Cost Benefit Analysis Example – Pay Off My Car or Invest?

Here is an example of a Cost Benefit Analysis I did regarding what I should do with my upcoming tax refund. I pay a ridiculous amount in student loans and to the government annually. So I can usually expect a sizable chunk back. Now I face the question of using my tax refund to either pay off my car or use it to invest.

Why Student Loans vs Car Loan?

I have $64,450 in Student Loans (5% interest) and a $10,132 Car Loan (2% interest). So you think I’d be paying WAY more on my student loans per month. Actually since it’s spread out over twenty years, I actually only play $487.06 in student loans a month. My car loan is $340 per month because it’s over five years (I’m on my third year now).

So if I pay off my car loan, that will free up an extra $340 a month I can use to invest, but is it worth it? To figure out if I should pay off my car or invest my tax refund, I’m doing a cost-benefit analysis!

Cost Benefit Analysis Definition

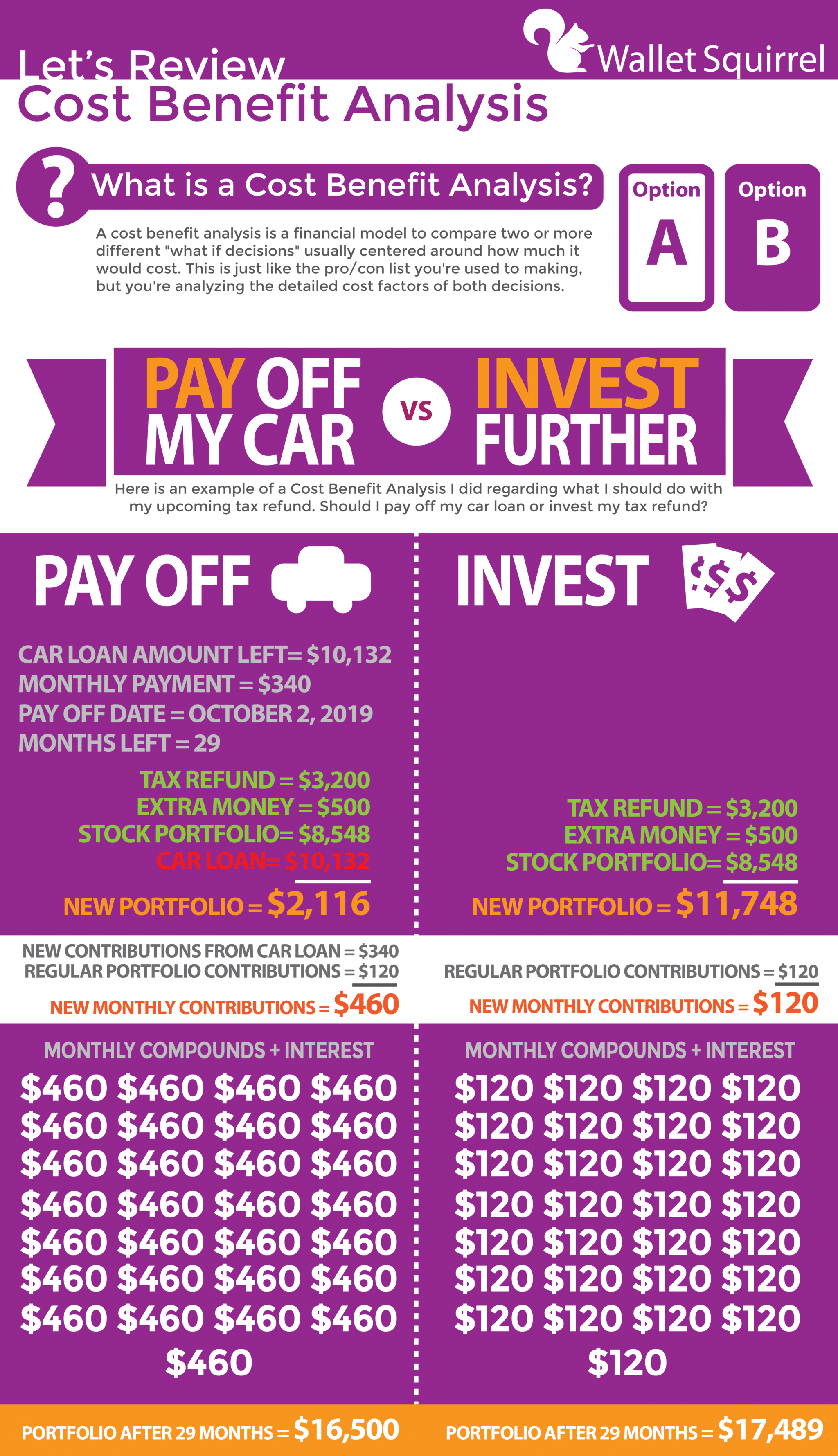

A cost benefit analysis is a financial model to compare two or more different “what if decisions” usually centered around how much it would cost. This is just like the pro/con list you’re used to making, but you’re analyzing the detailed cost factors of both decisions.

Cost Benefit Analysis Example Infographic

How to do a Cost Benefit Analysis? See my example

Question: I want to compare if I should use my tax refund combined with 3/4 of my stock portfolio to pay off my car loan or should I invest my tax refund. Which would be a wiser investment?

Math: So I pulled all the info on my car loan and stock portfolio below. Using the Pay Off Date of my car loan as the end date, I can calculate two options. In both options I would continue to invest $120 per month in my stock portfolio.

- Tax Refund

-

Tax Refund = $3,200

Extra Money = $500

- Car Loan

-

Amount Left – $10,132

Monthly Payment – $340

Pay Off Date – October 2nd, 2019

Interest Rate – 2.89%

- Stock Portfolio

-

Stock Portfolio – $8,548

Historical Stock Market Interest – 7%

Option 1 – Pay Off Car – If I pay off my car loan, that that would free up my car payment of $340 per month. So if I pay off my car loan in April, 2017 that would free up 29 payments of $340, adding to a total of $460 per month into my stock portfolio with my regular $120 monthly contributions ($340 + $120).

If I invested that $460 monthly, with compound interest onto the remaining $2,116 in my portfolio (tax refund + stock portfolio – car loan) , it’d equal $16,500 by October, 2019.

I even went so far as factoring in my new insurance rate because it would be lower with me owning the car. I actually called my Esurance agent and asked what my new insurance rate would be if I fully owned my car vs having a car loan. You should do this, it’s super helpful! The new insurance rate would be $336 per six months vs the current $588 per six months. So this would save around $500 a year.

I’d also recommend talking to your bank holding your car loan and asking them if there are any penalties for paying off your car early? Remember they make money off the interest and if you pay early, they are missing out on a few extra bucks. Luckily the credit union where my car loan was under had no penalties for paying off early. Again, it’s super helpful to find out all these little factors before you make a decision, these all factor into the cost benefit analysis.

Option 2 – Invest My Tax Refund – If I continued to invest instead of paying off my car loan. I’d dump that $3,400 tax refund (plus $500 extra) into my investment portfolio for a total of $11,748. Then add $120 per month for 29 months till October, 2019. With compounding interest, I’d have $17,489 by October, 2019. That’s about $1,000 more than if I paid off my car.

Plus it could be even more since I used 7% stock market interest and last year it was more like 13%, but I wanted to use historic returns because past performance doesn’t mean future performance. 😉

There’s more to it

So if I continue to invest in my portfolio instead of paying off my car loan, I’ll have a little over $989 more by October 2nd, 2019. but that’s only the numbers.

There is a certain amount of freedom to having an additional $340 a month. If I have an unexpected expense, that’s $340 extra I have to cover it if needed. I’m not going to lie, it would be nice to have that extra cash each month. It’d solve a lot of nightmares in the middle of the night of not having enough money.

On the other hand, if I don’t have the extra money each month, I can’t waste it. See it’s a dilemma! At least I NOW know how much I’d have with both options because I did the Cost Benefit Analysis!

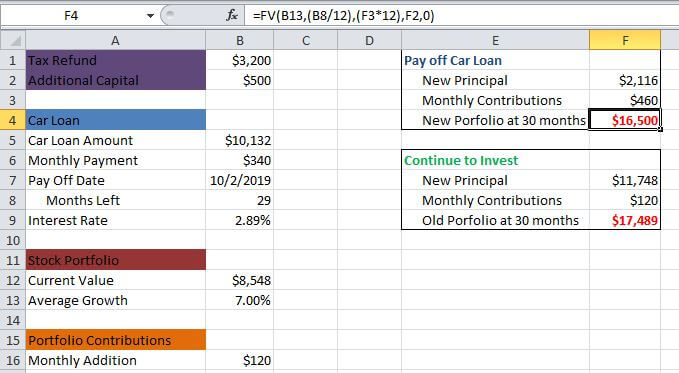

Cost Benefit Analysis Template

Here is the excel sheet I used to calculate my cost benefit analysis. It’s pretty simple, but you can see the formula I used for “Future Value” to calculate the final amounts. It was really cool tinkering with the different values to see how the two options compared. Try it for yourself by downloading the excel sheet I used.

I inputted in all the variables which you see above. Then broke down the new principal of my stock portfolio in each of the options. In Option 1 (Pay Off Car) it was $2,216 and Option 2 (Invest) the principal was $11,748. Then added the new monthly payments of both Options. Lastly I used the formula “Future Value” to break down both Options after 30 months.

Future Value Formula

The formula “Future Value” in excel was new to me, so let me break it down.

Cost Benefit Analysis Template

=FV (rate, nper, pmt, pv, type)

*note that the future value formula is in years, I had to adjust since I was using monthly deposits

Rate – The Interest Period (mine was 7%)

Nper – The total number of payment periods (months divided by 12 for number of years)

Pmt – The payment made each period (my monthly contributions times 12 for a year)

PV – The present value (my starting portfolio amount)

Type – When payments are due. 0=end of period, 1=1 beginning of period (most people I saw use 0)

How can you Apply this to your life?

When I first had the dilemma what to do with my efile tax return, my friend suggested a cost benefit analysis to analyze both options. While this was a good idea for my tax return, it’s a valuable tool for weighing pros and cons of any financial decision.

You can use this for compare cars when you’re buying new vs used, figuring out car loan costs. Or you figure out if you can buy a new house vs continuing renting. It’s a really a great tool to use!

What am I going to do?

Well that’s a good freaking question. What am I going to do? I need to do something because I have received my tax return and have $3,200 sitting in my savings account only earning 1% interest.

You’ve heard both options with the pros and cons of each. I have a logical decision which is to invest the cash right away in my stock portfolio to make more money or a financially freeing decision which would free up an extra $340 in month income. You’ll have to find what I’m going do in an upcoming post!

What would you do?

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

First thing I would do is to reduce your withholding rates so that you don’t get a big refund next year! If you are consistently getting refunds of several thousand dollars, you are over-withholding and giving the government an interest free loan! Wouldn’t it have been better to have this money all along and having been paying down your car earlier? 🙂

Second, I’d keep the cash. 2% interest is even better than the 3.5% on the student loans that I just wrote about not paying off early. You can’t get new money that low. And the market is doing better (although I think it is due for a fall). I’d go with more conservative allocation and make sure your emergency fund is good.

Hi 80/20 Your Finances!

After writing this article, I’m definitely meeting with my HR team to reduce my withholding. That’s a really good point. I always used the thinking that if I’m not spending that money throughout the year, I’m not wasting it. I can use the lump sum at tax refund time to pay things off like student loans/car loans/credit cards. I’ll switch it to take the money through the year and maintain my budget. =)

You’re totally right, 2% is definitely better than most loans out there. I think the real dilemma for me is just the $340 additional cash each month would be really nice to have and being car loan debt free. The stock market will obviously make me more, but I agree, I see a dip coming soon. So I’m in a pickle. lol

I’ll decide by next Thursday’s March Income Report.

Before all these are all jargons to me, thanks for explaining this.

Glad it helped! I’m still wrapping my head around all these as well!

Thanks for stopping by!

Andrew