Income Report – March, 2017

Have you ever sold $6,000 worth of stocks at 7:40 in the morning while eating Captain Crunch? I have.

Following last week’s post on my Cost-Benefit Analysis, Invest my Tax Return or Pay Off my Car. I came to a decision. I will pay off my car.

I am using my $3,200 tax refund (plus $500) in addition to 3/4 of my stock portfolio to pay off my $10,312 car loan.

Why Am I Paying off my Car Loan Rather than Investing?

There were many heated discussions within Andrew’s pool of friends. I could invest my tax refund and make $1,000 more by October 2nd, 2019 or put the tax refund toward my car reducing the amount of months till I pay it off.

I decided to fully pay it off. This is why:

- I never thought I’d NOT have a car loan, so the idea I could pay it off is incredibly happy because I’ll then only have student loans! (albeit $50,000 in student loans left) #MoreFinanciallyIndependent

- I’ll now have $340 more per month to buy stocks! This means more in-depth reports on more stock buys and stock analysis.

- I free up $340 per month in monthly cash flow. 99% of the time I’ll invest that, but it leaves me open to do more side projects for Wallet Squirrel. I love experimenting on Wallet Squirrel and they usually result in earning more money or at least some great lessons learned. I’ll take that.

In the end, I’m very happy with my decision, but it’ll likely be the first and last time I ever pull money out of my stock portfolio.

What Happened in March?

If you recall from February’s Income Report, this was month (1 of 3) to test Wallet Squirrel’s newest contributor, Adam and MAN did he do well! He crushed it this last month by getting an article out every Monday at 1pm. While generating great content and increasing Wallet Squirrel’s SEO. Every blog needs an Adam.

Every blog needs an Adam.

- Most Popular Post – February’s Income Report. This proves that lots of people like to dive into how income is generated on Wallet Squirrel and how it’s being invested. Income Reports continue to crush it in web traffic (maybe it’s the infographics). Plus it was Adam’s introduction to Wallet Squirrel, which also made our most popular Tweet to date.

- Longest Post Last Month – 50 Amazon Affiliate Website Examples Making Money in a Niche. This post alone had 3,801 words and is quickly becoming one of our most popular post. It’s super helpful and motivating to anyone looking to start a affiliate website. Some of these sites make $20,000 per month.

- Wallet Squirrel is a legit company! – I shared a post Wallet Squirrel is now an LLC, but I’m not sure I did it justice on how excited I am about it! While the process was SUPER easy (read it), it’s a very empowering knowing that I now have an LLC to build my Squirrel Empire of side-hustles. Is it weird that I’m excited for taxes next year?

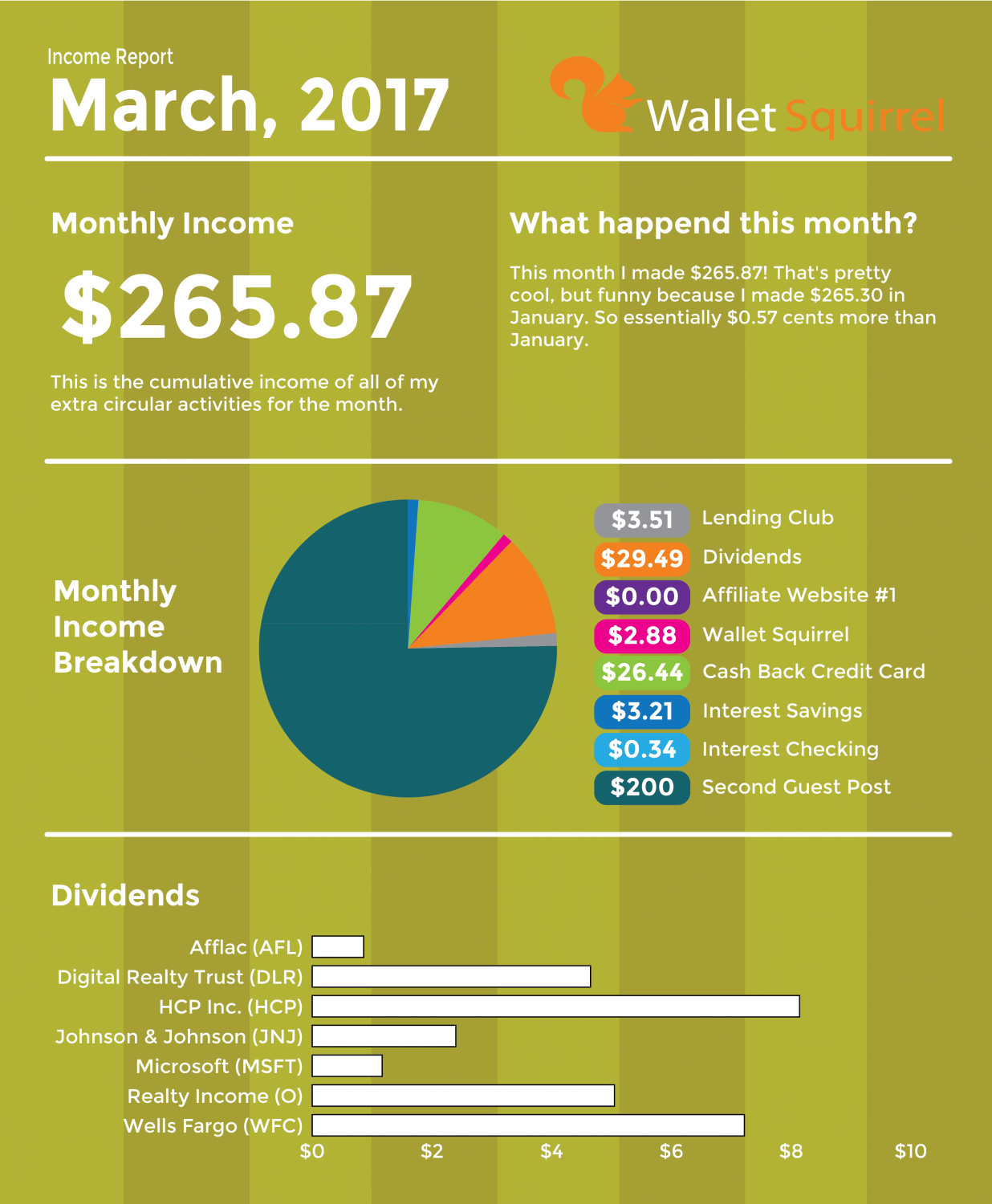

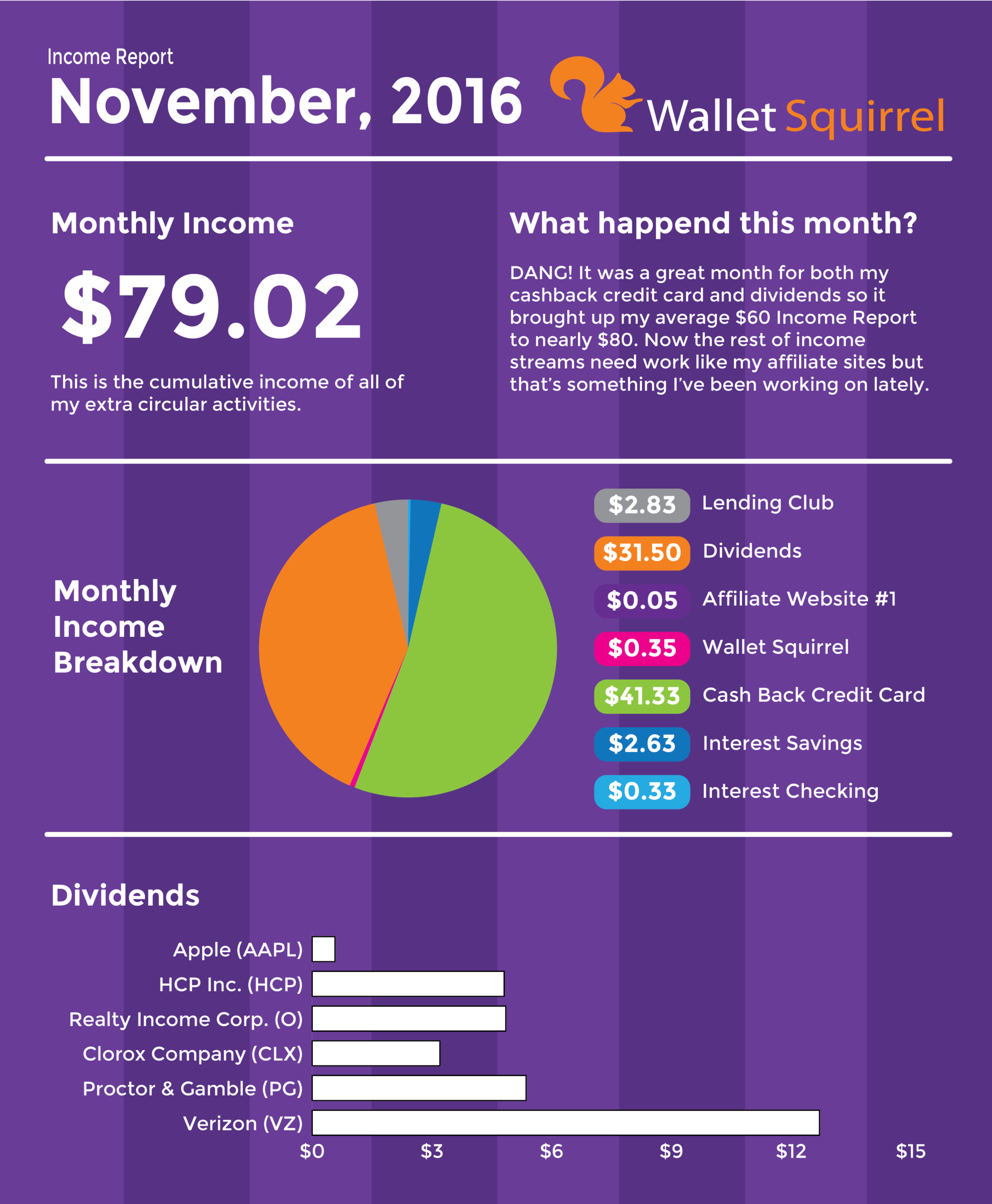

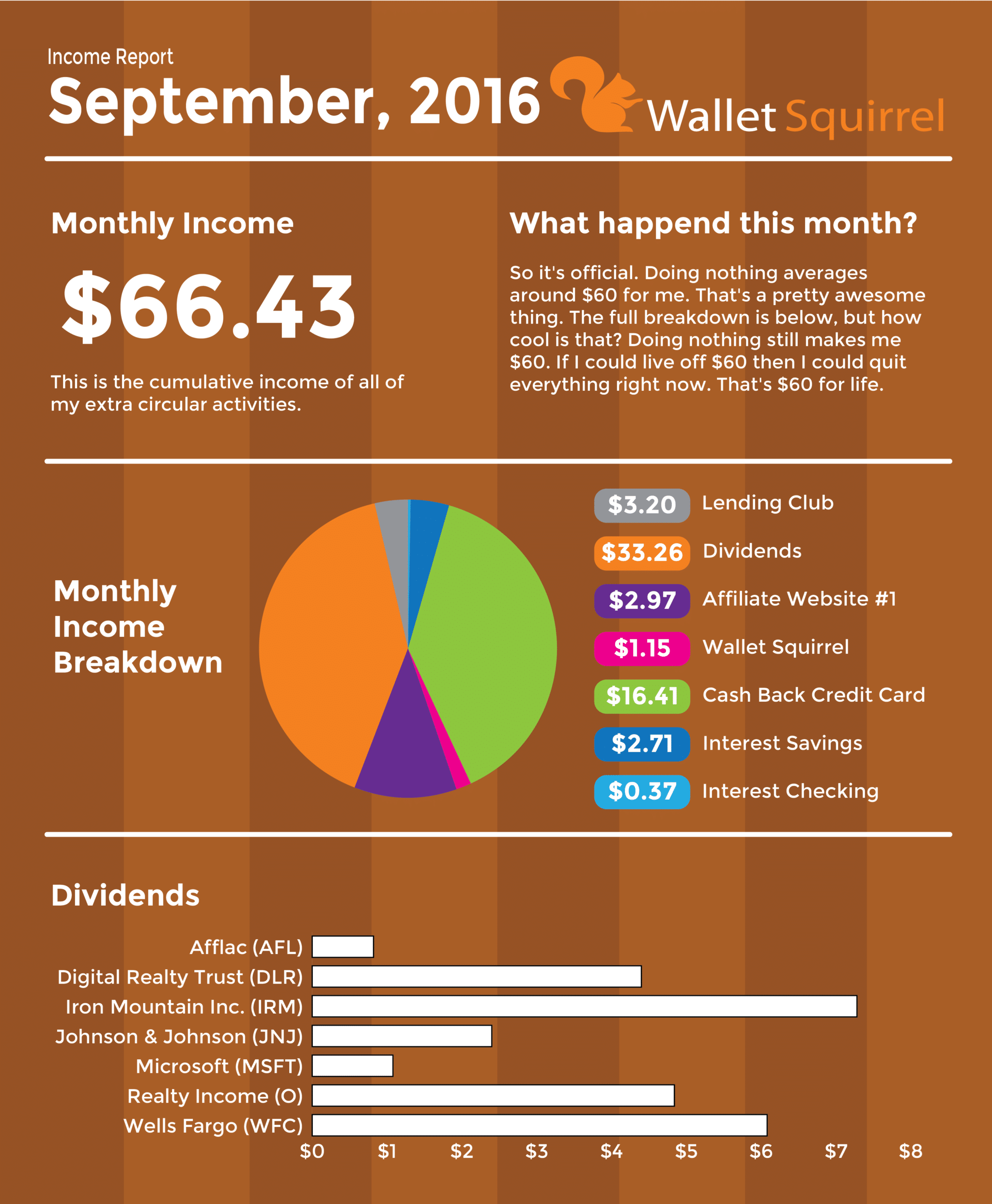

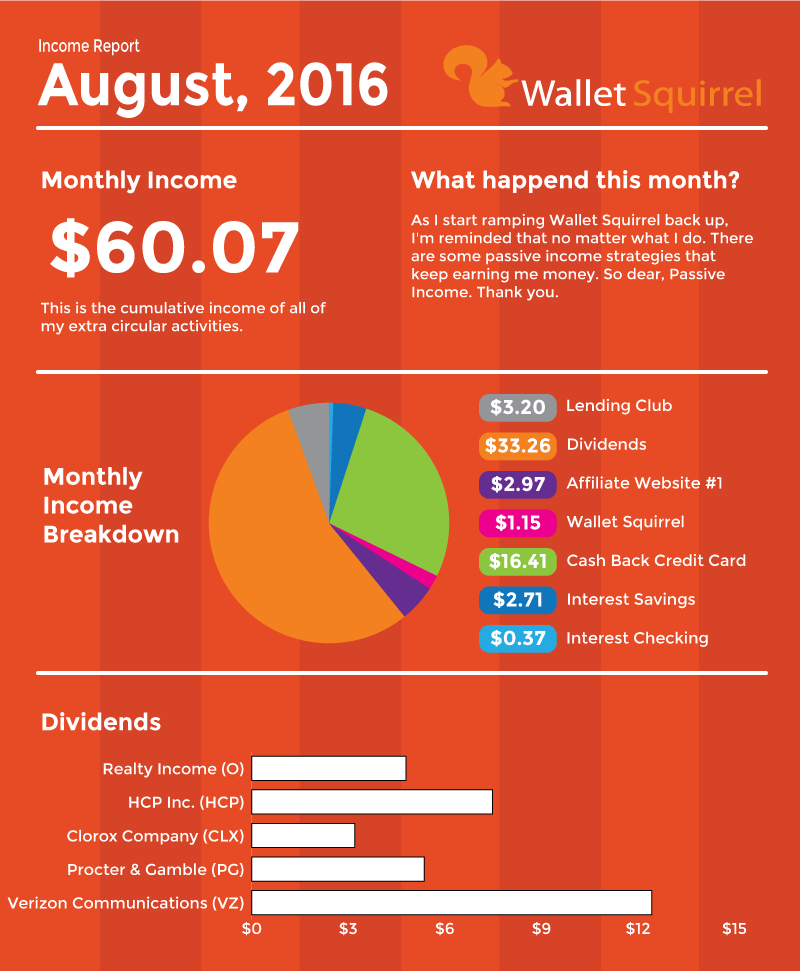

March, 2017 Income Report

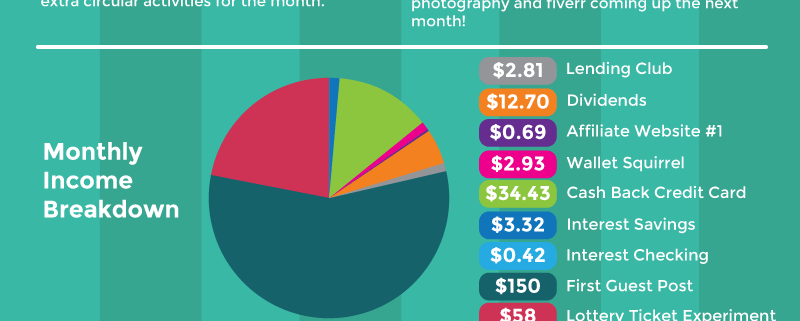

This month I made $265.87! That’s pretty cool, but funny because I made $265.30 in January. So essentially $0.57 cents more than January. Lol

The big factor was I did another sponsored post which I charged $200 . It’s great that doing a sponsored post can cover the cost of the website expenses and contribute to future side-hustles, but I feel odd putting other people’s content on my site. The only bonus is that I’m reviewing each post before I publish it and making sure it’s interesting. I reject A LOT of sponsored post.

Even though I’ve done 2 sponsored post so far, I have no idea how to charge for them. Does anyone have a pricing table?

I’m thinking I’ll charge $500 or $1,000 for the next one. If people won’t pay that, then I guess I won’t do any more sponsored posts for a while. Works for me. =)

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!