10 Personal Finance Moves I Wish I Knew Before Turning 30

Today I want to talk about 10 personal finance moves I think every twenty-something should do right now. I am going to talk about what I wish I knew during and immediately after college. This article will be extremely personal, sharing examples of the mistakes I made along with a couple of right moves.

If you feel like you are following my twenty-year-old self, it is time to make some personal finance changes in your life.

My goal with this article is that anyone, young or old, learns something new to improve their own personal finances. It is your turn not to do what I did in the past!

1. Plan for your future major expenses

Boy did I fail hard on this! I was too caught up with living in the moment. I think a lot of us can be like this when we are in our twenties and it is something we should keep an eye out for.

Where did this hurt me? Purchasing a home. I should have been more aggressive in saving up for that down payment when my wife and I moved out to Colorado. Instead, I focused on materialistic items and experiences (which are important but it wasn’t the time) during our first couple of years out here.

Why did this hurt me? Prices shot up like a rocket in Denver. We could have bought our dream home five or six years ago. In the long run, this didn’t kill us but it did set behind. We ended up buying a good starter home. Which we recently we sold, making $90,000 off of it and were able to buy our dream home with that money. If we planned better we wouldn’t have had to pay the premium we did on our dream house.

If I could do it all over again, I would create a roadmap for myself with those major expenses we had coming up. For yourself, those purchases could be anything you know is coming for you such as a home, car, master’s degree, trips overseas, and so on.

With the roadmap, you should lay out how many years out you want to make the purchase and how much you need for each purchase. These measures will allow you to make a priority list as well as how much you need to put away each month for these. We just recently did this so we can buy a new car with cash in a couple of years.

2. Have an emergency fund

The emergency fund is there for when life throws you a curveball. This curveball could include something horrible happening with your health, major car expenses, something going breaking your house, or even losing your job.

Many experts believe that you should calculate three to six months’ worth of essential expenses in your emergency fund in case you lose your job.

These expenses include (according to Vanguard):

- Housing (Rent or mortgage)

- Food

- Healthcare (Medication, insurance, and so on)

- Utilities

- Transportation

- Personal Expenses

- Debt payments

But Suze Orman (another financial expert) argues against the three to six-month number. She thinks you should save past the normal recommended number. In her interview with CNBC, she states, “You need to know that you are going to be secure.” This is why she recommends having eight to twelve months’ worth of expenses saved up.

I agree with Suze. Just out of college during the Great Recession, I struggled to find work. It took me nearly eight months to find a job that would somewhat support myself. Luckily, I was able to lean on my parents during this time. I couldn’t imagine going through that without an emergency fund or without anyone to help me.

Sadly, I did not learn from this experience. I continued in my twenties without an emergency fund. If a major expense came up such as a skiing accident or car crash, I would have been screwed.

My wife and I currently have twelve months of unemployment and two major house expenses saved up for emergencies.

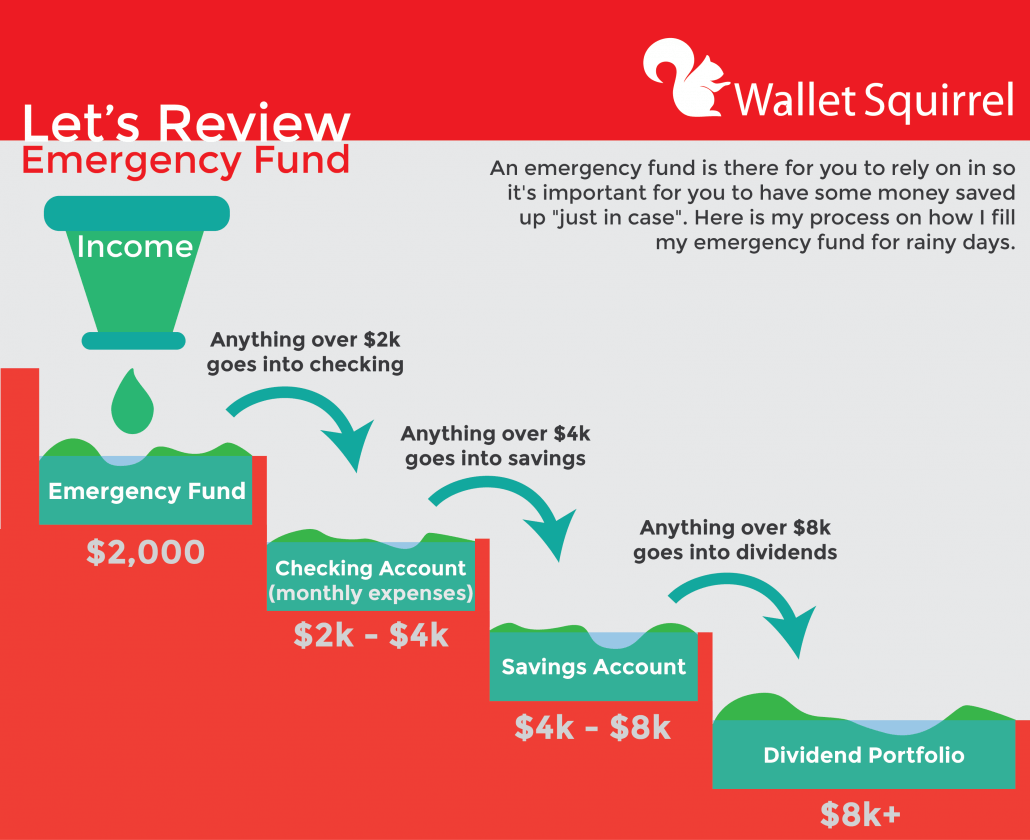

You also might enjoy reading about Andrew’s thoughts on emergency funds, My Emergency Find, Why I Keep $2,000 for Emergencies.

3. Budget

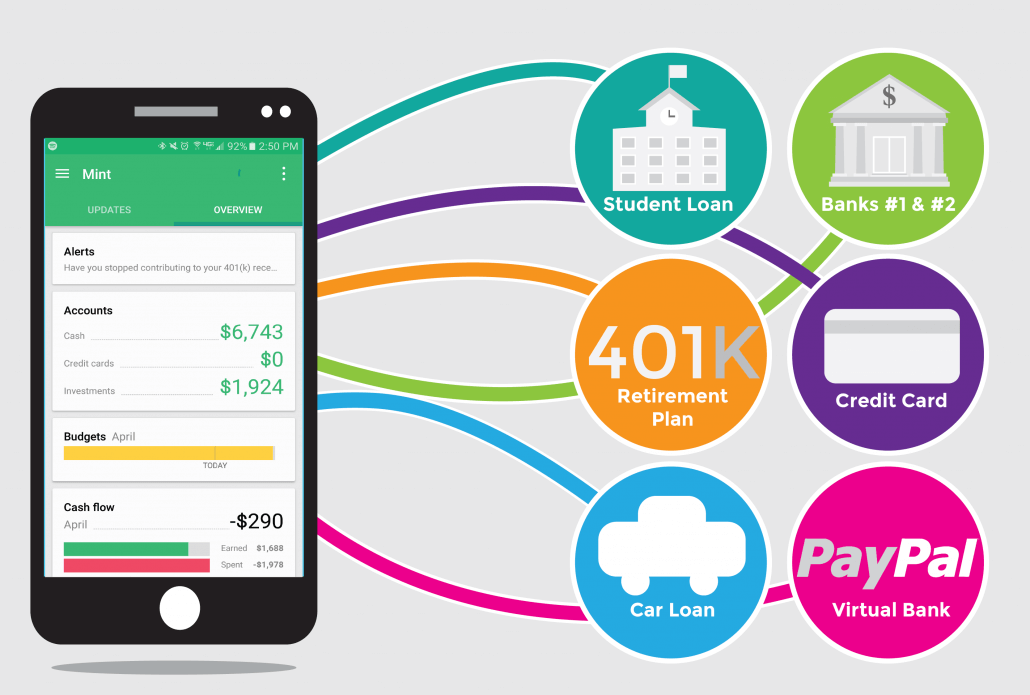

Your personal finance cannot be successful without a strong budget. Budgeting has become so easy with amazing apps such as Mint or Personal Capital. There really is no excuse for you not to be keeping a budget.

Setting up a proper budget will require way more time than what we have but we can take a 30,000-foot overview of it today. Basically, the goal is not to spend more money compared to what you make each month. You will want to layout your net income along with your monthly expenses and savings goals. Those savings goals along with any concrete monthly expenses that you cannot skip out on such as mortgage or utilities are the highest priority. From there you need to adjust those other expenses so your total does not go above your net income.

The difficult part, at least for me, is to stick to that budget (we will talk about this next). I am a foodie that lives in a foodie city, it is easy to lose focus and go over budget on the ‘Eating Out’ budget line.

I need to follow Andrew’s Peanut Butter & Jelly Theory when I am feeling the need to eat out.

4. Live within your means

It is so easy to spend on frivolous things nowadays. Man, there are some awesome materialistic things to purchase out there! You should see my shoe collection from when I worked in retail after deciding to leave landscape architecture. What a waste of money those purchases were!

This is where the budget comes in handy. You know how much you will make, save, and spend each month. Live within this budget, stay focused on this budget, and you will live within your means.

If you are feeling the urge to spend on frivolous things ask yourself this question. “Do I want or need this item?” Most of the time the answer will come back that you want the item, not need it.

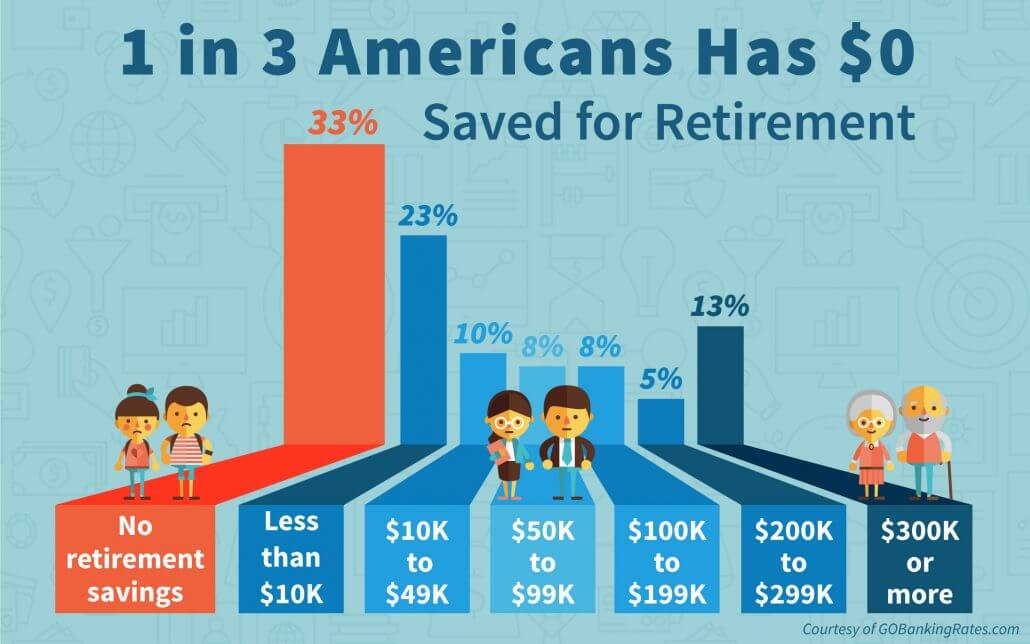

5. Start your retirement fund now!

In the first couple of years outside of college, I was the victim of immature thinking, “I’m young! Retirement is so far out! I do not need to save for that yet!”

Please do not be that person! Start saving now if you have not already! This will set you up for personal finance success in the long-term.

Fidelity says that by the time you turn 30 you should have saved up what half of your annual salary is (Investopedia). So if you are making $50,000 a year, you should have $25,000 saved up for retirement.

My wife and I did get back on track once we moved to Colorado after I got my first ‘big boy’ job and my wife got her teaching position.

Image Credit: http://time.com/money/4258451/retirement-savings-survey/

6. Start paying off those student loans

I put off paying my student loans as long as I could. Big mistake. After almost seven years, I still had that original debt plus interest. I keep seeing friends on Facebook posting about how they just paid off the last bit of their student loans. Boy, do I envy them.

Get those student loans paid off as soon as possible to free up all of that interest money you are sinking into them. That interest money you save could go towards your retirement, your financial freedom.

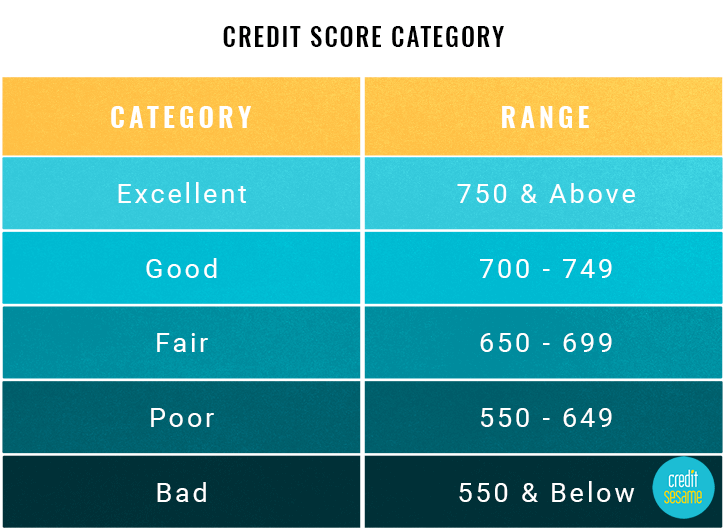

7. Build up that credit score

This is an area that I excelled at. I was able to start building up credit back in college with student loans as well as an emergency credit card. Then when my wife and I moved out to Colorado, I was able to continue to build on top of this foundation. Over the last 12 years since starting my credit building I have only missed a handful of payments and now carry no credit card debt or car debt. All of this has led me to have an exceptional score!

There are some people who argue that a credit score is pointless if you shoot to be debt-free. This is a statement I can agree with if you either plan to never own a home or you have enough cash to buy a home outright. For most of us though, our credit score will be very important for us to buy that home. My wife and I both have excellent credit scores. Because of this, we were able to lock in a 3.25% interest rate for our latest home. This will save us thousands in the long run.

Image Credit: https://www.creditsesame.com/blog/credit/credit-score-range-for-experian-transunion-equifax/

8. Patience

Have patience for the big goals. In today’s world, we are conditioned for instant satisfaction. I am very guilty of this. I used to think too short term such as, “I have to earn that money now!” Keep focused on your long-term goals which will make you happier.

Currently, my wife and I are planning to travel to France for our 10-year anniversary. I have been tempted to make purchases for our new house that would disrupt this plan. These short-term purchases would provide quick happiness but it will not be the same as the memories France will provide. I still get happiness from the Pacific Rim trip I took nearly twelve years ago.

Do not fall into this trap. Play the long game.

9. Invest

Speaking of the long game, I have started investing again with the Robinhood App. This investing is on top of our retirement fund. This is intended to earn extra money through dividend investing.

The goal is to start earning a significant amount of income off of dividends.

My personal goal is to eventually make $1,000 or more a month just off of dividends. As you can imagine, this goal will take a while to achieve because it will take a lot of dividend stock ownership to make a large impact but eventually things should start snowballing very well.

I wish I had started this back in my twenties. Just the Apple stock that I should’ve would’ve could’ve bought in college would be worth over $200,000 today.

10. Keep learning about personal finance every day

You should never stop trying to learn about personal finance. There is always something new to learn. This is why you should try to read a couple of books each year about personal finance or just finance in general.

Either way, life is boring when you are not learning new things every day. Might as well make those new things something that will get you to financial freedom sooner. You could even start a blog about the new things you learn and earn extra money explaining them to other people.

For me personally, I bought myself an Amazon Kindle. I read every night now because of that bad boy. You can even connect it with your local library (if they provide the service) to check out free ebooks. Learning something new is never wasted time.

Time to Make Your Personal Finance Moves!

All of my friends call me the old man, mainly because I am the oldest of us all. Well, it is your turn to learn from this old man and the financial mistakes he has made.

If you feel like you are making any of these mistakes, as I did, it is time for you to make a change with your personal finances. Do not waste away the time as I did, you do not get that time back. Time will just keep moving forward, leaving you behind.

If you are looking to earn some extra money and need some ideas on how to do that, then check out our Creative Ways to Make Money page. Here Andrew and I provide 70, yes 70, ways you can make money outside of your 9 to 5 job. We even test these out for you so you can easily figure out what side hustle is best for you.