Latest Stock Purchase & Analysis – Cisco (CSCO)

After seeing multiple investor friends pick up Cisco (CSCO) lately, I had to check it out. So these are the insights I looked into and ultimately factored into my first purchase of Cisco.

Why am I sharing my latest stock purchase?

Each month I try different ways to make extra money and share how much I make in my Income Reports. Every month I use this money to buy more stocks and other investments to build a $10,000,000 investment portfolio. It may take a while, but it’s done with one investment at a time.

This month I bought 9 shares of Cisco.

What is Cisco

Cisco (Stock Ticker CSCO) is a hardware and software company that designs, manufactures, and sells Internet Protocol (IP) based networking and other products related to the communications and information technology industry worldwide.

I basically just like to think of Cisco as the infrastructure of the internet. All of the highways that connect websites and databases and funny cat videos of the internet are primary run on Cisco products.

If you want to know what a company does look at their revenue. In 2016 this is where their money came from:

- Switching (30% of revenue) – Switches connect computers, printers, and servers within a building or campus. These allow everything to talk to each other. Switches create a network of devices.

- Routers (15% of revenue) – If a switch is a network, routers connect networks. A router links computers to the internet.

- Collaboration (9% of revenue) – This is a general term to describe their immersive video conference software, IP telephones, software to connect the devices to talk to each other. This includes Jabber, Cisco WebEx and Spark. For example, my office uses Cisco WebEx to coordinate all of our in/out video conferences.

- Data Centers (7% of revenue) – Data Centers allow large scale flexible computing. This can be from storage to computing power.

- Wireless Infrastructure (5% of revenue) – These are the base stations and infrastructure for Wi-Fi. Think of hotels, casinos, grocery stores, airports and any building that provides Wi-Fi. Most of these devices are Cisco related.

- Security (4% of revenue) – These are the firewalls that block out Russian hackers and malware from accessing their infrastructure and their client’s servers/computers/Internet of Things.

- Services (24% of revenue) – These are the people that run these services, train clients how to use them, manage networks, operate systems and support their wide variety of products.

We can say that the other 6% is “Other”, but you get the idea they do a lot with the internet. Combined all these products and services generated $49,247,000,000 in total revenue in 2016.

Why did I buy Cisco?

When looking over Cisco, they really hit some of the key factors that I look for when buying a stock.

1. Dividend (good)- They have a 3.69% dividend that they’ve had since 2012. That 3.69% is really nice considering this is a tech stock that traditionally has lower dividends.

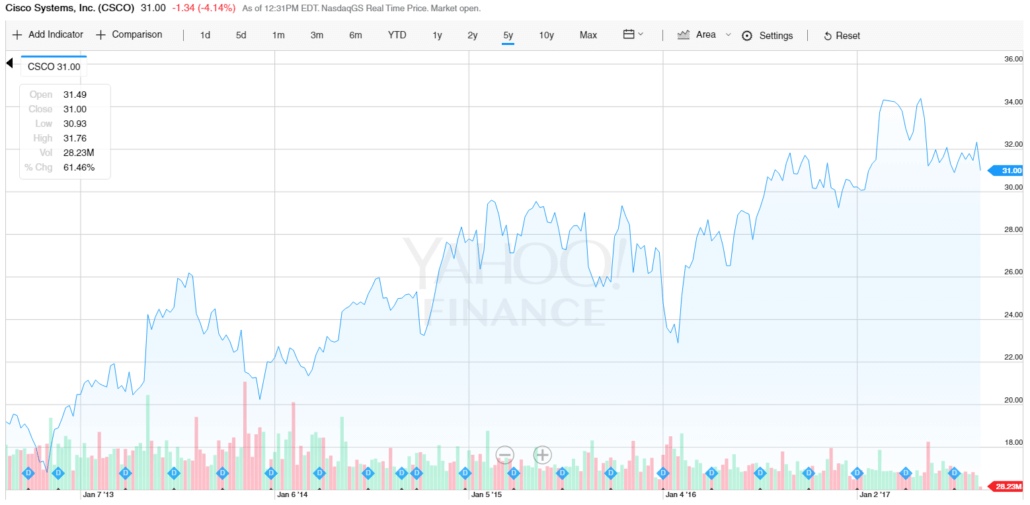

2. Historical Performance (good)- They say that past performance doesn’t indicate future performance, but I like the graph of the stock price over the last 5 years. It has its dips, but overall it has a progressive climb. That is a plus for me.

5 Year Graph of Cisco’s Stock Price

3. Strong History (good) – I’m not a big fan of crazy risk, so I like to invest in proven companies. Cisco has a market cap of 161.702 Billion, they’ve been around since 1984 building the internet. I want to make sure that the company has been tested long enough and a strong times interest earned ratio that they know how to manage market downturns.

4. Reoccurring Revenue (getting there) – Cisco has traditionally been a hardware company, but they are transitioning into more of a software company and one that wants to focus on a subscription model. Their CEO, Chuck Robbins even mentioned in their 2016 Annual Report that they are “working to move more of our revenue to a software-based and subscription-based model”. I am a huge fan of reoccuring revenue, so when I see a company of this size transitioning to that business model, I can get on board.

Since I liked what I saw, I bought 9 shares at $31.89 per share for a total of $279.09.

Why did I buy now?

In honesty, I probably rushed into buying Cisco because I wanted to buy their stock before their earnings call on August 16th (yesterday). I thought the stock would increase after the earning call, but it dropped a bit after coming short on revenue. F*&K.

The stock price has dipped about a dollar since then. I failed.

I will continue to hold Cisco because I think they are in the right direction, but it just sucks that I bought it right before the dip. This will probably teach me not to rush into anything when looking at future stocks.

Conclusion

I like Cisco and look forward to following them, but will be hesitant into rushing into any future buying just because a earnings report is coming up and everyone else is bullish on a stock.

If Cisco continues to invest more into their subscription-based business model, I’ll likely add more to this position.

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

I recently bought this company as well. You could always buy some more after this dip =).

-TDM

Thanks for sharing your analysis and reason for buying Cisco. I nearly bought this stock a few years ago, between 2012 to 2013, because of how much cash they had of their balance sheet. Do I ever wish I made that purchase now! I don’t remember the exact numbers, but I remember the price of the stock being somewhere between $15 to $22 per share, and like roughly $5 to $10 worth of that price was purely cash per share if I recall correctly. I haven’t looked at them in a while though. Thanks for the reminder! If the CAD to USD exchange was better, I’d probably start a position too. Have a great weekend!

Hey Dividend Mogul!

I keep buying on every dip and they keep going lower. I’m currently saving my extra capital for these overall stock market dips. Yay buying on other people’s anxiety. =)

Thanks for commenting,

Andrew

lol yea Graham, that would have been pretty awesome!

After looking at that 5 year graph, the stock price looked so good back then. Oh 20/20 vision. lol

Here’s to finding the next stock,

Andrew

Great company great addition. I know Lanny just added them recently as well. Thanks for the detailed analysis as well!

Bert

I was definitely inspired by your post to look into this stock. Glad I bought some!

-Andrew

Squirrel –

Welcome to the Cisco club! I know they dipped about $1, I’m looking forward to potentially buying more once capital comes back up for me : )

-Lanny

I increased my CSCO position yesterday due to an option assignment. I’m happy to own more shares of CSCO and I’m looking forward to collecting some nice dividends along the way!

I wouldn’t be too concerned that the stock dropped after you bought. If you hold long-term, that wouldn’t matter much. And you can always buy more shares to lower your cost basis!

I do own some shares in CSCO at @27 average price,maybe will add some more tomorrow.Have 2 free trades expiring in the account.

Thanks Lanny!

I actually just picked up a few more shares at $30.40 as the price is coming back up! I’m excited to own a bit of this tech company. =)

Thanks for commenting!

Andrew

Hey FerdiS,

Yeah I was really impressed with their dividend payout. That’s awesome you picked up some more CSCO, I just picked up more as well this morning for around $30.40.

I’m absolutely holding them long-term, so I agree I shouldn’t be too concerned. I’m already seeing their price come back up. Plus I bought them because I liked their new business plan and those take time to fully mature.

Glad to be in the Cisco club with you!

Andrew

Dude, $27 is awesome!

I’m a little behind for sure, but I’m glad I finally picked this up. I added 3 more shares to my position at $30.40 this morning to bring my cost-basis down. Nowhere near $27 though.

Personally, I use the Robinhood App so all my trades are free. =)

Thanks for commenting!

-Andrew

Great buy, I initiated a position as well recently! Very nice to see you building up your portfolio, keep it up!

Thanks Mr. Robot,

I’m stoked to own a position in it and the stock price continues to creep up. =)

Yup, building my portfolio to (hopefully) $10M. We’ll see how that goes.

Thanks for commenting,

Andrew