How I earn $25 a month with the Best Cashback Credit Card

Let me first state credit cards aren’t evil, credit card companies are. Your credit card isn’t going to crawl out one night and go on a Las Vegas spending spree with your ex-girlfriend laughing at you until you get your next statement. No, it’s a tool in your ninja financial tool belt and I’m going to explain how it makes $25 for me each month with the best cashback credit card, and how it can help you too.

Oh you heard me, this is me explaining how to have your credit card make YOU money. 99% of the of time, credit card companies make money off you because they think you’re stupid, well if you’re reading this, you’re not stupid. You want to learn how say ENOUGH and try something different.

My $6,000 Credit Card Debt Past:

Let’s just say I was a moron. I like most people, got their first credit card in college, well Wells Fargo in fact. They told me it was a good investment, they told me it would build my credit. They told me I would earn “points” each time I spent money and I could use those “points” to buy other things. I was going to buy things anyways, so why not earn “points” when I do. Sounds awesome right? I had this bank since high school, I invested my first summer job paycheck with this bank. They couldn’t steer me wrong.

Now I won’t bash Wells Fargo. I think everyone should do their own research and make their own call, but let me tell you what those “points” got me the last 9 years I had/used that credit card.

Keep in mind, this is me using my credit card cautiously, I heard the rumors about people with credit card debt, but everyone had debt. Why should I be different? In fact, I racked up $6,000 in debt for multiple years paying only the minimum (that’s only the interest boys and girls). It’s OK though, had SO many magical “points”. I could buy so much more stuff!

So here’s the thing they didn’t tell me with my “points” credit card.

- There was a $20 annual membership fee

- You can only use “points” in their own online store

- Everything in their limited online store cost more than Amazon

- Oh, and your points expire

WHAT THE FUCK!!! Did I mention I was a moron? In the last 4 of the 9 years, I kept checking the online market place and the best thing I could buy was a $40 putter. I (like you probably) thought, if I keep using my card, I can save enough points to buy the $50 putter. Wrong, when I checked back, my oldest points had expired. Plus did I mention the $20 annual fee? FUCK!

In the end, after all the debt, I cumulatively used the points (that hadn’t expired yet) on $75 worth of gift cards to Amazon. So in 9 years, I paid $180 ($20 annual fee x9) for $75 worth of Amazon gift cards. Again, I will reiterate, I was a moron.

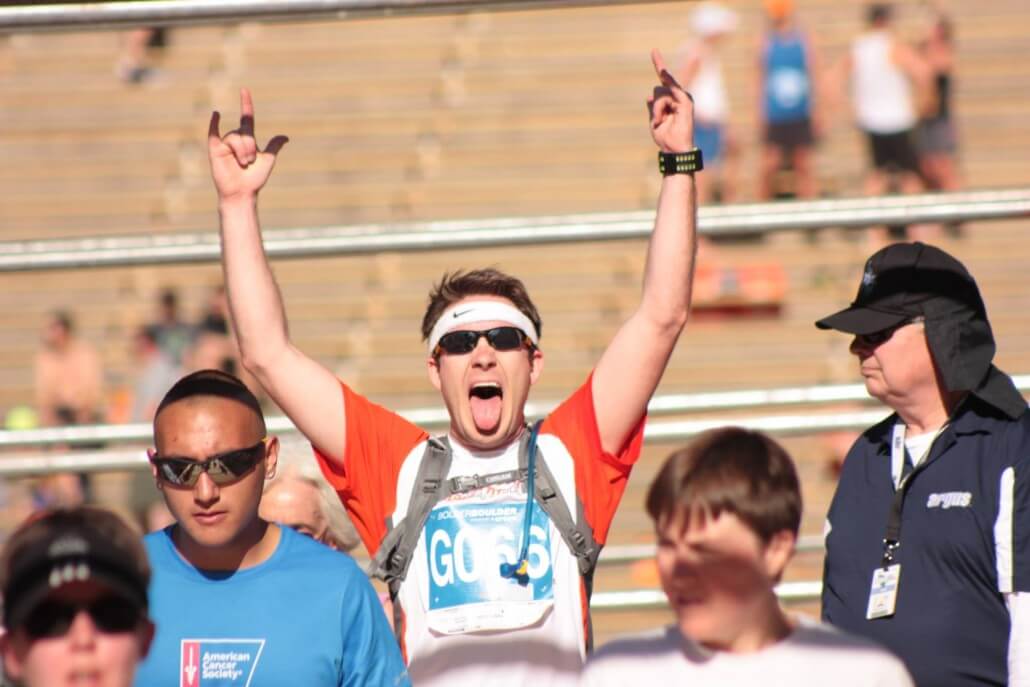

When I Paid off my Credit Card Debt:

Exactly 1 year ago, I finally had a job that allowed me to pay off my credit card debt. (Hint: I paid off more than the minimum payment each month) Wahoo! I even celebrated by walking into Wells Fargo and giving them back their credit card. A purely ceremonial gesture. Apparently that’s not something most people do, most people just cut them with scissors and throw it away. I recommend this. Wells Fargo actually told me to keep it open and use it for small purchases to continue to “build my credit”. Seriously, the advice Wells Fargo had for me, was to keep this awful credit card open and keep spending money on it. Really? All bow down the mighty credit score.

I decided my credit score was good enough and haven’t used that card since. It’s been 1 year.

I Did Research And Found The Best Cashback Credit Card For Me:

Now with a story like this, once I paid off my credit card debt, you think I would be done with credit cards forever. Right? Well, do you recall me saying credit cards aren’t evil, credit card companies are? I just needed to learn how to use my credit card responsibly and find the right card for me. Credit Cards are a dime a dozen and so they separate themselves by giving you “rewards” for using them. These can be broken into three categories:

Point Rewards: The more money you spend on your credit card, the more “points” you get to buy stuff. These points are only redeemable through their own custom online store and often at a markup or definitely not a discount. Simply, I think this is stupid, my experience has been awful. If you’ve had a positive experience with a “point” system, I’d love to hear about it.

Mileage Rewards: The more money you spend, the more “miles” you earn. So you can essentially earn a free airline trip. This is pretty cool, but you have to watch out for “blackout dates” where there are days you can’t use your points and usually you can only select from a few airlines, but hey free miles.

Cashback Rewards: The more money you spend, the more cash you get back. Spoiler alert, this is what I prefer. Screw points and miles, when I get cash back, I use actual “cash” to buy anything I want on Amazon or buy my own plane ticket. No airline restrictions or “blackout dates”. Cash is King. Here is how I went about finding the best cashback credit card.

Let me say something about Cashback Credit Cards

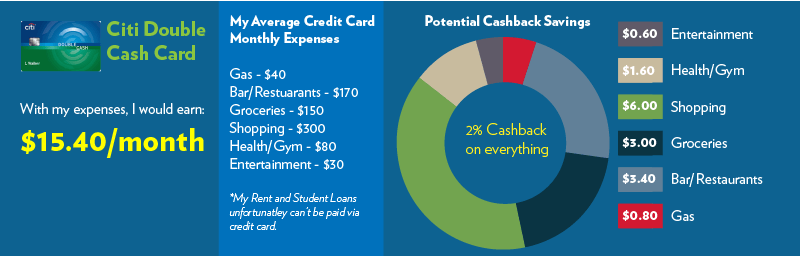

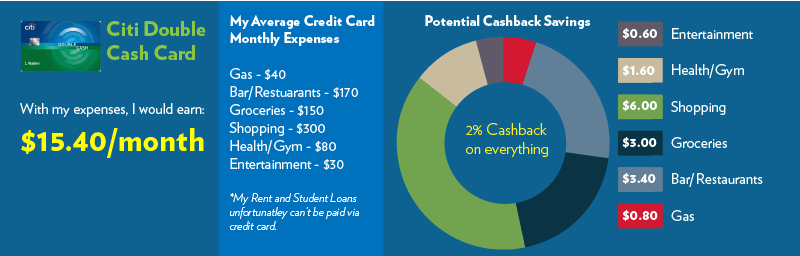

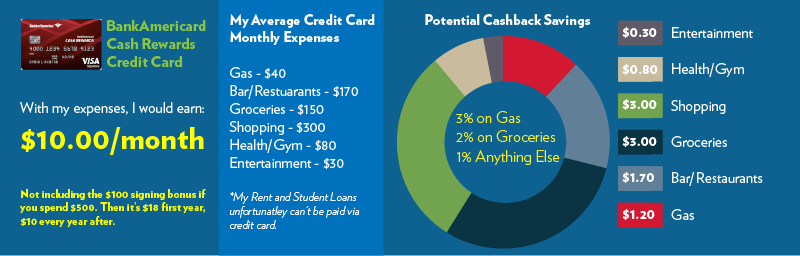

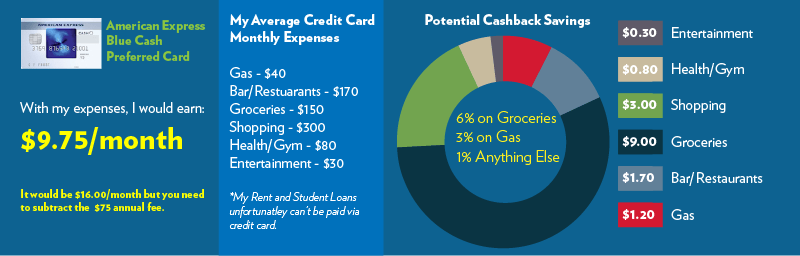

Pay close attention to the amount you get back for different purchases. Some of the best cashback credit cards will give you 6% for groceries and 1% cash back for everything else. You may rightly think, damn 6% that’s awesome. Do your calculations! Here is what my finances look like with three different cashback credit cards. I used Mint.com to figure out my average spending.

With those numbers, I found the Citi Card Double Cashback to be the best cashback credit card for me. NerdWallet is a good resource for finding different credit card options.

How I make $25 a month with Citi Double Cash Back Credit Card

First and foremost, I never buy anything I can’t pay off at the end of the month. I have my account automatically pay off the entire balance each month, just in case I forget, but using my Mint app it keeps me aware of my remaining balance which I pay daily. I make most of my money by buying camping gear, contacts, new shoes and all those items are only considered 1% cashback from every other credit card, but 2% back with my Citi Cash Back Credit Card which is easily the best cashback credit card for me. Yes, if you don’t buy things, your savings far outway the 2% cashback, but these are for purchases I’m going to buy anyway and that I have budgeted for. It all adds up and $15.40 is just the minimum.

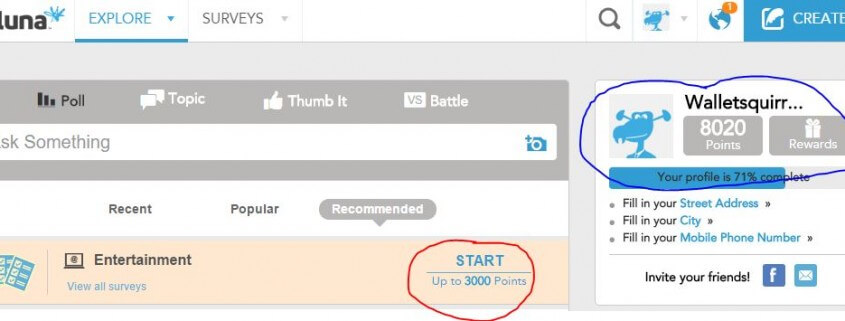

As you can see in my Income Reports, my credit card is my often my number one income producing passive income. This is on average around $25 a month. Most people pay interest on their credit cards, but if you’re smart, you can make your credit card company pay you. Here are the last couple months of additional income from what I consider the best cashback credit card.

- September, 2015 – I earned $19.86

- October, 2015 – I earned $15.14

- November, 2015 – I earned $31.79

- December, 2015 – I earned $29.40

- January, 2016 – I earned $31.42

- February, 2016 – I earned $8.06

- March, 2016 – I earned $40.49

Please know I am not paid to sponsor Citi Double Cash Back card, I just found it to be the best cashback credit card for my lifestyle.

In all, since I started with my new credit card in September. I have earned $176.05 in the last 7 months! I have earned money back from purchases I make every day. I don’t have to think about miles or blackout dates or if something is 6% or 3% today. Every purchase I make, I get 2% back. That is pretty unfreaking believable! It’s definitely better than when I used to pay $180 over the last 9 years just to have my old Wells Fargo credit card.

So now I use my credit card for EVERY purchase because I know I will get money back. I will continue to post my progress within my income reports and share exactly how this continues to pay up.

Question: Do you do use credit cards in a similiar way?

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!