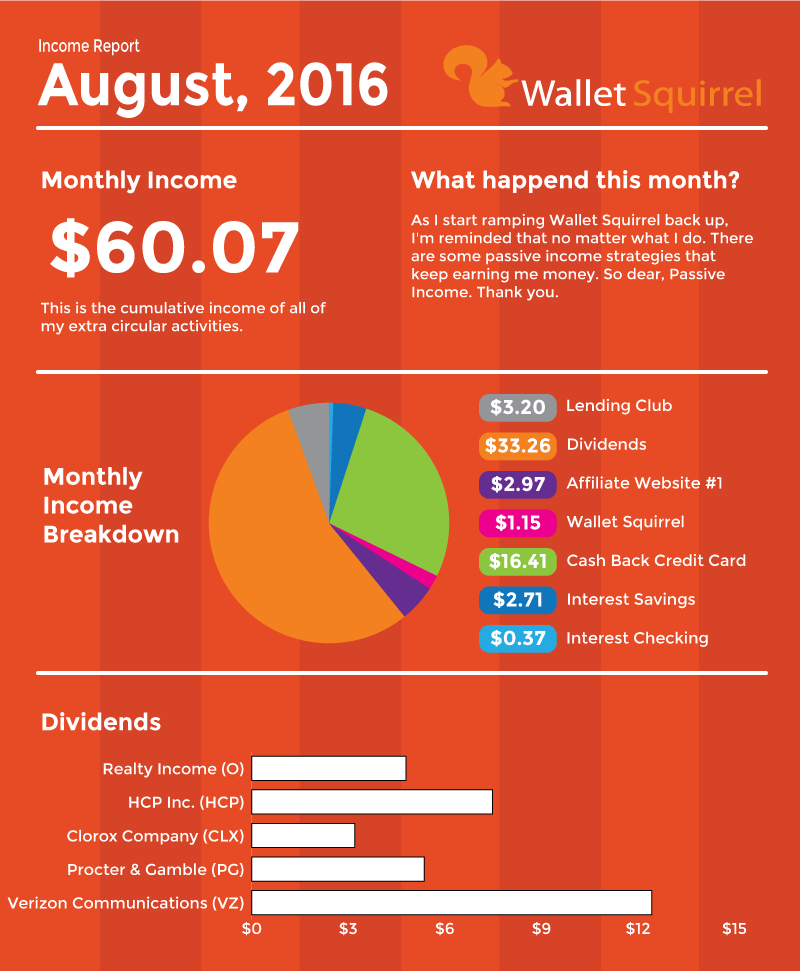

Income Report – August, 2016

As I start ramping Wallet Squirrel back up, I’m reminded that no matter what I do. There are some passive income strategies that keep earning me money. So dear passive income. Thank you.

Let’s talk Double Cash Back Credit Card

During a recent Entrepreneur Meet and Greet in Denver (yes, I go to these). It was pointed by a fellow entrepreneur who read my blog (eek, people read this) that we should clarify good and bad ways to use a credit card.

See, I pay off my entire credit card debt daily, since I paid mine off in 2015. So I treat my credit card like cash. I know that I am going to HAVE to pay it all off the next day so anything that I’m willing to pay cash for, I use credit. Mainly just for the 2% cash back.

It was pointed out though, that some people may not know this difference and could continue their spiral of debt. I’m obviously not condoning this. Only use a credit card if you have good credit card habits. It’s easy to say you’re getting 2% back with a credit card, but things still cost 98%.

Moral of the story. It’s hard to say my 2% Cash Back Credit Card is a sort of passive income. Especially if I’m using it to buy wants like Colorado Rockies Tickets. However, a majority of the time I use my Cash Back Credit Card on purchases I’m going to make anyways, so I consider it passive income.

Monthly Goals (I HATE monthly goals)

I have a bad habit of not liking being told what to do. Once I write something down, I’m telling myself to do something and sometimes that’s a bit much. Especially when the guilt of failing a to-do list is a lot worse than actually accomplishing something. Maybe I’ll rename this “Some things Andrew, could maybe do in the future, if he wants”. Catchy right?

- Write 2 posts this month on how to earn additional income. That’s what this site is about and let’s get down to the roots.

- Comment on 70 blogs. I came to this number because I have 70 blogs on my “To Read” list. Let me know if you want to be on this list.

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

Earning $60 passively is nice especially when it comes from various sources. I don’t really read much about the P2P lending as I used to about two years ago. I wonder if less people are utilizing this form of earning a passive income stream. Keep up the good work and don’t ignore those solid dividend stocks. They can do well for you over time. Thanks for sharing.

You know the P2P lending is still giving me a good return. However I until you get to $2,500 you can’t do the automatic re-investing so it takes a little time. I’m currently making about a 14% return on my dividends and P2P lending so it’s not to bad.

Looking good WS. I fully endorse using credit cards for every purchase you can. I’m not saying go buy stuff, I’m saying pay all necessary bills on a credit card. I’ve never calculated how many points my wife and I get every year but I know it’s a lot. We never buy Christmas presents for our friends and family. we just cash in some points for gift cards . Love the inforgraphic BTW. Are you using Canvas or some other tool to create these?

I’m definitely a fan of credit cards, but wisely of course. That is a REALLY cool idea about using your points to buy gift cards for the family. I’m sure you wrote a post on that, I’ll have to look it up.

I’m using Adobe Illustrator, so I can make whatever I want. I’m trained as a graphic designer. It’s a bit a work, but it helps carve out a niche in the busy Personal Finance world.

#WorthIt

Looks like a great month for dividends! Glad to see your justification for a cash back credit card. I wish Lending Club was allowed in PA…

Yea, not a fan of it only being available in a couple of states. Overall I’ve enjoyed it, but can’t wait till I can auto-invest in loans that match a certain criteria. Otherwise picking out loans is a little time consuming. Sorry about PA.

Wallet Squirrel,

It’s great to see you posting. Definitely agree with comments above – wish Lending club was allowed in Ohio, dammit!

Congrats, though, and keep grinding!

-Lanny

While I agree with the sentiment that spending on a credit card to get cashback isn’t saving, I think you’re right. If it’s stuff you’d buy anyway why not.

I try to get credit cards with long 0% on purchases, then put the money I’d normally pay off the debt with to good use. When the 0% ends, transfer to another one. A bit more hassle, but I’ve earned a decent amount over the years.

That does pretty much suck. Maybe they’ll change. I was relieved when they finally overturned the Amazon Affiliate rule in Colorado. I need to revamp my Affiliate Site to take Amazon Affiliates. I’m really curious to see how that will help! =)

Now that is a Credit Card hack. Definitely a little more work playing credit card shuffle, but if you’re really to put in the work, I’m sure the rewards are nice. I may have to try that sometime. =)

Update on a previous conversation we had: Robinhood now supports ACATS out (but still not in). That means that you can build a portfolio one stock at a time, and once it reaches critical mass (like 100 shares for covered calls), transfer to another brokerage. Sorry Firstrade, I’m signing up for Robinhood tonight.

HA HA HA that is awesome. Let me know if you have any questions about signing up with Robinhood.