My Emergency Fund, Why I Keep $2,000 For Emergencies

Early last year, following the January 17th post season game of Broncos vs Steelers, I recall reading Dave Ramsey’s “Total Money Makeover”. Yes, I was desperate.

In one of the first chapters, he goes on and on (he literally can not shut up about it) about having an Emergency Fund. Yes, others have mentioned it, but for me, Dave Ramsey was the first to tell me I need to get on this. He was my first.

Here’s the thing with Emergency Funds. Everyone seems to have a different way they set these up. Davvy-Poo Ramsey talks about putting money in an envelope under your bed for safe keeping to pull out in dire emergencies. His believes that if people have an emergency fund easily accessible, they will spend it. Apparently he believes his audience has no self-control, maybe they don’t, but I went a different direction. I will always love Davvy-Poo for starting on my Emergency Fund journey, but here’s where I deviate.

My Emergency Fund

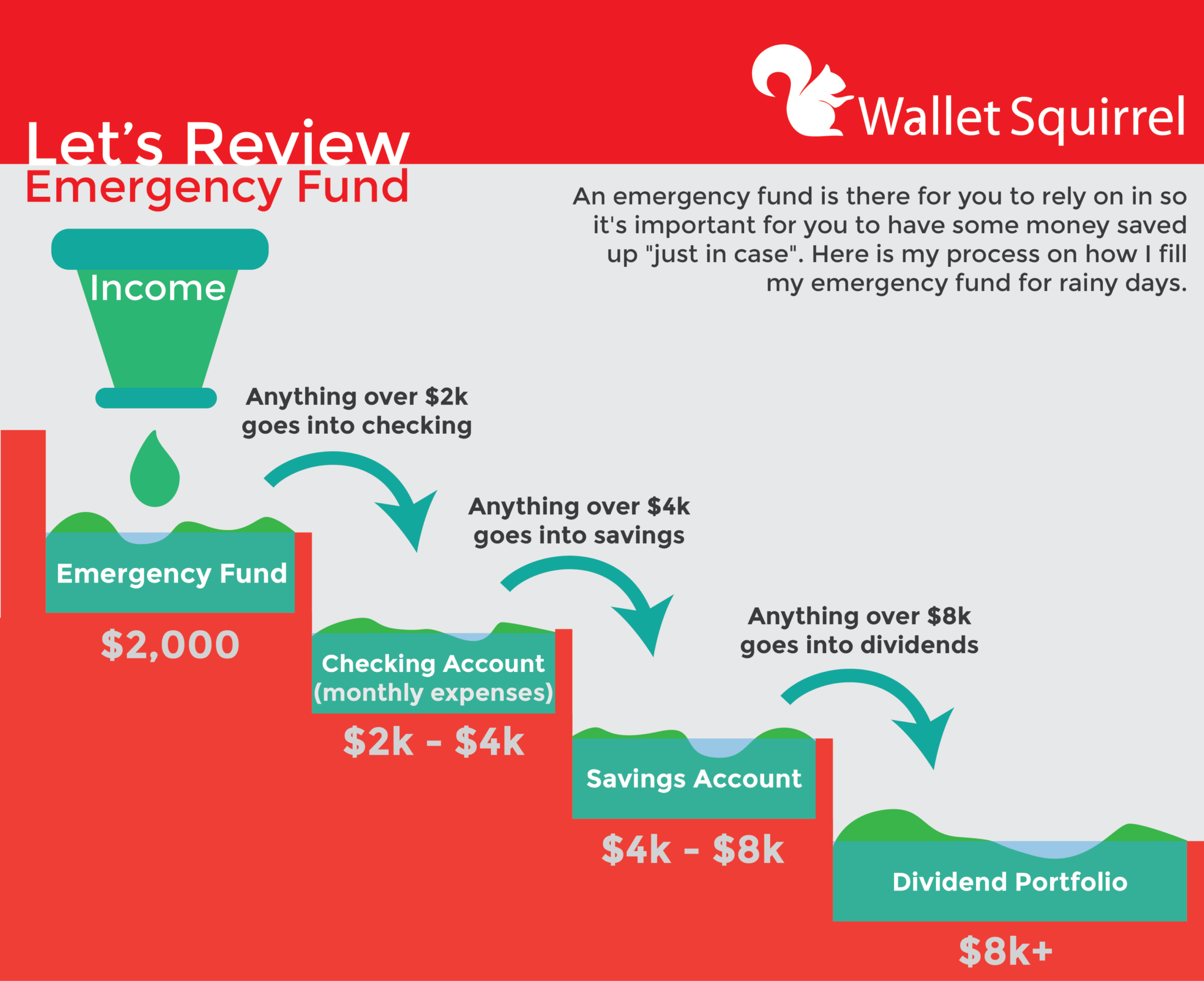

I have everything electronic. I keep $2,000 in my checking account as my “Emergency Fund” where it’s readily available. I don’t have cash hidden under my bed like National Geographic’s Doomsday Preppers (how the mighty National Geographic has fallen).

My active checking account fluctuates between $2,000 and $4,000 each month to cover my monthly expenses. At the end of the month, anything over $4,000 goes toward my savings account and that into my dividend portfolio. Here’s what I mean (infographic below):

Why I set up my Emergency Fund like this?

I have a method to my madness. Two reasons why I set up my Emergency Fund like this:

- My checking account is immediately accessible for debit withdraw if needed. PLUS my checking account gains interest (albeit a small amount) my emergency fund is large enough I make about $0.20 each month. I couldn’t do that hiding cash under my bed like a caveman.

- The biggest reason is fees. Overdraft fees are ridiculous and I’ve done that a couple times when I kept extra cash in savings. Since my Emergency Fund is the base of my checking account, if I go over my monthly expenses, it just pulls cash from my Emergency Fund which is the foundation for my checking account. No OVERDRAFT FEES EVER.

How much do you need in an Emergency Fund?

This is where a lot of people differ on how much they should have saved in an emergency fund. For me, I try to have $2,000 in my immediate emergency fund. This will cover about 1 month’s expenses for me. My emergency fund essentially gives me enough time to access my stock portfolio if needed.

In case of a legit emergency, here’s what I’d actually do

I’ve never had a legit emergency that’s affected my income (I’m young and invincible), but if I ever did, I have a plan.

- I would have immediate access to $2,000 in my checking account

- I would have immediate access to my emergency fund of $2,000 also in my checking account

- I would have semi-immediate access to my saving account which usually holds $4,000. It’s a semi-secondary emergency fund. This also makes interest =)

- That would give me time if needed to sell stocks and access my portfolio currently made up of $7,000.

With my average monthly expense of 2,000. My emergency process would cover me for 7.5 months if I could make no money what so ever. That’s pretty cool! Yes, I have friends and family that would be willing to help, but it’s important to me that I could support myself.

How do you set up your emergency fund?

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

Interesting read. I firmly believe that emergency funds should be the cornerstone of a portfolio. I like to hold much more than $2,000 and I’m a little crazy but I do hold some cash (under the mattress). Having been through a financial disaster, I’ll never again be cash poor.

We ar lucky! Our emergency fund is fully funded. We have a mechanism in place for a life happens fund that should cover the usual expenses that come with house improvement etc. This way, we can keep the EF for real emergencies. The other expenses are more wants than needs.

Thanks Investment Hunting for commenting!

How much do you hold in your emergency fund (in terms of survival months)? I figured 1 month of my emergency fund would give me enough time to liquidate my portfolio if needed. Plus I suppose my Savings Account is like a secondary emergency fund. So it would overall total $6,000 but I never think of it that way.

I’ve never been through anything extreme in terms of financial disasters. So I don’t know first hand what it would be like, but I’m more afraid of being robbed than I am of my FDIC insured bank failing.

I usually keep around $50-$100 in my wallet (people please don’t rob me), but what situation can you think of needing immediate cash that running to the nearest ATM won’t work?

So you have a “Life Happens” Fund AND an “Emergency Fund”? That’s pretty sweet!

I’ve noticed I feel a lot more financially secure now that I have my Emergency Fund. Now since you have 2 emergency funds, do you feel extra secure? lol I bet it’s a pretty cool feeling!

Wallet Squirrel,

Great post and again love the infographics. I keep very little in my emergency fund, but I do carry approximately $1-$2K when I break it all down. If things go wrong with work – I’d sell my assets that have liabilities tied to it (Vehicle) and generate rental income (my house); if that doesn’t do the trick (as that would cut monthly expenses down by about $800/month), I then have a stock portfolio in the absolute worst case scenario – which I do have savings bonds to boot as well that could last 3-5 months easily. Aka in terms of Cash – not as much, but I do like the idea of having $2.5K potentially that literally is just “there” for the monsoon days.. haha

-Lanny

Man your infographic skills are amazing! It made the concept so easy to understand and in a pretty cool way. One day you need to mentor me on how to do these more complicated ones haha. I think your concept is sound as you have enough on hand for immediate emergency as well as enough to cover your expenses for several months so props to you. As you know I am in school so I do not have income or quite frankly large expenses besides rent and alcohol (a necessary expense in college some would argue) but I have managed to set aside 1k in an account. I plan on growing this as I start working to 2-2.5k like yourself for the security of having that cash on hand in a bank. I know some people use CDs but I want that cash right now! Always tempted to throw that cash into the stocks on a bad day though haha but I have been good about leaving that money on the side.

Dude, I think that absolutely works. For me, my emergency fund is there for me to survive on until I can tap my other resources.

Yours is great, it sounds like you have a solid plan to make it work. Having a plan is have the battle. Thanks for sharing, I like it.

Nice Stefan, thanks for sharing your Emergency Fund stash. $1k is still more than MOST people. The most important thing is that you have a process set up that you’ll be OK in case of an emergency. Who uses CDs as an emergency fund? That doesn’t sound very liquid.

Absolutely love to help with the infographics! Glad you like them. =P

PS. alcohol is completely necessary in college. How else are you supposed to survive?

Read one time that some people choose to layer their emergency funds where they keep some in the bank and other in like a 30, 60, and 90 day CD to get extra interest. Found it interesting but that defeats the purpose of an emergency fund in my opinion.

CD sounds so odd. If an emergency happens then you have to wait 30 days to access your money or take a penalty. So you essentially will lose money. Yikes.

A natural disaster, no power = no ATM. A run on the banks, it almost happened in 2009, in fact some banks had no cash. Worst case scenario, cyber terrorism on our financial system. Will these things happen, most likely not, but a little under the mattress money doesn’t hurt.

I have 17000 in my emergency savings, but only because I still have debt. I don’t think 1k is quite enough, and my job is pretty safe so it’s about 3 weeks, and then I could go on EI if I needed to. We also have national healthcare, and I have a good benefits plan, I have no children, nor do I have a car (I take the bus), and I rent (so my landlord is responsible for any house repairs that might incur) so $1700 is all right for me. I also usually have a few hundred in my checking account. I tried to follow Dave Ramey’s 1k emergency plan, but it just wasn’t enough for me to feel safe. I make about $0.65/m from my savings account which is nothing, but hey it’s better than nothing, my debt is 3% interest, so I am losing money on this, but oh well I am losing less than if I were to keep it in my mattress. Oh well.

lol you originally say $17,000 in the first line but later rephrase to say $1,700. That’s a large difference.

That’s not bad and it’s better than most. The biggest thing is having enough to cover emergencies that come up or enough to last you 3-6 months.

I’m the same way of keeping my emergency fund in a savings account rather than under my mattress making no extra money. I have a total of $4,000 in my savings and it makes about $3.80/mo (1% interest account).

Sounds like you’re doing pretty well, thanks for sharing!

-Andrew

Oops the $17k was a typo. I wish I had that kind of money. Lol. 🙂 no I only have a little more than $1700. Maybe I’d like to bump it up to $2k but I am very nearly finished paying off my 40k student loan I have 6k to go and i paid that down in 2 years on a very low income. So apart of me just wants to put all of my resources towards my debt until its paid off. My boyfriend just paid off his debt and now has $3100 in his emergency savings fund. I wanted him to get his up to $10.5k because of his unstable career path but maybe 8.4k is enough which is 4 months expenses. Perhaps I will show him this model to see what he thinks.

I paid off my debt in March and now I’m up to 8k in my e-fund. I kind if want to go up to 10k and I think that’s when I will feel satisfied. My hours got cut at work I’m looking for another job. Keeping my fingers crossed