I Tried Lending Club for 2 Years, Here’s How Much Money I Made

How Investing in Lending Club Went?

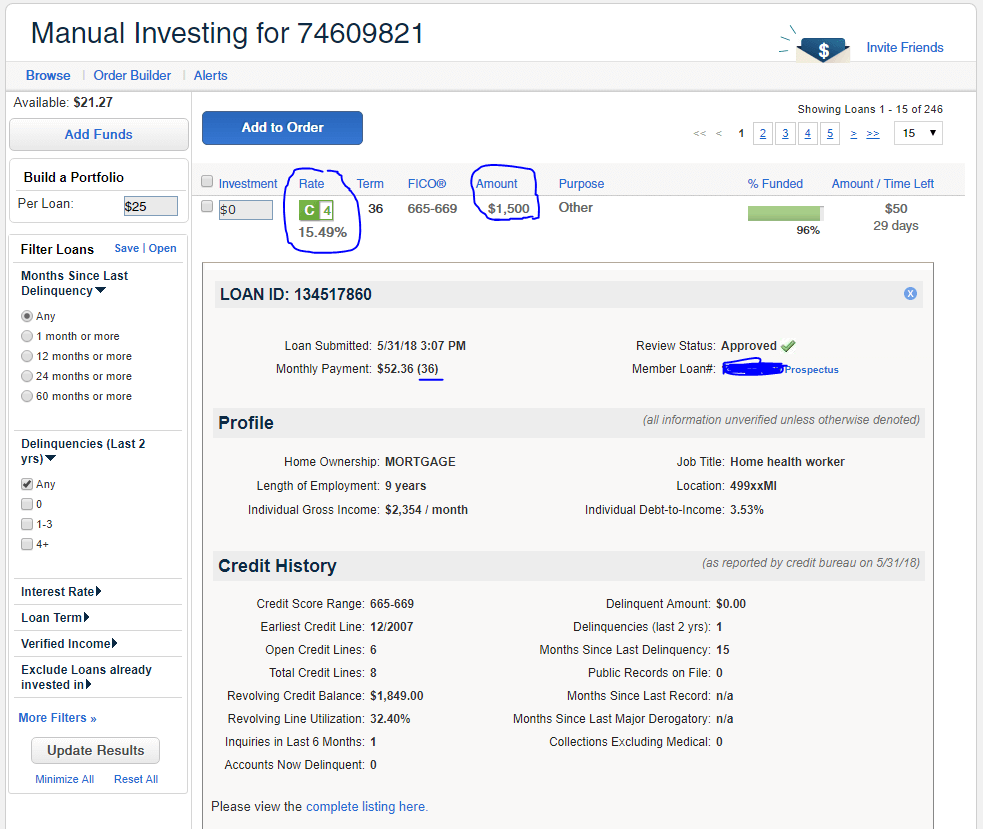

When I started 2 years ago, I choose to individually select which micro-loans I wanted to invest in. I knew, like a traditional bank, some loans may default and you lose money. So I took the time to research each loan application and Lending Club gives you a detailed credit history to choose from.

I specifically looked at their credit history, what they want to use the loan for and history of delinquencies. As well as their debt to income ratio. If these look good, then I help crowd-fund this microloan and invest $25 (typical) to the loan. Once it gets fully funded (below is 96% funded), the money will be taken out of my account and given to the borrower and I’ll receive payments back over 36 months (term of the loan).

You can also use Lending Club’s own rating system that’s “A-E” with “A” being borrowers with a great credit rating and likely to pay back their loan but have a lower interest rate. All the way down to “E” which don’t have a great credit rating but have a higher interest rate. Lending Club has since discontinued rating “F-G” because too many of those loans were defaulting and they wanted to clean up their platform. I still have some “G” loans grandfathered in until they’re paid off.

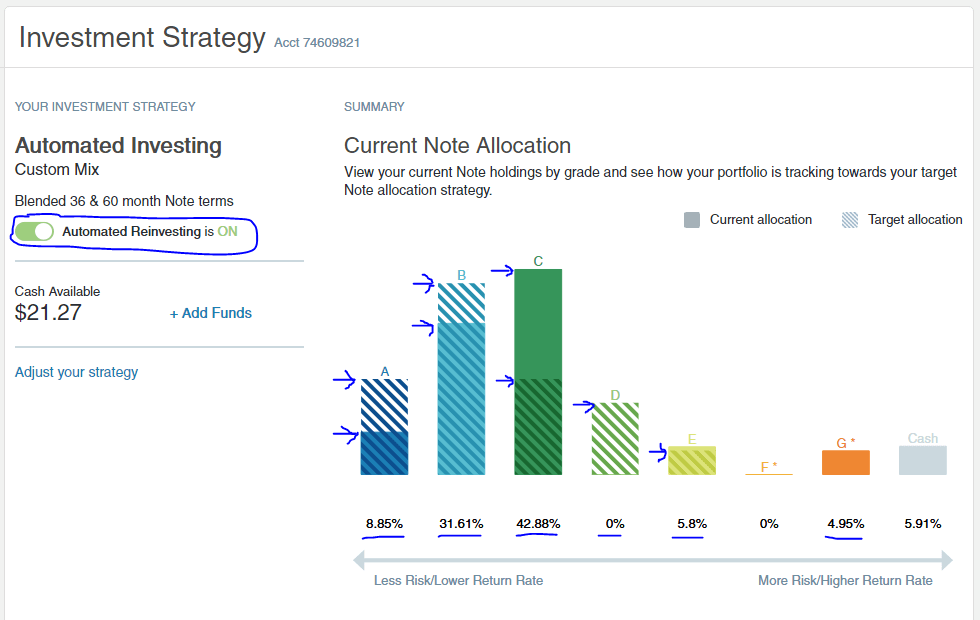

Over the last 2 years, I choose all of my individual loans manually. This was a huge time waster. Plus letting money sit in your account un-invested isn’t making money.

Last week I switched my account over to automatic investing so once I received enough money back in my account ($25), it’ll automatically reinvest into loans that meet specific criteria. I’m a bit more conservative on the loans I prefer because I want to avoid bad borrowers who default, which typically have a lower “D-G” rating.

Here is how I have my Lending Club automated investing currently set up. My account will prioritize “B” rated loans, followed by “A” and “C” loans. The solid colors are what I’m currently invested in and the hash lines are what my automated investing settings are currently at. Since each loan takes 24-36 months, it’ll be awhile before they even out. Remember, I just turned on automated investing last week.

How Much Money After 2 Years of Lending Club?

Since I started in February, 2016 and invested $300 it’s been fairly consistent (compare stock market stats). Typically every month I received an average of $3.05 per month. For 2.4 years (currently June, 2018), that would be around $85.4, but that’s not the whole story since I’m constantly reinvesting the extra cash and some loans defaulted.

Deposited: $300 (How Much Cash I Invested in Lending Club)

Total Loans: 30 (I invested in 30 loans at $25 each, including reinvesting)

Principal Received Back: $427.51 (Those 30 loans paid me back $427.51 so far, still ongoing)

Interest: $87.96 (Of that $427.51 received back, $87.96 was interest)

Default Loans: -$28.03 (2 loans defaulted and didn’t pay me back the full amount)

Total Profit after 1.5 years: $59.93 or 9% annual interest

*Interesting to note that some people were diligent and paid off their loans early, however you don’t earn extra interest if they choose to do this.

*The two loans that defaulted were 1 “F” rated loans which Lending Club has discontinued and surprisingly a “B” rated loan which shows that even highly rated loans can still default.

Conclusion

In the last 2 years, Lending Club has made about 9% annual interest. That’s not bad and significantly better than a 1% savings account. Yet still less than the 11% annual interest I’m seeing in my stock portfolio.

The biggest downside to Lending Club is your money isn’t liquid, meaning once you invest your money in a loan, it’s there until 24-36 months till the loan is paid off. That’s not too bad though, if you’re a long-term investor, you invest your money and forget it. So it’s not a big deal.

Overall, I’ve had a good experience and will continue to keep a little money in Lending Club to see how it does during a market downtown when everything crashes. Until then, good luck investing!

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

Leave a Reply

Want to join the discussion?Feel free to contribute!