What Is Estate Tax – How does it work & does it affect you?

What Is Estate Tax – How does it work & does it affect you?

The estate tax is a big issue lately because of the current US administration’s plan to remove it in their current their tax overhaul. While I won’t go into the politics, I do want to touch on “What is estate tax” because most of us don’t know what it is or don’t have enough money for it to be a concern.

In fact, only 0.2 percent of Americans will owe any federal estate taxes in 2017, but it’s consumed 70% of the media lately. So let’s dive into what is estate tax.

What is Estate Tax

Estate Tax is a federal tax you pay when you die. So when someone dies and leaves their children their estate, it’s taxed before your children get your wealth. When I say “estate” we’re not talking about your mansion (although it could be), I’m talking about all your assets combined including cash, real estate, houses, stocks, etc. Everything you owned makes up your “estate”. I explain “estate” in the article what happens to debt when you die.

The Estate Tax is a tax on your “Estate”, but it only taxes your estate after a certain amount.

The federal estate tax exempts the first $5.49 million of your estate but taxes anything over that $5.49 million at a 40% rate, that’s what you pay in estate taxes. However if you’re married, you’re allowed to exempt the first $10.98 million and taxed anything over that.

What is the Estate Tax Formula

It helped me a lot understand the Estate Tax once I visually saw how it worked.

(Your Estate – $5.49 million) * 0.4 tax rate = How much you pay in Estate Taxes

So if you died with $10 million in assets to leave to your children ($10 million is my goal). You would subtract 10 million from the $5.49 million federal exemption which is 4.51 million. That 4.51 million would be taxed at a 40% rate, so in the end , ou would pay $1.804 million in taxes to the federal government.

So the rich are taxed 40% when they die? Well no

When we talk about the federal estate tax, we’re talking about taxing those assets over $5.49 million at the 40% rate. Not your entire estate.

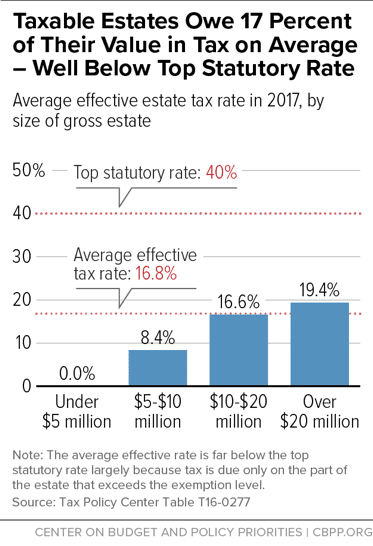

The Center on Budget and Policy Priorities has a table on the average amount of wealth people paid in estate taxes in 2017.

So the average person who paid estate taxes in 2017 paid the federal government 17% of their entire wealth because of the estate tax. This is lower than 40% because of two reasons.

- You have such a large exception, the first 5.49 million is tax free. So in my example of a $10 million dollar estate, the entire estate is only taxed 18% in total. Because the 1.804 million I pay is 18% of the overall 10 million portfolio.

- There are several ways shield your money from estate taxes including donating to charity, gifting money (you can gift an individual up to $14,000 per year), set up a trust and other loop holes that help lower your estate tax bill.

How much money does the estate tax make?

In 2014, according to the Tax Foundation, the estate tax raised $19.3 billion or 0.6 percent of the total federal revenue ($3 trillion). In the past, it used make up 1% of the federal revenue. Because in 1990 the federal estate tax exception was a lot lower and more people had to pay the estate tax.

Does the estate tax affect you?

Likely not unless you’re bundled up with a large amount of wealth, or more than $5.49 million.

Keep in mind this is your total wealth as your “estate”, so farmers who don’t necessarily make a lot, but own large amounts of land. That land could be valued at a high rate, bringing your “estate” higher than that $5.49 and causing you to pay the estate tax before passing it down to your heirs.

However most people, 99.8% of Americans, don’t have to worry about paying the estate tax.

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

Great explanation! As I’ve heard it, the debate over the estate tax tends to be something of a philosophical matter, in terms of some being of the opinion that the money is being taxed twice – once when it’s earned, and upon death.

Nice summary. As a married person my spouse and I enjoy double the exemption you mention $5.49×2 = about 11 million. Given that, I’m not very worried about estate taxes ( unfortunately 🙂 ). I’m more concerned about some of the tax “reform” discussions coming out of Washington D.C. right now. I live in a high tax state and a high tax county in that state. If they eliminate or reduce the deductions for those state and local taxes, my current federal tax bill will go up a lot. Not happy about that. Have a great weekend. Nice blog! I like how it is set up. Tom

Hey Miguel!

Thanks for the comment, I was pretty excited to explain this to a couple friends and I have had some pretty intense arguments about it. I totally get the taxed twice feeling but I was hesitant about going into the politics if it’s right/wrong. Glad it gave a nice overview of the concept though!

-Andrew

Yikes Tom,

I high state tax AND a high county tax. That sounds pretty awful. It sucks when the place you need/want to live in have some awful tax penalties. I agree that Washington has some interesting tax reform discussions (including “Estate Tax), but I was afraid to wade too deep into the politics and start political discussions. I just wanted to at least educated people as to what the “Estate Tax/Death Tax” is so they’re aware.

Thanks for sharing as always!

-Andrew