Lending Club Review, My Experience Investing With Them

Traditionally if you wanted to get to loan to pay off credit card debt, loan consolidation or even build a pool in the backyard you’d have to go through a bank. You’d wait for a loan officer, fill out paperwork and then explain why you need the money.

Now Lending Club is something different. They use peer to peer lending to act as their own bank. They have two pools of people, borrowers (people who receive loans) and investors (people who lend the money). The idea is if you need $20,000 to consolidate a credit card bill at 21% interest, you can get a loan through Lending Club at 11% to save some money on your loan. You get a loan at a lower rate and Lending Club gets that interest off your new loan which is then distributed to the investors who supplied the money.

Here is my experience with Lending Club as an Investor:

Signing Up

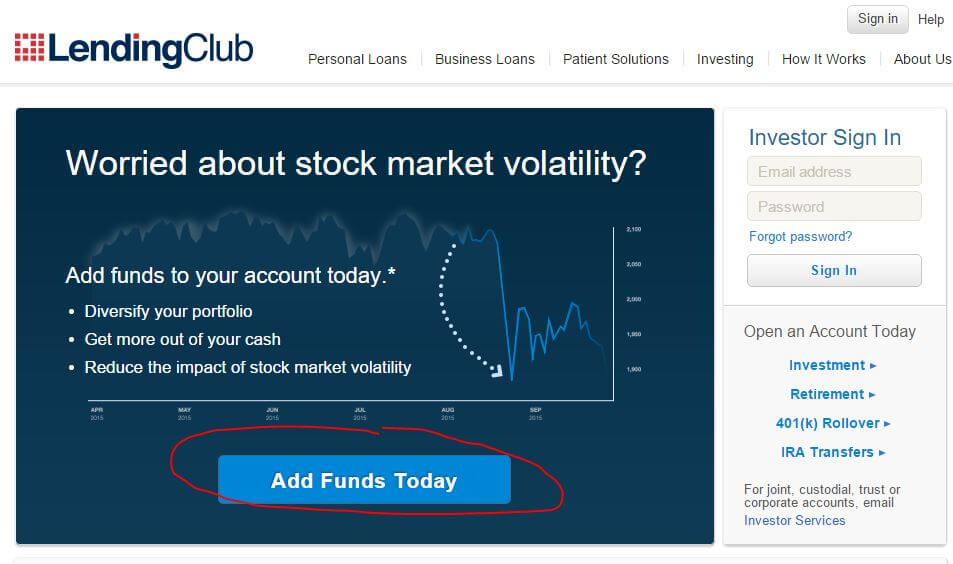

Getting started, it’s easy to sign up as an investor. Lending Club easily identifies a big button on their home page to start an account as an investor. You supply all the same info you would need to set up a brokerage account. This would include name, address, social, all that fun stuff. Keep in mind, always be worried about sharing your social, but Lending Club is a pretty established company so I felt comfortable with it.

Depositing Money into my Account

Once you get in, you’ll be asked to deposit money into your account to start funding loans. To simply test Lending Club, I threw in $300. I had it taken out of my checking account like how my brokerage account works (you seeing a theme?). It’s a lot like a brokerage account. The only crappy part is that it took up to 5 business days to get into my Lending Tree account. So if you’re hoping to hop right in, you’ll need to be patient.

Browse Loan Opportunities

Once I went through signing up, I was in. I could, at that time, access all the available loans that needed funding. There were a lot. This part was pretty cool. You have a list of loans with each borrower’s info to help you select which loans to fund. You can’t see their name or social or anything to individually identify an someone but you can see their:

- Loan Title and Purpose – Whether to Refinance Loans, Credit Card Payoff, Home Improvement, etc.

- Loan Amount – Amount being requested by the borrower

- Grade and Interest Rate – Borrower’s credit grade as assigned by Lending Club, as well as the loan’s interest rate

- Funding – If a borrower is asking for $10,000 you don’t have to give all of that, you can only lend $25 and other people go in with you. This is how many people are currently in

- Time Left – The amount of time remaining before the loan listing expires (loans are listed for 14 days)

- Loan Details – detailed information about the borrower’s credit history as well as additional loan information is available once you click on each loan.

The idea is those with a good credit history are assigned with a lower interest rate since they are highly likely to be able to pay (less risk but less money they pay you) and those with a not so great credit score at a higher interest rate (higher risk, but better reward for investors).

Lending Club does state though 99.9% positive returns with diversified portfolios with over $2,500 invested. So I’m curious to see how my little $300 will do.

Manually Selecting Loans vs Automatic Selecting

You can both manually chose which loans you choose to fund as well as Lending Club offers an Automatic approach. The bonus of Auto Investing is that once any money is paid back into my account, the Auto Investing will automatically reinvest it in the criteria I select. For example, I can have it reinvest in A & B Grade loans so they have less of a chance to default. So the idea of Auto Investing is great, but it requires a minimum amount of $2,500 in your account and since I only have $300. I will manually invest.

How I Selected Loans to Invest in

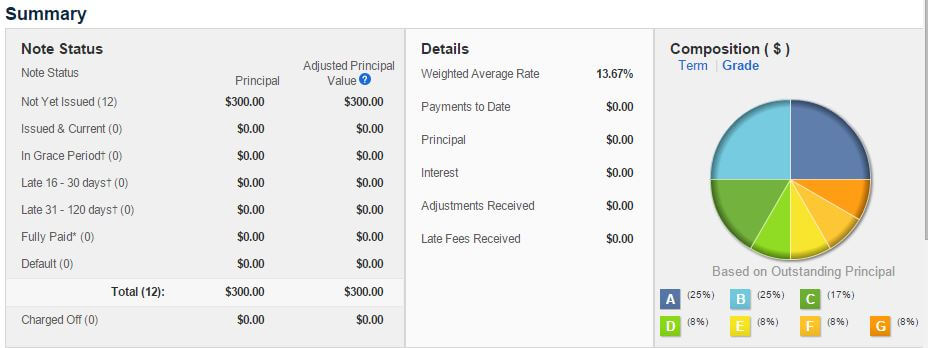

Since I can only invest a minimum $25 per loan (diversity remember), with $300 I selected up to 12 loans to diversify. I chose:

- Credit Card Payoff – Lending Club Grade A @ 7.39%

- Credit Card Payoff – Lending Club Grade A @ 6.97%

- Loan Refinancing & Consolidation – Lending Club Grade A @ 7.89%

- Other – Lending Club Grade B @ 9.16%

- Credit Card Payoff – Lending Club Grade B @ 8.49%

- Loan Refinancing & Consolidation – Lending Club Grade B @ 9.75%

- Loan Refinancing & Consolidation – Lending Club Grade C @ 11.9%

- Loan Refinancing & Consolidation – Lending Club Grade C @ 12.9%

- Loan Refinancing & Consolidation – Lending Club Grade D @ 16.29%

- Other – Lending Club Grade E @ 20.75%

- Loan Refinancing & Consolidation – Lending Club Grade F @ 24.24%

- Credit Card Payoff – Lending Club Grade G @ 28.14%

These 12 notes have an average of 13.67% interest return . Now there is no way I can know for certain these borrowers will pay off these debts, but based on their credit history, they always pay up. However some loans were a bit sketchy like someone wanted to do a home renovation, but had $30,000 worth of debt. They could be trying to make an emergency repair, but I’m hesitant they wouldn’t try to pay their debt off before cosmetic renovations.

Selecting loans is hard work (I’d already prefer Auto Investing). The ones I selected have a good diversity of Grade Ratings as well I reviewed each person’s credit score, job status, monthly income and length of employment to get a good idea of the type of people I am working with. I am excited to see how these pan out monthly.

Now – The Waiting Game

The only thing I don’t like about Lending Club vs the Stock Market is that my money is solidly invested. I can always sell stocks at anytime, but it’s not easy to sell your note (loan). You’re giving someone your money upfront and have to wait to collect it back in monthly checks (with interest of course). So since I funded those loans, I won’t get my money back until in some cases up to 3 years. The waiting game begins.

I will add any interest I receive each month in my monthly Income Reports to give you an idea how much you can really make with Lending Club.

Hi, I’m Andrew, a 28 year old entrepreneur who experiments earning money online and invest every dime.

Thanks for this great post on this method of investing I’ve never really considered! How do you report your interest income that you make off of this for income tax purposes? Does Lending Tree send you a tax form with all your interest earnings, or do you have to keep track of it all and manually report it? Thanks.

Hi Squall,

Lending Club does send you tax forms, I personally used Turbotax and it had a Lending Club Option where it automatically uploaded the tax forms into my Turbotax account. It was pretty awesome.

Thanks for commenting!

-Andrew

You should start making YouTube videos and linking new videos to new blogs. This way, you get improved SEO, traffic, and more ad revenue. Ever thought of that?

Have you done a follow-up to this post? I’m seeing the initial review & nothing more.. I’d be really curious to know.

Great point, we do need to update this. To date, I haven’t really been impressed with Lending Club. The automation helped, but there were so many defaults and the returns weren’t as good as my dividend investment portfolio. So I’ve recently started to pull my money out of Lending Club. However, it’s a really slow process as your money is locked into these loans.