Cheap Caribbean Vacations – The Ultimate Guide

Whether you prefer to be wholly tethered to white-sand beaches or experience an entirely different culture rich in history and tradition, the Caribbean islands have something glorious in store for you.

If you relish water sports in crystal clear seas, there are a plethora of options available almost year-round – from spectacular snorkeling to world-class diving, the Caribbean is always prepared to deliver.

Even though the beaches are the island’s main draw, there is an abundance of lush rainforests and picturesque peaks replete with various bird species and countless hiking trails. Plus, the islands’ colorful heritage and unique cuisine are both enigmatic and unforgettable.

But for the frugal tourist like myself, the expense associated with planning a trip to such a widely-popular destination like the Caribbean can be quite prohibitive. Above all, I do not advocate getting into debt just to make a dream vacation into reality. At the end of the day, you want your holiday to be filled with phenomenal memories instead of a sour “broke feeling” aftertaste.

In this post, I’ll explore several strategies to assist you in mapping out your future Caribbean odyssey so you will not inflict a significant dent in your savings accounts.

Finding Cheap Caribbean Vacations

COVID19 Considerations

Effective January 26, 2021, travelers returning from overseas will need to present proof of a negative test result taken within 72 hours or documentation that they had recently recovered from COVID19 before being allowed to board a US-bound flight.

Reaching out to your destination’s tourism department or hotel to inquire if testing sites are available is highly recommended. More importantly, it is critical to choose a test site that can generate results before your departure.

Case in point, since I am traveling to Aruba in the summer, I did my due diligence by emailing their tourism department, which responded promptly. Their response included a comprehensive list of test sites, respective fees, and the expected release of test results.

Though this article is travel-related, this is by no means a recommendation to travel at this very moment. Should you decide to proceed with your trip, please be mindful of the current health guidelines being enforced by foreign countries. Even though the risk of contracting COVID19 could not be completely eliminated unless you totally isolate yourself, traveling does substantially increase the likelihood of infection, so travel only when you are able to tolerate this risk. Moreover, quarantine requirements and travel restrictions are constantly changing, so make sure that your destination does permit you to enter without requiring you to stay indoors for longer than your entire vacation.

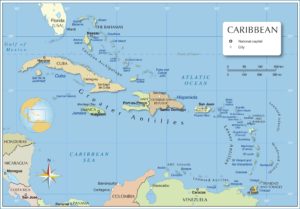

The Caribbean Islands and Their Highlights

Photo Credit: Nationsonline.org

Anguilla – Beaches

Antigua – Beaches, Cuisine

Aruba – Beaches, Nightlife

Bahamas – Beaches, Nightlife

Barbados – Cuisine, Golf

Bonaire – Diving, Hiking

British Virgin Islands – Beaches, Diving

Cayman Islands – Beaches, Shopping

Curacao – Beaches, Hiking, Diving

Dominica – Diving, Outdoor

Dominican Republic – Beaches, Golf

Grenada – Beaches, Outdoor

Guadeloupe – Beaches, Diving, Outdoor

Jamaica – Golf, Outdoor, Cuisine

Martinique – Beaches

Montserrat – Diving, Outdoor

Puerto Rico – Nightlife, Outdoor, Culture

Saba – Diving

St. Barthelemy – Beaches

St. Eustatius – Diving

St. Kitts & Nevis – History, Golf, Outdoor

St. Lucia – Outdoor, Beaches

St. Maarten – Beaches, Plane-Spotting

St. Vincent and the Grenadines – Beaches, Diving, Golf

Trinidad & Tobago – Beaches, Diving, Golf, Outdoors

Turks & Caicos – Beaches, Diving

US Virgin Islands – Beaches, Diving

(Source: Fodor’s Travel)

Where to Go?

Comprising over 20 island-nations and territories, figuring out where to go in the Caribbean can be incredibly daunting. Unless you have the luxury of time and money to island-hop every few days, I do not suggest visiting them all in one trip.

Selecting which paradise island to explore will primarily depend on the purpose of your holiday.

Would you like to intersperse lounging at the beach with hiking?

Do you plan to either do professional diving or recreational snorkeling?

Are you a foodie and love chronicling various international cuisines?

If you are a history buff, would you be interested in visiting Alexander Hamilton’s birthplace in Nevis?

Are you scouting the perfect romantic getaway for your honeymoon?

Other considerations that can influence your choices revolve around budget and time. Some islands, such as Anguilla, Barbados, St. Barthelemy, and the British Virgin Islands, strictly cater to the well-to-do crowd which makes bargain hunting practically impossible. I will skip those if you are on a shoestring budget.

Once you have narrowed down your potential options based on the factors above, start searching for cheap airfare and wallet-friendly accommodations. You might also want to consider embarking on a discounted cruise once it is safe to do so. The sections that follow will walk you through this process.

When to Go?

A few years back, I would strongly recommend avoiding hurricane season. But with climate change in full effect, it has become much more challenging to accurately predict when hurricanes are likely to form.

By and large, the Atlantic hurricane season starts at the beginning of June and lasts until November. Historically, powerful hurricanes have occurred between August and October. To minimize the risk of inclement weather impacting your vacation, I would avoid traveling during these months.

In the event that a hurricane has disrupted your travel plans, hotels and airlines normally offer refunds or rebooking without a fee. For added protection, I advise purchasing travel insurance.

If you would like to leverage flight deals during hurricane season, the southern islands of Trinidad & Tobago, Aruba, Bonaire, and Curacao have traditionally escaped the wrath of powerful hurricanes in the past.

How to Find Cheap Flights?

ONLINE TRAVEL AGENCIES (OTAs) VERSUS AIRLINES

If COVID19 has taught us a lesson, it is to book flights directly with airlines. Tickets booked with online travel agencies (OTA) such as Kayak and CheapOAir were difficult to modify or cancel without a fee during the pandemic.

However, the reality is that there are so many airlines that fly to the Caribbean that running individual searches in order to arrive at the cheapest airfare will surely take an enormous amount of time. Hence, I suggest taking the OTA route as they generally scan all airlines, including budget carriers, for the cheapest airfare.

First, run your searches through these three OTAs as they consistently yield the cheapest airfare possible: Momondo, Skyscanner, and Google Flights.

Next, take note of the exact details of the flights you found and initiate a similar search directly on the airline’s website. Compare both fares and pick the cheaper flight.

If it is a difference of a few dollars, I’d rather book with the airlines as their terms mainly offer more flexibility. In fact, almost all major U.S. carriers have started waiving their change fees for flights to the Caribbean, albeit temporarily. At any rate, it is good practice to always verify the terms and conditions of the ticket you are planning to purchase before hitting the buy button.

EXPLORE OPTION

Another fantastic feature of my recommended OTAs is their ability to perform an extensive search for the cheapest flight available in any region. This feature is commonly called the “Explore” option and is available on Momondo and Google Flights.

When searching, write down “Caribbean” in the destination search box. Enter your preferred dates, then jumpstart the search. Select the particular flight that aligns with your preferred travel time (i.e., number of stops, length of layovers) and budget.

This strategy works best if you do not have a specific island in mind and are willing to fly anywhere as long as the price is right.

MISTAKE FARES

Subscribing to travel websites that comb through the web for bargain flights and mistake fares is another avenue to find airfare deals to the Caribbean.

These websites have devoted employees who meticulously monitor various travel search engines for insanely cheap plane tickets. Subscribers immediately receive a newsletter once these deals get unearthed, so they don’t miss out on these valuable promotions.

If you are curious about error fares, they are usually the outcome of computer glitches that happen quite often. Since these flights are dirt cheap, you need to pounce the moment the deal enters your inbox as they tend to quickly vanish within a few hours.

Some of these platforms require paid subscriptions, but most offer free basic memberships, so I would recommend the latter. The most popular mistake fare websites are Airfare Watchdog, Secret Flying, The Flight Deal, Travel Pirates, Scott’s Cheap Flights, and The Thrifty Traveller.

TRAVEL HACKING

Anyone remotely interested in travel should be familiar with how travel hacking works as it has the potential of saving anyone a considerable amount of money.

Every major airline has its loyalty program, and loyalists naturally get rewarded with free flights. Free travel is attained after reaching a certain number of points, usually dependent on the cost of the redemption.

Previously, the only way to accumulate these “loyalty” or “frequent flier” points is by repeatedly flying with the same airline. But that is just now a thing of the past. Currently, anyone can earn these frequent flier points by travel hacking.

Simply put, travel hacking is the art of applying for specific travel credit cards in order to earn generous sign-up bonuses that can be ultimately redeemed for free flights. It is by far the best strategy to save money on airfare.

However, this approach is sadly not for everyone. If you currently hold a lot of consumer debt or have difficulties paying off your monthly credit card balance in full, then this strategy may not be suitable for you at this time. Nevertheless, once you are debt-free, you can undoubtedly take travel hacking for a test drive to find out if it can work for you, too.

Whether you are a novice or an expert traveler, I highly recommend dabbling in travel hacking. It has brought me to countless places I would never have imagined visiting in this lifetime for a fraction of the price.

OTHER STRATEGIES

Aside from the above tactics, there are also additional methods that you can utilize to ensure that you are getting the best bang for your buck.

In short, flexibility is the name of the game. The more fluid your plans are, the higher your likelihood of grabbing deeply discounted tickets. Besides flexibility, other recommended strategies when hunting for cheap airfare include using incognito mode while searching, booking one-way, multi-city, or round-trip and comparing costs, booking one person at a time, and paying with local currency, among others.

Where to Stay?

ONLINE HOTEL SEARCH ENGINES

The strategies in finding reasonably-priced lodging will mirror the techniques for airfare. Performing a search using various online hotel search engines is recommended.

Although frugal tourists tend to naturally gravitate towards inexpensive accommodations, I firmly advise reading customer reviews before finalizing your reservations.

You would want to ensure that the property is compatible with what you are looking for, taking into account the lodging’s safety and security as well as how comfortable and clean the accommodations are. Also, you would want to know whether the hotel offers refundable rates in case your plans get derailed.

- Hotels.com – One of my favorites as it gives a free stay after every 10 nights.

- Booking.com – Consistently features deeply discounted properties.

- Agoda.com – Terrific promotions year-round.

- Hostelworld.com – If you want to save and do not mind roughing it out, staying in a hostel might be an option.

- AirBNB.com – If you want a property with additional amenities such as a kitchen, parking, etc, then consider staying in an Airbnb.

- VRBO.com – Another wonderful option for long-term stays.

Mix and Match

Some search engines such as Kayak, Expedia, Orbitz, etc. allow travelers to lump airfare and hotels together in the same reservation resulting in hefty savings. Before booking, though, make sure you compare these rates with the fares you get when booking them separately.

Hotel Hacking

Identical to airfare hacking, it is possible to rack up a significant amount of hotel points when you sign up for hotel credit cards. These points can then be exchanged for free nights in virtually every major hotel chain possible.

Some of these credit cards also give out a free night certificate when you pay the annual fee. Whenever you book a night that is more expensive than the cost of the annual fee then you have come out ahead.

It bears repeating that in order to maximize these travel hacking offers, you need to have a stellar credit score and be inherently averse to debt. Despite how lucrative these credit card deals are, if you tend to encounter difficulties paying off your credit card balances when they are due, then banks might deny your application.

Once you are debt-free and have a substantial travel fund, you can consider the current offers available from these popular hotel chains: Hyatt, Marriott, Hilton, and Intercontinental Hotels. Even though all of these hotel brands have a vast footprint in the Caribbean, they are not present in all of the territories. Verify that the hotel credit card you’re applying for actually has a property on the island you are planning to visit before signing up.

Package Tours for Island Hopping

Our final strategy is taking advantage of package tours, which are predominantly cruises that visit multiple ports. Despite their unsavory reputation as being virus Petri dishes, I will be remiss if I do not mention Caribbean cruises as a viable option to save a decent amount of cash.

Essentially, once we have successfully developed herd immunity and a large percentage of the population is vaccinated, joining cruises is a terrific way to visit several islands without breaking the bank.

Costco.com – routinely offers a wide range of low-cost Caribbean cruises.

Cheap Caribbean Cruises – scours the web for the cheapest available cruises.

Cruise Cheap – year-round discounts for cruises around the globe.

Travel Zoo – periodically releases deeply discounted tours.

Saving For Travel

FRONT LOADING

I save for my travels by mindfully setting aside a specific amount of money per month, so I could have almost all the funds available to withdraw while overseas or to pay my credit card bills upon my return. Since I love travel immensely, I typically save on virtually everything to guarantee that my travel fund is continually blossoming.

With rigorous discipline, it is not only possible to fund your future Caribbean vacation, but any remaining savings you have can be funneled towards other future bucket-list vacations on your drawing board. Just make sure that you keep your saved money in a high-interest savings account, so your travel fund continues to grow even in your sleep.

Final Thoughts

As you can see, navigating the countless options involved in booking your future Caribbean voyage can be extremely overwhelming. I hope that the frugal strategies I’ve outlined in this post can help you plan your trip confidently while staying within your budget.

The more money we save, the more money we can direct to our travel funds so we do not go broke when we return from our vacations. After all, traveling should never create a financial burden on anyone.

I hope that this post has also encouraged you to learn more about travel hacking so you can eventually accumulate travel reward points and redeem them for free flights and hotel stays on your forthcoming Caribbean adventure.

Lastly, I hope that this post has made you move closer to the vacation of your dreams. I can’t wait for you to embark on that journey!

This article originally appeared on Your Money Geek and has been republished with permission.