

Why does a nice meal out with friends have to end with awkward silences while everyone calculates percentages in their heads while they secretly judge the performance of the server? Ending in silent comparison of who tipped more, who was more generous, and who felt more charitable than the rest of the group.

I Now Tip 20% Regardless of Service

Tipping makes me so anxious that I’m just starting to tip 20% regardless of service (paying with my credit card). The server can refill my drink at the perfect time or pour hot soup on my head. Creating a baseline 20% tip in every situation saves me from unnecessary anxiety at the cost of a few extra dollars from my budget. Sorry budget.

Except Subway “Sandwich Artists”, I still don’t understand why they now have a tip jar. They literally walk along with me placing ingredients I select onto bread. Is tipping at fast food restaurants now becoming a thing?

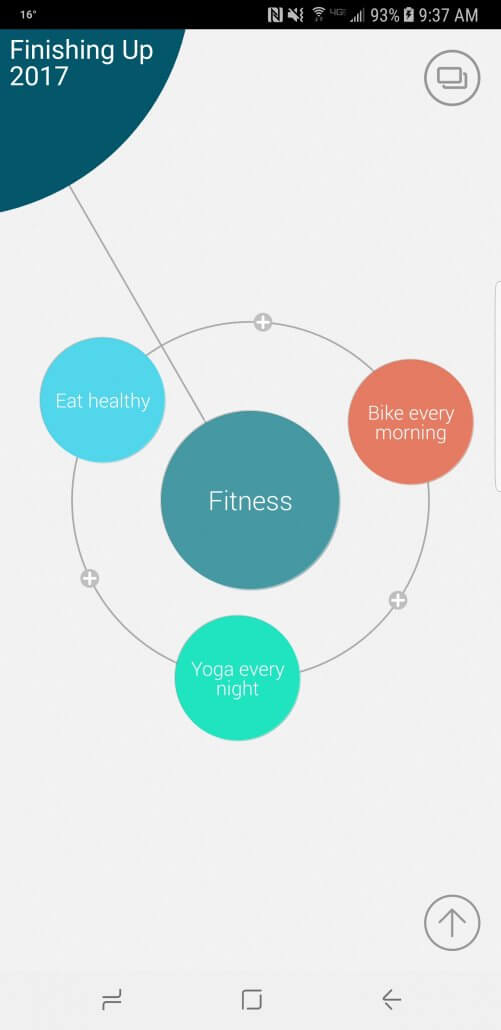

If you also tip 20% regularly, here is a chart to help you decide what 20% would be when you’re looking over a menu because they don’t list the extra tipping cost on the menu.

20% Tip Per Cost of your meal

| Check | 20% Tip |

| $20 | $4 |

| $40 | $8 |

| $50 | $10 |

| $60 | $12 |

| $70 | $14 |

| $80 | $16 |

| $90 | $18 |

| $100 | $20 |

If this seems like a lot of money to tip, you can always stay in and eat a Peanut Butter and Jelly sandwich. Save eating out when you know you can spend extra money on a 20% tip.

What do you tip your servers? There is obviously no right answer otherwise they wouldn’t leave the tip field on every check blank. I REALLY want to know. Do you judge your waiter every service or, like me, give them a flat fee regardless?

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!