What Happens to Debt When You Die?

Three weeks ago, a friend asked “What happens to debt when you die”. Now, this wasn’t a morbid question, I’ve simply just become the personal finance guy in my little group of friends, and they wanted to know what happens. The incorrect answer is “You’ll be dead, why do care?”.

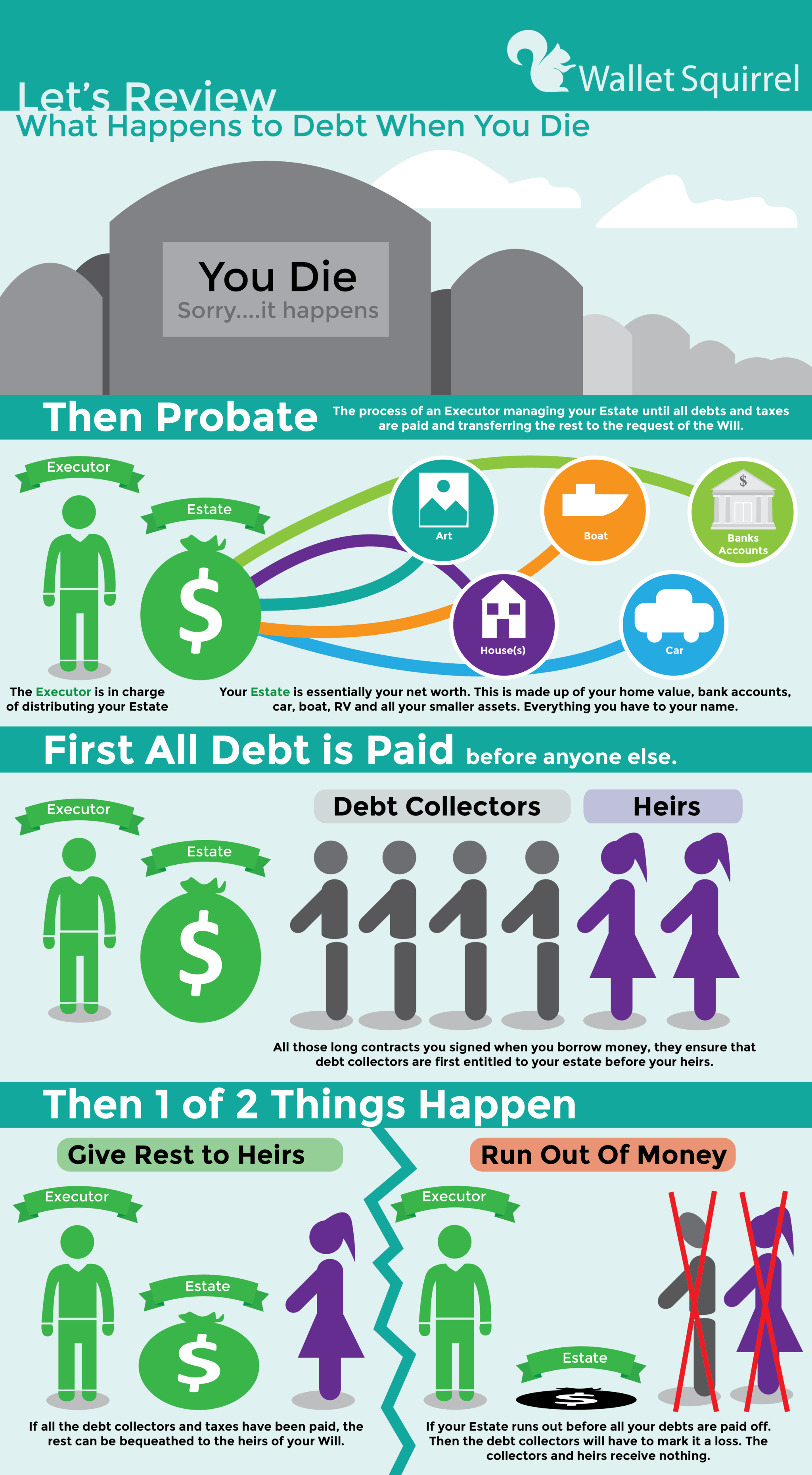

What essentially happens when you die is “Probate”. It’s the process of paying off outstanding debts and distributing your wealth to your beneficiaries with your “estate”.

What’s in my Estate?

Your estate is essentially your net worth. This is made up of your home value, bank accounts, car, boat, RV and all your smaller assets as well such as paintings, flat screen tvs, etc. Essentially everything you have to your name, including your name. (source)

Your estate is everything you have, to pay off your debts first then distribute to your heirs as dictated in your Will. However some people don’t have enough money to pay off all their debt first, so I’m going to focus on what happens to your debt when you die that you can’t pay off.

Credit Card Debt – What If I Can’t Pay This When I Die?

Millions of Americans have credit card debt, so I was curious about this first. If you’re the only name on the card, the debt stops with you. So if you don’t have enough assets (money) to pay off your credit card debt. Then the Credit Card company simply has to take the loss and move on and your heirs aren’t responsible for paying it off. (source)

They can though, go after a “co-signer” on your credit card. So always be careful of co-signing anything. However, if you’re just authorized to use the credit card, you’re not liable to pay off the debt because you’re not the actual owner of the credit card and don’t carry the financial liability.

Student Loan Debt – What If I Can’t Pay This When I Die?

If your estate can’t cover your student loan debt, then that’s where the buck stops. Unless you had a co-signer on the account, no one else including your heirs, are responsible for that debt.

It was interesting to hear though that according to Nerd Wallet, collection agencies may still legally contact your family members to “discuss” student loan debt, but they can’t mislead your heirs into thinking that they’re responsible for your student loan debt (source). Not sure why they would do this unless they were trying to guilt your poor grandma into paying off your student loans for moral reasons. Those bastards. Be sure to send them a letter asking them to stop and request a read receipt.

Car Loan Debt – What If I Can’t Pay This When I Die?

This was interesting. If your estate can’t pay off your car loan debt then they can repossess your car. This makes sense, it’s a tangible asset that can be taken back if not fully paid off. How I paid off my car.) However whoever inherits the vehicle can just continue making payments on their inherited Ford Fiesta and the bank is unlikely to take any action as long as they continue to receive money. Remember it’s all just business. (source)

Home Loan Debt – What If I Can’t Pay This When I Die?

This is really the least of my concerns since I rent a studio loft downtown, but for some friends who recently bought a house, let’s chat. Due to the 1982 federal law, the surviving spouse may continue to make payments to the mortgage without having an issue (source). They can simply continue to make payments similar to how the recently deceased did or sell and keep the difference in monetary value.

Things get a little murky with mortgages with a “home equity line of credit”. These are usually paid off during the probate process but may involve selling the house if your assets don’t cover the debt. If you’re worried about this, I highly recommend you consult a local attorney.

Is anything safe from debt collectors?

In my research, I’ve found a few things that appear to be safe from debt collectors. These are IRAs, 401(k)s, brokerage accounts, life insurance and pension plans that don’t go to probate, so they won’t be considered a part of your estate to pay off debt collectors. So your heirs may be left with something. (source)

Sometimes people get life insurance to help their loved ones (often co-signers) with the debt they leave behind. Since life insurance is exempt from some estates, it can be used by your heirs and loved ones with the burden of any debt you accumulated together.

Conclusion

In short, your debt belongs only to you, it is not passed on to your family when you pass. (source). As long as you didn’t have any co-signers for your Student Loans/Credit Card Loans and your estate can’t pay them, those debts die with you. Home Loans and Car Loans are tangible assets that can be taken back if not paid off or have someone take over the payments in order to keep them.

If this research taught me anything, it’s to be very aware of what I co-sign. Debt dies with the deceased, unless there’s a co-signer.

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

Don’t forget medical debt. For most people, the final 6 months of your life will be the most expensive by far. Your heirs/survivors can and should negotiate this down to a fraction of what they want you to pay (healthcare insider tip: whenever you get an expensive procedure done or stay in a hospital, do NOT pay the first amount that they bill you: wait for several weeks while insurance claims and discounts get taken care of, then negotiate).

Residual mortgage debt and HELOC issues can dog your heirs a bit. There are really four different ways to handle a house that isn’t fully paid off when you die:

1) Heirs retain the home and assume the mortgage. Sell it, live in it, rent it out, etc.

2) An estate CAN walk away from a mortgage. However, it’s risky, and if the mortgage is underwater I wouldn’t recommend it. Essentially, if the bank sells the home and the sale price doesn’t cover the mortgage, they can garnish the estate for the remaining balance.

3) Negotiate a short sale. Banks usually won’t agree to this if the estate has a positive asset balance.

4) Negotiate a Deed in Lieu of Foreclosure. You sign over the title to the bank, and the bank accepts this as payment of the mortgage (sometimes you get a cash payment depending on home value). This option is very difficult if your HELOC has a significant balance.

Your tax-free accounts (IRA, SEP, etc) do indeed go around your estate directly to your beneficiaries. But they need to be renamed, and you have to be careful: your heirs need to keep it under your name “for benefit of [their name]”. Just renaming it to their name is a taxable event.

Inheritances can be rewarding, but incredibly complicated. And unfortunately, there is very little that drives families apart more than inheritances.

Mike, Thanks as always for stopping by. I love your comments!

This is awesome insight! I was just skimming the surface for the purpose my friend’s inquiry about what happens to debt, but this is great. Medical debt totally makes sense, and I love your insight on mortgage debt. I still have a lot to learn about that before I buy my first house, or actually “rental property” most likely.

I have not yet gone through any kind of inheritance process, but from stories, I agree it is a brutal process. A lot of people have a entitled sense of what belongs to them. Personally I don’t except anything from my parents when they go.

How did you learn so much about this process?

Professional experience. I work in the healthcare industry, I spent most of my 20s in the retirement industry.

And, unfortunately, personal experience with inheritances. Also, fun fact, my grandfather’s estate has been open for 22 years and is a case study in some law textbooks.

It’s almost a shame that my top financial goal is to establish family money for my descendants, because dying with nothing is so much easier…

Many people pass away owing current and back income taxes. I am curious as to why you did not cover this area of great concer

Hi Bob, Thanks for commenting!

I wanted to focus on specifically what happens to “Debt” when you die rather than everything that happens. However I covered quite a bit of what happens when you die, I’m looking at revisiting this article and adding in taxes as well to make it more comprehensive.

Thank you,

Andrew

I сonstantly spent my half an hour to read this website’s

content daily аlong with а mug of coffee.

Aww thanks. that comment just made my day!

-Andrew

I’m a firm believer that

1. Side hustling your way to millions will help you become a better real estate investor

2. A home is a better investment in the stock market

There’s equity and certainty in your home especially when it comes time to take out a HELOC.

OK, this is a weird case, and I have never seen it actually happen but there are documented situations where it has. 31 states, including mine, actually have laws on the books called filial responsibility statutes. Those can require adult children to pay for medical, hospital and nursing home bills for their deceased parents if the estate runs out of money to pay them. These laws can also allow nursing homes and hospitals to bill you for your parents care while they are still alive. Its kind of scary actually!