3 Reasons Why Monthly Dividend Stocks Are Better than Quarterly

Here on Wallet Squirrel, every day we are finding new ways to earn money and investing those profits to build an online stock portfolio. Our stock portfolio is exclusively made of dividend stocks, so in the future, we can live off the income produced by those dividends. As investors, we have some preferences on why monthly dividend stocks are better than quarterly.

All Hail Dividends

If you’re curious about what dividends are, our best summation is that they are a portion of a company’s profits that are distributed to shareholders regularly.

If you want to know more, check out our What Are Dividends article. There are a lot of companies that produce dividends (why I love them), but receiving dividends monthly is pretty awesome!

Why Monthly Dividends Stocks are Awesome!

- Monthly Dividend Stocks are way easier to budget for – If you’re waiting quarterly for those dividend checks, you’re forced to budget that income for the next several months. A lump sum you have to let sit in your bank account tempting you to spend it. No matter your willpower, you’ll always be thinking “I’d be willing to eat Ramen Noodles for the next month if I bought a boat right now”. You’ll be the most sodium-rich sea captain. You’re better than that.

- Better Compound Interest – If you’re receiving dividends every month, you can use that to reinvest in more stocks and have those dividends grow more by the time your other quarterly stocks arrive. Simply, the faster you reinvest those dividends, the faster they’ll compound interest. For Example, if you owned 1,000 shares of a $10 stock at a 5% annual dividend. At the end of the year, you’ll have earned 5% at $500. However, if you received monthly dividends, you could reinvest those dividends each month and have earned 5.12% at $511.62. This is assuming you have a DRIP campaign set up. However it’s obviously more, and that’s only one year.

- It’s enjoyable seeing regular income – There is something incredibly satisfying as an investor seeing their investments create monthly income. It feels like you’re earning extra as your stock price fluctuates, you’re still seeing income being produced. You can reinvest or spend that monthly income but it gives you extra cash each month to play with.

What Type of Companies Produce Monthly Dividends?

You’ll mostly find monthly dividend companies limited to Real Estate Investment Trust, Business Development Companies and sometimes Master Limited Partnerships.

- Real Estate Investment Trust – is essentially a company that owns multiple properties and generates income based on those properties. They can specialize in different real estate niches such as commercial property, apartments, office buildings, hospitals, etc. Each REIT usually has a specific focus and most produce dividends.

- Business Development Companies – are organizations that invest in small to medium-sized companies to help them grow in pivotal stages of their development. Their income is made up of their investments in companies.

- Master Limited Partnerships – are organizations that generate predictable income streams based on production/processing/storage and transportation of depletable natural resources.

Are you invested in any monthly dividend stocks? Tell me about them.

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

I loved getting monthly dividends, but I HATED doing my taxes at the end of the year with any MLP, Master Limited Partnerships. I swear they are so ‘not streamlined’ that you often have to change/leave off parts of the paperwork to get them to pass muster using any tax software. I dumped ALL of them. Not worth it IMHO.

Hey OthalaFehu!

I keep hearing that about the taxes with MLP as a nightmare. However I use Robinhood and it automatically imports my investment tax documents into “TurboTax” so I’ve never had to go about the complex documents.

I’m not sure I’m missing something, but it’s usually pretty easy. I didn’t know if other brokers did this with Turbotax or other tax software….

-Andrew

Hey Andrew..great website. I recently got into trading stocks, but i never thought of buying stocks because they generated consistent dividends…im going to take a look at that.

Are you planning to get into any other online ventures? Would love to discuss more.

I own MLPs, REITs, and BDCs. Honestly, I don’t care so much about when the dividends come in, if it’s a company I like. Realty Income is a stock I like because of the underlying business – the monthly dividends are just a little bonus.

I think it’s more important to have a *portfolio* that yields monthly dividends rather than individual stocks that yield monthly dividends.

Hey John!

Nice website to you as well John. Stocks are definitely a nice way to go for some extra income, especially large amounts of income. So far I’ve made FAR, FAR more with stocks than I have with my savings account (13% annual increase vs my 1% saving account).

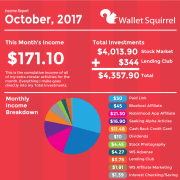

Otherwise, I’ve been making money with an affiliate website (not much right now), Lending Club, Ebates, Cash Back Credit Card, Stock Photography and other forms highlighted in my Income Reports.

Can’t go wrong earning a little extra cash =)

-Andrew

I totally agree Mike!

Always love when you comment. These comments are so good!

Back when my portfolio was over 10 stocks, I was still receiving a good amount of dividends monthly even though it was made up of quarterly stocks (minus Realty Income). Just seeing those dividends come in every month is pretty awesome! Plus hugely motivating.

PS. Totally love the Realty Income Business Model more than their monthly dividends =)

-Andrew