SE vs SEP, My First Journey to into Oil & Gas Stocks

So everyone and their sister is talking about oil prices. Are they bottomed out or what not and to get in now while the prices are low. So how do I get into this action?

While I’m still learning about the oil players, one company has come to my attention thanks to Motley Fool, and that’s Spectra Energy (SE). I know what you’re saying, why are you even listening to the Motley Fool and frankly it’s just because I like the amount of info they give me. So when they bring up Spectra Energy, I find it as a good starting point into oil and gas.

Spectra Energy (SE)

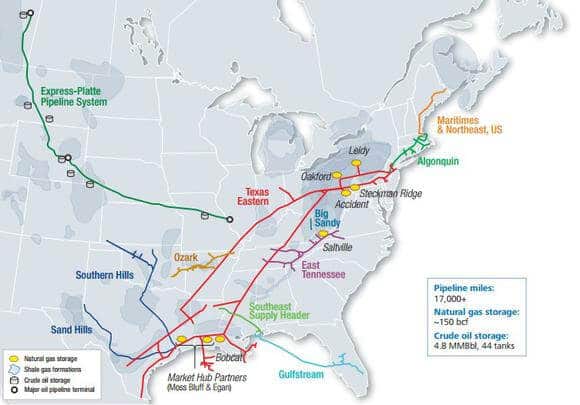

In essence, Spectra Energy is a natural gas company that operates in the transmission, storage, distribution, gathering and processing of natural gas. They were originally apart of Duke Energy but spun off for tax reasons. I think of Spectra Energy as a natural gas company that operates along the east coast providing natural gas from the Gulf of Mexico and Texas all the way up the east coast through New York and Maine.

Now slightly confusing

Spectra Energy Partners (SEP)

Spectra Energy is the natural gas company and they created yet another spin off of their actual pipeline transmission known as Spectra Energy Partners which is a MLP (Master Limited Partnership). They essentially own the pipelines and charge companies to use their pipeline highway, essentially like a toll. Think of Kinder Morgan except without the major losses right now, SEP is fairing slightly better than KMI right now.

SOURCE: SPECTRA ENERGY PARTNERS, LP.

Now I did buy 3 shares of SE at $27.44 because who wouldn’t want to get into the high exciting world of natural gas. The idea is I will build my position in SE while the stock is down and keep building until oil prices bounce back to normal (whatever that is). Plus at a dividend yield of 5.70% I will enjoy my lovely dividend. Life is good.

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

Leave a Reply

Want to join the discussion?Feel free to contribute!