How Does Bail Work and Do You Get Bail Money Back?

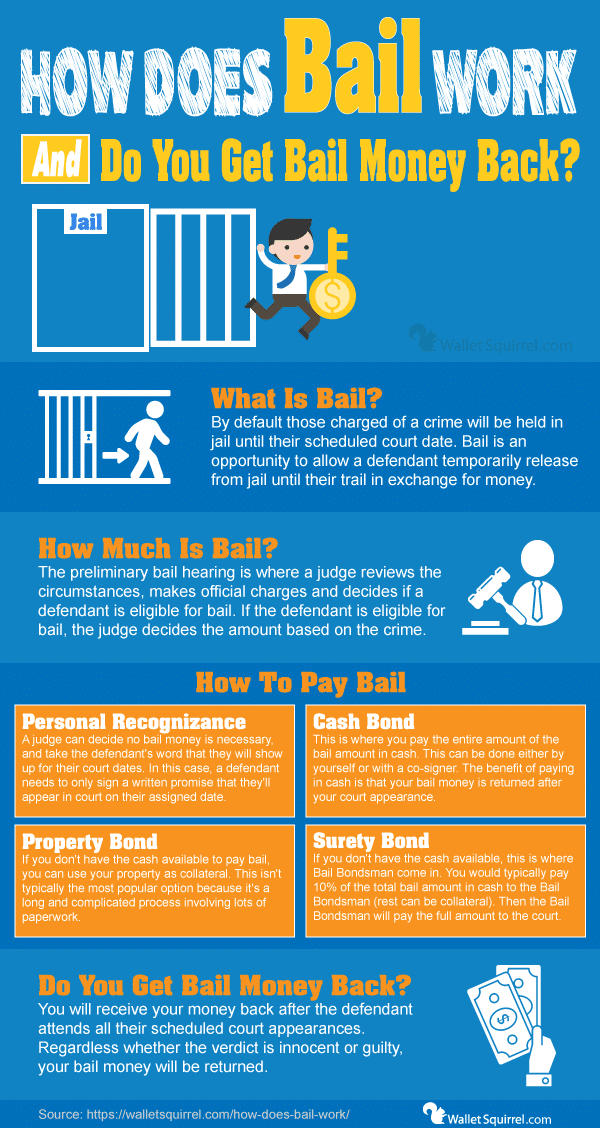

What Is Bail?

When someone is charged with a crime and booked by law enforcement. By default, those charged with a crime will be held in jail until their scheduled court date. Bail is an opportunity to allow a defendant to temporarily be released from jail until their trial.

Considering court dates often take weeks or months after the initial arrest, bail is often preferred to waiting in jail.

Cash Bail System

The United States is largely a Cash Bail system. Meaning you are required to stay in jail until all your scheduled court dates, that is unless you can pay the court money for bail.

In order to be granted bail, a defendant must pay the court in exchange for temporary release from jail until their scheduled court date. The amount of money paid is typically set at a base amount per alleged office, but judges have a large amount of discretion in raising it, lowering it, or completely waiving it at the preliminary bail hearing.

Many states are working to abolish cash bail. States including California, Alaska, Washington D.C., and New Jersey have completely abolished it or limited cash bail because it heavily favors the wealthy. Poorer individuals who don’t have money for bail are stuck in jail for weeks or months until trial. This leads to further financial hardships as they are forced to miss payments, miss work and potentially lose their job and go into debt before they can even attempt to prove their innocence.

How Does Bail Work?

So let’s say you’re arrested for a crime you may or may not have committed. Law enforcement is first going to take you to the local police station for booking. This entails providing general information (name, address, etc.), mug shots, fingerprints, and a criminal background check. After your booking process, and the well-known “one free call”, you are placed in a station jail cell with other recent suspects.

What happens next in the “how does bail work” process is the preliminary bail hearing. This occurs usually within 48 to 72 hours after the booking. The length depends on when you were arrested because courthouses are typically only open on weekdays.

The preliminary bail hearing is where a judge reviews the circumstances, makes official charges, and decides if a defendant is eligible for bail. If the defendant is eligible for bail, the judge decides the amount, if any.

When a judge sets a defendant’s bail amount, they are starting from a base amount according to the severity of the crime. Then they weigh additional considerations such as the defendant’s criminal record (if one exists), past experience showing up for court, flight risk, ties to the community, and whether they are a danger to themselves or others. These all factor into the judge’s consideration, who ultimately has the final say in the bail amount.

Not until a bail amount has been set in the preliminary bail hearing, can a defendant be released from jail on bail.

If you find yourself in this situation, consider having your lawyer present for the preliminary bail hearing to help plead with the judge and reduce any bail amount set.

How To Pay Bail

Once the preliminary bail hearing has set the bail amount, it can be paid in cash, money order, or cashier’s check to the Clerk of the Court.

If you do not have cash on hand or creative ways to make money, there are other options to help pay.

Bail Vs Bond

There is a lot of confusion about the terms bail vs bond, but they have two distinct meanings. Bail is the process that allows a defendant to temporarily be released from jail until their trial date. While the bond is what the defendant provides to the court in exchange for bail.

Bond is usually cash, property, or another one of the different types of bail listed below. Think of the phrase “A person’s word is their bond”, except most courts prefer money to be the bond.

Types of Bail Bonds

Since a bail bond is how a defendant affords bail, there are different types of bonds. Think back to our initial “how does bail work” example of So-And-So was released on a $400,000 bail. That doesn’t mean So-And-So had $400,000 in their bank account ready to hand over, although they may have it or used crowdfunding. Here are the different types of bail bonds that help people afford bail

Personal Recognizance – A judge can decide no bail money is necessary, and take the defendant’s word that they will show up for their court dates. In this case, a defendant needs to only sign a written promise that they’ll appear in court on their assigned date.

Cash Bond – This is where you pay the entire amount of the bail amount in cash. This can be done either by yourself or with a co-signer. The benefit of paying in cash is that your bail money is returned after your court appearance.

Property Bond – If you don’t have the cash available to pay bail, you can use your property as collateral. This usually isn’t the most popular option because it’s a long and complicated process involving lots of paperwork. Additionally, the property you use as collateral typically needs to have a value of 150% or more of the bail amount. Although that varies by state.

Surety Bond – If you don’t have the cash available, this is where Bail Bondsman comes in. This is often a popular option as people don’t typically have thousands of dollars around to post bail. In this case, you can enter a Surety Bond agreement with a Bail Bondsman to pay for bail.

What is a Bail Bondsman

A Bail Bondsman is a licensed agent who helps with Surety Bonds. This usually involves paying 10% of the total bail amount in cash to a Bail Bondsman, and the remaining amount can be personal collateral such as property, cars, jewelry, etc. Then the Bail Bondsman will pay the entire amount to the court (if necessary) for your release on bail.

The Surety Bond makes the Bail Bondsman responsible for the defendant showing up for their trail. If a defendant doesn’t show, the Bail Bondsman is left on the hook. The Bail Bondsman will lose all the money they paid for the defendant’s bail and thus will make every effort to track the fleeing defendant to recoup their losses. This is where you find popular tv shows like Dog The Bounty Hunter make a living chasing down people who broke their Bail Bondsman agreements.

How Do Bail Bondsman Make Money

When you enter a Surety Bond with Bail Bondsman, you typically pay 10% of the total bail amount in cash. This upfront cash is usually kept by the Bail Bondsman as their fee for the risk their taking. The total amount varies by state and even the individual Bail Bondsman. This hefty fee is the downside of using a Bail Bondsman.

How Long Does It Take To Get Out of Jail After Posting Bail

Once the bail amount is paid and signed for, the paperwork usually takes 4-8 hours to be processed before you can leave. This is an average, but some cases can take up to 12 hours. There are a number of procedures the jail must ensure before releasing an inmate. It all depends on the jail and their current workload.

Bail Conditions

Once out on bail, there may be certain conditions you must follow. Each judge decides their own conditions at the preliminary bail hearing based on the particular case. You may have some, none, or all of these common bail conditions.

-

- Travel Restrictions

- Mandatory Check-in

- Staying Alcohol & Drug-Free

- No Weapon Possession

- Employment Requirements

- Mandatory Classes by the Court

- No Contact / Stay Away Orders

How To Bail Someone Out Of Jail

If a friend was arrested and used their one-free-call to ask for help. Here are the steps on how to bail someone out of jail. First, identify where they’re located and when their preliminary bail hearing is scheduled. Second contact your friend’s lawyer or help get them a lawyer. The sooner you have a lawyer involved, the better.

Otherwise, there isn’t much you can do until the preliminary bail hearing within 48 to 72 hours after booking. Only then can you figure out how much it will cost to bail out your friend.

Do You Get Bail Money Back

You will receive your money back after the defendant attends all their scheduled court appearances. Regardless of whether the verdict is innocent or guilty, your bail money will be returned. However, some courts may take a fee for administrative court costs.

The entire bail process is simply the defendant promising to attend their scheduled court appearances. Money is provided to the court to ensure the defendant keeps their promise and once that promise is met, the money is returned. The only exception is if you did a Surety Bond with a Bail Bondsman, the upfront money you paid (usually 10%) is kept as their fee.

What Happens if You Don’t Show Up For Court

If you fail to keep your bail promise to attend your court date. Your initial bail money is forfeited to the court and a judge will issue a warrant for your arrest.

If you missed your trial, you may petition for a reinstatement of your bail instead of forfeiting it. However, it would have to be an incredibly good reason for missing your initial trial.

Wrap Up

Hopefully, this helps makes bail feel less scary and provide a better understanding of how does bail work.

Bail is simply the process of being temporarily released from prison until your court date. This happens through an exchange of money (the Bond) for the court to hold until your return. Once you return for all scheduled court dates, the court returns your money minus any court fees.

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!