Income Report (September – November)

I have a regular job, but these income reports are what I earn ON TOP of my regular income (we all want to earn more). This is income from experimenting different ways to earn income online, and money I’ve received through dividends from investing.

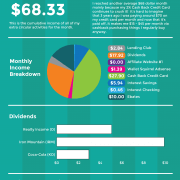

In the last three months I have received $416.17 in additional income.

| Additional Income | September, 2015 | October, 2015 | November, 2015 |

| $117.01 | $237.97 | $61.19 | |

| Interest Checking | $0.07 | $0.26 | $0.23 |

| Interest Checking Payout Date | 9/10/2015 | 10/10/2015 | 11/10/2015 |

| Interest Saving | $0.08 | $0.16 | $1.35 |

| Interest Saving Payout Date | 9/10/2015 | 10/10/2015 | 11/10/2015 |

| Cash Back Credit Card | $19.86 | $15.13 | $31.79 |

| Credit Card Reward Date | 9/10/2015 | 10/12/2015 | 11/11/2015 |

| Affiliate Website #1 | $97.00 | $221.00 | $20.50 |

| Month to Month | 9/1 – 9/30 | 10/1 – 10/31 | 11/1 – 11/30 |

| Dividends | $0.00 | $1.42 | $7.32 |

| Long-Term Care (LTC) | $1.08 | ||

| Omega Healthcare Investros (OHI) | $1.68 | ||

| Realty Income Corporation (O) | $0.76 | $1.14 | |

| The Clorox Company (CLX) | $0.77 | ||

| The Coca-Cola Company (KO) | $0.66 | ||

| The Procter & Gamble Company (PG) | $2.65 |

Income sources:

Interest Checking – Any way I can make an additional penny on top of my regular income is a plus. So when I switched banks in 2015 to hop into an interest checking account, I was thrilled to see that money just sitting in my checking account actually made money. It’s not much, but it’s more than $0 which what I was making in my old checking account. Yay for $0.56 I made in the last three months!

Interest Saving – Most people make some money in a saving account, but I recently switched banks and now make %1. It’s awesome! I definitely recommend to shop around for a bank that fits your goals. I try to keep a padded buffer of cash in my checking account in case of any BIG purchases and usually anything extra goes into my stock portfolio. Since my stock portfolio is more long term, I use my saving account to save up for any near big purchases. Currently I am adding some money each month to my 1% saving account to pay off my car in the near future. My little car payoff account has made $1.59 in the last three months. That’s something!

Cash Back Credit Card – So I used to know nothing about credit cards. I got swindled in college into getting a credit card with points from Wells Fargo. I even had to pay $20 annually to participate and my points expired after a certain date. Worst idea ever (slightly dramatic). This last year I switched to the Citi Double Cash Back Card which gives you 2% back on every purchase. While I have zero credit card debt, I use my new credit card to pay for EVERYTHING and immediately pay it off the next day. Now I enjoy around an extra $20 a month for buying everything I normally do anyways. In the last three months, I have earned $66.78 for just using my card. NOTE: Please be careful whenever using a credit card, if you don’t pay it off immediately, the fees in interest are awful on any card. Use responsibly.

Affiliate Website #1 – A lot of people talk about earning additional income from creating an affiliate website. I tried it and it’s moderately successful, but it’s a lot of work. Mine focuses on Halloween Decorations (I’ll cover this in a future post) so it’s usually low for most of the year and spikes around Halloween time. I’m sure it could do better if I put more time into it, but I can’t complain about the $600 a year it usually brings in. I made $338.50 in the last three months.

Dividends – Like my interest checking and saving account, I do absolutely nothing to create this income from my stock portfolio. My goal is to generate enough dividends monthly to live off. That sounds awesome right? In the last three months I made $8.74 in dividends from the stocks I own. This is my favorite source of income, the more I invest (responsibly) the more dividends I’ll receive. In the future, I anticipate this being my highest source of income.

Thank you for your time, and have a great day =)

Hi, I’m Andrew, a 28 year old entrepreneur who experiments earning money online and invest every dime.

Leave a Reply

Want to join the discussion?Feel free to contribute!