What are Dividends and Dividend Investing?

On Friday, I sat at lunch with some friends talking about life, weekend plans, and personal finance. I’m a dork I know, but I found myself explaining what are dividends and dividend investing. So let me take a shot at this since I talk about them ALL the time.

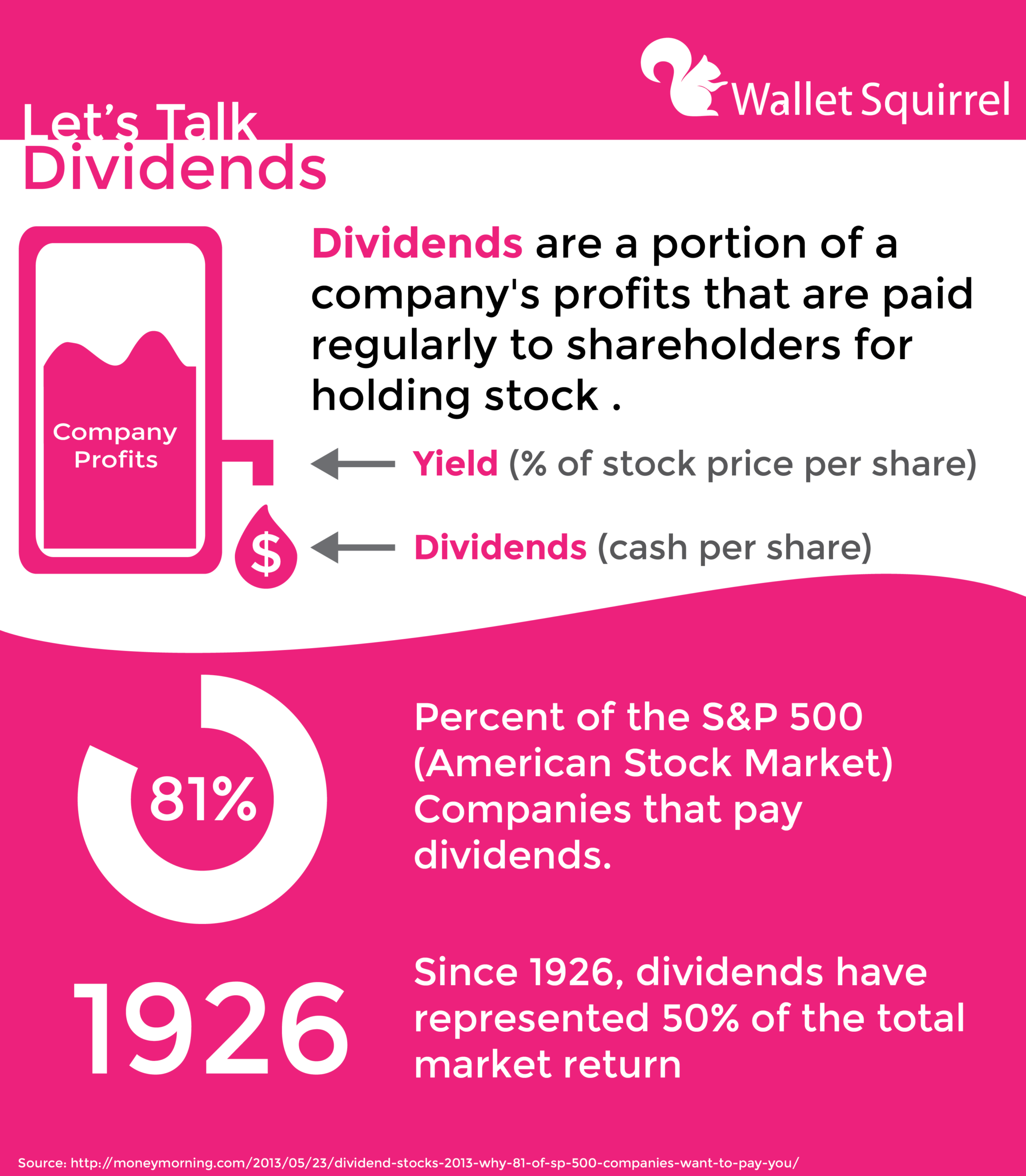

What are Dividends?

Let’s start with what are dividends. Dividends are a portion of a company’s profits that are paid regularly to the company’s shareholders. The amount of profits shared among shareholders is a percentage of the stock price called “yield”. This is shared sometimes annually, quarterly or monthly to the shareholders depending on the company.

Dividends are popular because not only do shareholders of a company’s stock see the price move. They receive dividends just for owning the stock. It’s like a small bonus.

For example: Apple (AAPL) stock price is currently $100. Apple has an annual dividend yield of 2.27%. Shareholders will receive $2.27 throughout the year just for holding onto the stock. The neat part is shareholders will receive income from their investment without selling.

Why do stocks produce dividends?

First, not all stocks produce dividends. Stocks like Google and Amazon don’t produce dividends. Every company decides for themselves whether they want to or not.

Stocks like Google and Amazon don’t wish to produce dividends because they want to focus all extra capital for research and development. Typically younger companies like this don’t pay dividends. However if you look at Coca-Cola, while they do innovate, their extra cash is distributed as dividends because they found it’s better put towards dividends to attract more investors. Dividends are very attractive to investors because of compounding.

Let’s Talk Compounding!

The idea is that dividends will compound increasing your investment. Let’s say you invest in 50 shares of stock ABC at $100 a share with a 3% dividend yield, you’ll annually earn $150 per year in dividends. However if the stock increases its dividend 5% (not stock price value, but dividend yield), your $5,000 investment in 20 years will be worth $13,143. That’s a 162.85% gain! Here’s a great dividend reinvestment calculator.

That’s if the stock stayed the same price at $100, but typically the market increases annually at 7%. So both the stock price and dividend will increase. Cool right?

What is Dividend Investing?

Dividend Investing is the idea of investing in only stocks that produce dividends. The purpose being of living off the dividends produced by the stocks you own opposed to selling your stocks for money. It essentially creates passive income.

Let’s say you plan to live roughly till your 92, and you want to have $60,000 per year for retirement. If you retire at 65 you would need to have $1,620,000 (before taxes) saved up to spend $60k every year. Yet, by 92 you will have run out of money, totally broke, dirt poor.

However dividend investors use dividend yield to create passive income for retirement. In the same situation, a dividend investor would save a larger amount upfront, $2,000,000 in a portfolio of dividend stocks at a 3% dividend yield. That 3% yield will create $60,000 (before taxes) per year. If you never touch your principal (that $2,000,000) you’ll be able to keep receiving dividends every year, forever. So even if you live to 126 (oldest person in the world), you can rely on that $60,000 every year since people seem to keep living longer and longer. I personally plan to live to 182.

Dividend Investing is relying on a reoccurring stream of income that never runs out opposed to a stash of cash that will eventually run out. If you haven’t figured it out, I’m a dividend investor.

Fun Fact: All five of Warrant Buffett (one of the greatest investors of all time) largest stock holdings pay dividends. These are Wells Fargo, Coca-Cola, American Express, IBM and Wal-Mart. He lives on the buy and hold strategy. He invests in good companies that pay dividends and sits back and receives a paycheck. Sounds like a dividend investor to me.

I’m constantly wordsmithing on how to explain what are dividends and dividend investing to people. How’d I do? Any tips on explaining it better?

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

Enjoyed your overview and I think you did the topic justice. You could have potentially explained the downside to dividends such as: They are not required to be paid out by companies and they can potentially be cut should economic hardships occur. I love dividend investing though I think it is a great way to accrue capital quickly and it is exciting to see how much you earned every month! Looking forward to the next income report.

Most people think in terms of capital appreciation: did the price of the stock increase after they bought it? During one very technical discussion with a friend, he expressed doubt that dividend growth investing was worth it. I countered that if you’re looking for short term capital appreciation, then go ahead and play the stock market. Dividend investors have a much lower chance of getting in on the ground floor of the next big thing (to be honest, though, I did buy Facebook at $28, so I’m not immune).

But a) historically, dividend growth stocks have outperformed non-dividend growth stocks [this was a tough sell for him, but it made sense once I explained that dividend growth investing naturally shoehorns you into blue-chip stocks, so there is inherent survivorship bias].

And b) from a cash flow perspective, I don’t have to sell stock to generate cash; in fact, the more stock I buy, the greater my cash flow. He gets one form of value from a stock. I get two. I’ll take that.

Thanks Stefan!

True, I could have touched more on the downside of dividends. Perhaps I’ll do an update to this post later this week. The main thing was, I wanted to explain what they were since I talk about them all the freaking time! Now I have a link to point people to when I talk about dividends. =)

Thanks for the comment and I’ll post my next income report this week! Can’t believe it’s been a month already.

Dude that’s awesome!

Great call with getting in on Facebook at $28. I keep sticking to dividend stocks since I like the short term gratification I get when I see dividends come in, but there are great companies like Facebook, Amazon, Google and Adobe that I’d love to get into. I would love to see your portfolio sometime. You got to start a blog!

I could have totally went into the history of dividend stocks because that is interesting that you brought up that dividend stocks have historically outperformed non-dividend stocks. Although the cash flow perspective is an amazing selling point, that’s what did it for me at least. Perhaps I could have touched on that a bit more as well.

So many good ideas! Thanks for sharing Mike H.

Nice post WS, you explained it really well.

I’d also add that if you invest in growing companies, then you would get your initial $60K on $2M but then your income will hopefully grow faster than inflation, making you richer and richer.

Tristan

(hopefully this isn’t a double post, it error’d when I posted first time)

No double comment, I worry about that all the time. I have a rapid clicking finger.

That’s a great point on the investment growing as well. That $2M will grow to $2.1M to $2.2M to $2.3M, etc. That is also very exciting. I sometimes get so focused on the dividends, I sometimes forget investments grow as well! I’d like to think that’s a happy bonus.

Can I was why you don’t invest in Dividend producing ETF’s ?

I use the Robinhood App which primarily focuses on individual stocks. I used to use Betterment which focused on ETFs and a few of them produced dividends which was awesome. I ended up going fully to Robinhood because I wanted to focus on stocks that solely distributed dividends.