Dear Bitcoin Craze, You Know You Have To Pay Taxes Right?

Bitcoin is still currently the most popular cryptocurrency. It’s the “new” thing along with blockchain technology, even if the price has come down a bit. However, if you’re thinking of buying any cryptocurrencies. You should learn how they’re taxed. Because yes, you will absolutely have to pay taxes on cryptocurrencies.

Cryptocurrency Isn’t Actually A Currency

The IRS considers cryptocurrencies “property” similar to how it does for stocks or personal property. Which makes the idea of buying things with cryptocurrency an awful idea. Here’s why.

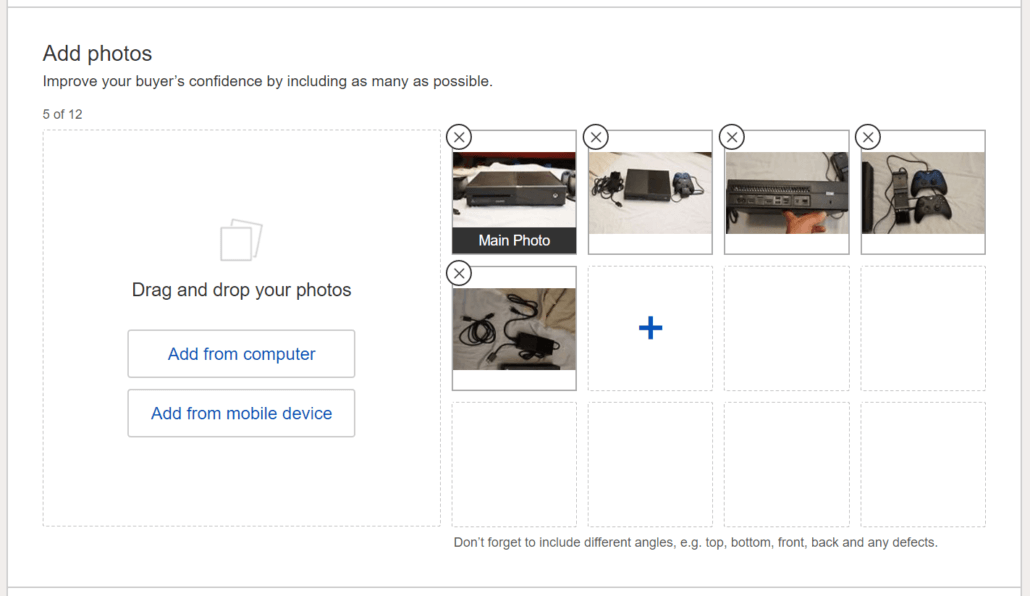

Say you want to buy a sofa with Bitcoin. To actually make that purchase, you’re actually making two sales. You technically are first selling your Bitcoin to convert it to money (sale #1). Then you’re using that money to make the purchase of something, like a sofa (sale #2).

So to the IRS you are selling your Bitcoin and need to pay the short-term capital gain tax (25%) if you held that bitcoin less than a year, or long-term capital gain tax (15%) if you held it longer than a year. Then you will have the cash to now buy the sofa where you will pay sales tax on the sofa to actually buy it.

*Note the capital gain tax is factored for someone who earns $75,000 annually. Your tax percentage will fluctuate based on your annual salary. We’re also assuming you’re paying the capital gain tax because Bitcoin is worth more than when you bought it.

So you’re paying tax when you sell Bitcoin and then again for the sales tax.

Cryptocurrencies Are Monitored

Since cryptocurrencies aren’t affiliated with any government they shouldn’t be monitored, that was the idea, right? Wrong, Bitcoin is monitored by the IRS…to a degree.

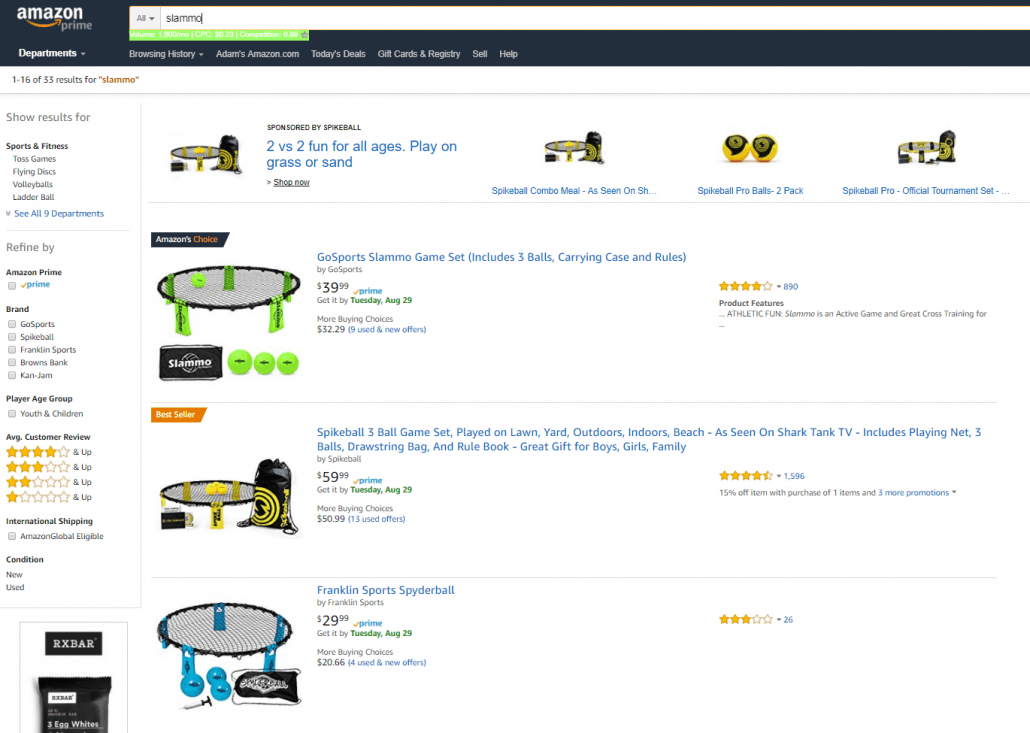

According to the IRS, all your Bitcoin trades should be reported to the IRS because you should be paying taxes on the buying and selling of all cryptocurrencies. Every single time. So if you’re thinking of using sites that accept Bitcoin, all those purchases need to be reported to the IRS. Every time you sell Bitcoin.

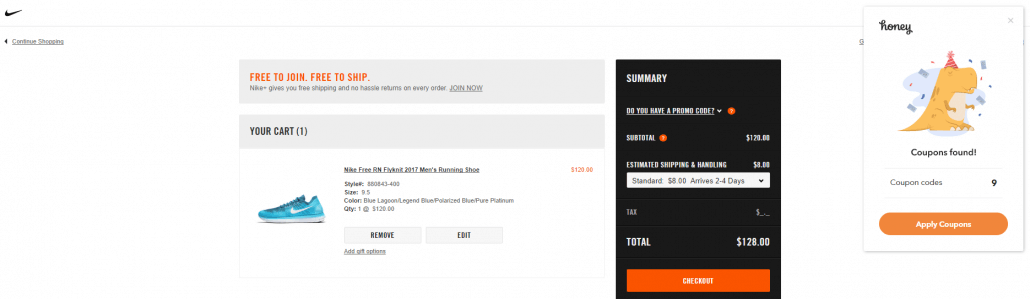

So every time you buy something from Overstock.com, which accept Bitcoin. Those transactions should be (often not) reported to the IRS since you’re essentially selling “property”. That can be a tax headache.

During the Bitcoin craze, the IRS felt that Bitcoin sales were being under-reported because they expect people to report their own Bitcoin sales. Each year from 2013 to 2015, only about 800 taxpayers claimed Bitcoin gains. If you don’t report these gains, you can later be audited by the IRS, which no one wants. So be careful and report your Bitcoin gains.

If you think Bitcoin provides anonymity, think again.

In November 2017 a California Federal Court ordered Coinbase, the popular platform to buy and sell cryptocurrencies, to turn over thousands of records of customers to the IRS. It requested a list of everyone who bought, sold, sent or received more than $20,000 worth of Bitcoins between 2013 and 2015 (source). This could later be anyone who bought/sold more than $600 worth of cryptocurrencies.

You can expect the IRS to continue to monitor cryptocurrency brokers in the future.

Tax Laws Haven’t Caught Up With Cryptocurrency

If these seem harsh on Cryptocurrency, it’s a debate currently going in a legislature near you. Cryptocurrency is moving so fast (Bitcoin $1,000 to $19,000 in 2017) that the tax laws don’t have time to catch up. Especially since a digital currency is considered “property” by the IRS, it’ll continue to cause taxation confusion and headaches if you try to think of it as a currency.

As Bitcoin and other cryptocurrencies gain momentum, more people will use sites like Coinbase or the new RobinCrypto to purchase these new cryptocurrencies in hopes the price will skyrocket. In doing so you need to understand the tax implications and your responsibility to report your cryptocurrency activity.

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!