Unroll Me App Review – The Best 5 Minutes for Your Email’s Inbox

Unroll Me App Review – The Best 5 Minutes for Your Email’s Inbox

Unroll Me App Review – The Best 5 Minutes for Your Email’s Inbox

This Unroll Me App Review is going to show you why you should spend 5 minutes every month using this tool to clean up your email inbox. At the end of each month, your inbox will be writing you a thank you letter.

I wonder if it will send the thank you via email or snail mail?

In a previous post, How to Pay Off Your Car Loan Faster – How I paid off $7K in 3 Months, I mentioned that I used Unroll Me app to remove advertisement distractions from my email.

Well, today we will talk about Unroll Me and really just how easy it is to use!

What is the Unroll Me App

To start off this Unroll Me app review, let’s answer a couple of questions as to what the tool does and who the company behind the tool is.

Unroll Me is a free service that allows you to easily (an understatement) unsubscribe from all of those pesky email subscriptions.

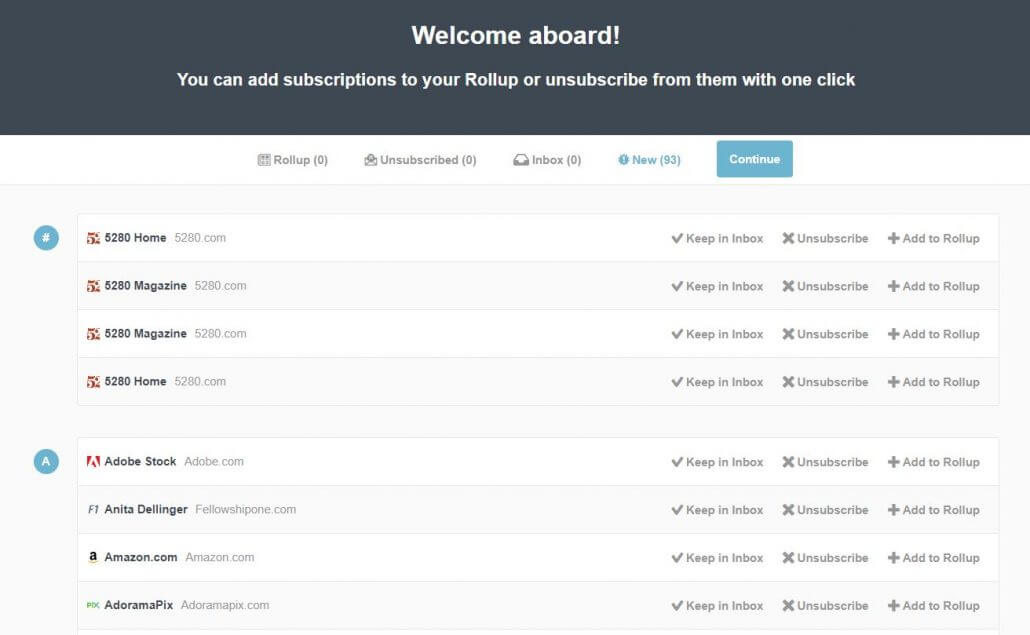

After signing in, the algorithm scans your inbox looking for e-commerce emails. Once found, the application lists them out allowing you to decide what to do with the subscription.

Who Is Unroll Me

Slice Technologies is the parent company that owns Unroll Me. They are able to make Unroll Me a free service because they collect data on the e-commerce emails you get. They use this data to, “build an anonymized market research products that analyze and track consumer trends.”

Slice says they strip all of the personal information (name, email, address, or anything else that could identify you) from the data collected. The technology behind Unroll Me is designed to determine if the email is personal or e-commerce. The algorithm completely ignores the personal emails as it searches your inbox.

You can read their blog for more information to see what the data is used for. Some of the research they post is actually pretty fascinating but I am a nerd when it comes to data.

How to Use the Unroll Me App

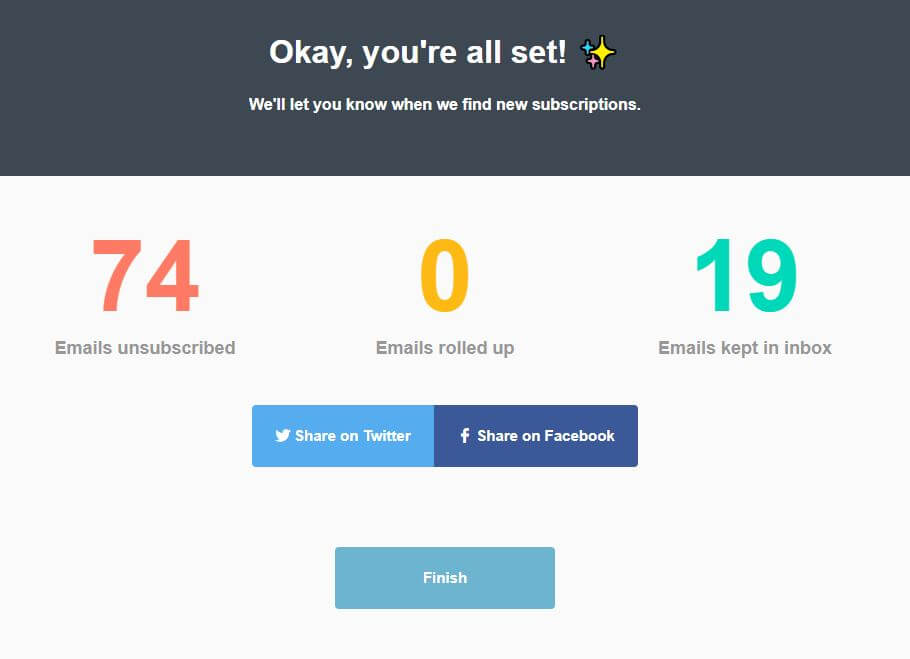

It literally took me five steps and less than five minutes of my life to unsubscribe from 74 subscriptions. I really could not believe that I was done already!

I will walk you through the steps…

- Go to Unroll Me and click on ‘Get started now’.

- Choose your email provider and click through the prompts.

- The algorithm will run. It searches through your inbox for subscriptions and then spits out a list of them.

- Click either ‘Keep in Inbox’, ‘Unsubscribe’, or ‘Add to Rollup’ (I’ll explain that later) for each subscription on the list.

- Success!

Was that not super easy? I know! Right?!?!

Oh! I mentioned I would talk about what ‘Add to Rollup’ is. The Rollup is a single email that Unroll Me will send to you at the end of the day. This email will consist of all the content from every email that is a part of the Rollup from that day. I have not personally tried this yet but they say the Rollup email is very digestible and easy to read.

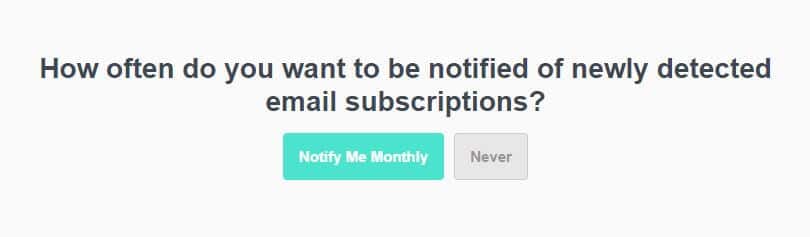

One final tip. If you would like, you can have Unroll Me notify you on a particular schedule to check for more subscriptions that were not in your inbox at the time. I decided to do the monthly reminder.

Why Unsubscribe?

We now live in a world where we are completely submerged by advertisements. The design of these advertisements is to tempt us to spend our hard-earned money on materialistic items.

These ads do not stop with commercials, billboards, or temporarily tattooed to the back of that guy’s head on the bus. Subscription emails also drown us every day with more temptation.

Using the ease of Unroll Me to unsubscribe from these emails trying to derail us from our financial goals allows us to stay focused. This is why you should unsubscribe to these emails.

Also, they are just annoying. Unsubscribing will also help keep your blood pressure down.

Final Take

To wrap up this Unroll Me app review I must say that I really enjoyed my experience with this tool to free me from those spammy email subscriptions.

Look, I understand if you are skeptical because of the data collection. You are entitled to have those feelings!

The algorithm design to strip out my personal information is what sold me to try out the Unroll Me app. I understand if you are still skeptical after hearing that. But hey! As a data guy myself, I do know this technology exists and it is pretty amazing.

Overall, this is a great free service. If you can get over the data collection thing, then I think you will enjoy it just like I did.

Unroll Me App Review – The Best 5 Minutes for Your Email’s Inbox

Unroll Me App Review – The Best 5 Minutes for Your Email’s Inbox