My Emergency Fund, Why I Keep $2,000 For Emergencies

Early last year, following the January 17th post season game of Broncos vs Steelers, I recall reading Dave Ramsey’s “Total Money Makeover”. Yes, I was desperate.

In one of the first chapters, he goes on and on (he literally can not shut up about it) about having an Emergency Fund. Yes, others have mentioned it, but for me, Dave Ramsey was the first to tell me I need to get on this. He was my first.

Here’s the thing with Emergency Funds. Everyone seems to have a different way they set these up. Davvy-Poo Ramsey talks about putting money in an envelope under your bed for safe keeping to pull out in dire emergencies. His believes that if people have an emergency fund easily accessible, they will spend it. Apparently he believes his audience has no self-control, maybe they don’t, but I went a different direction. I will always love Davvy-Poo for starting on my Emergency Fund journey, but here’s where I deviate.

My Emergency Fund

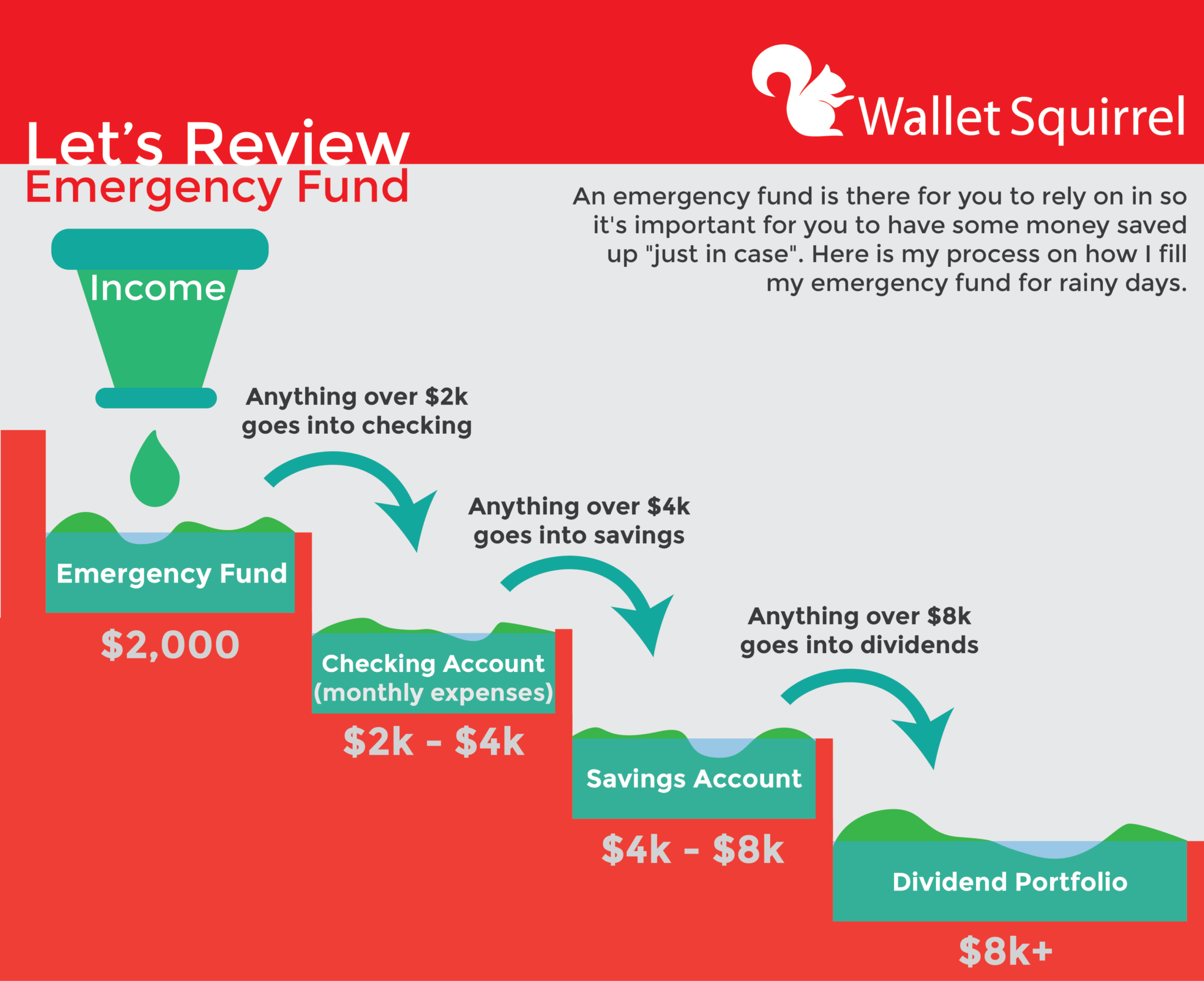

I have everything electronic. I keep $2,000 in my checking account as my “Emergency Fund” where it’s readily available. I don’t have cash hidden under my bed like National Geographic’s Doomsday Preppers (how the mighty National Geographic has fallen).

My active checking account fluctuates between $2,000 and $4,000 each month to cover my monthly expenses. At the end of the month, anything over $4,000 goes toward my savings account and that into my dividend portfolio. Here’s what I mean (infographic below):

Why I set up my Emergency Fund like this?

I have a method to my madness. Two reasons why I set up my Emergency Fund like this:

- My checking account is immediately accessible for debit withdraw if needed. PLUS my checking account gains interest (albeit a small amount) my emergency fund is large enough I make about $0.20 each month. I couldn’t do that hiding cash under my bed like a caveman.

- The biggest reason is fees. Overdraft fees are ridiculous and I’ve done that a couple times when I kept extra cash in savings. Since my Emergency Fund is the base of my checking account, if I go over my monthly expenses, it just pulls cash from my Emergency Fund which is the foundation for my checking account. No OVERDRAFT FEES EVER.

How much do you need in an Emergency Fund?

This is where a lot of people differ on how much they should have saved in an emergency fund. For me, I try to have $2,000 in my immediate emergency fund. This will cover about 1 month’s expenses for me. My emergency fund essentially gives me enough time to access my stock portfolio if needed.

In case of a legit emergency, here’s what I’d actually do

I’ve never had a legit emergency that’s affected my income (I’m young and invincible), but if I ever did, I have a plan.

- I would have immediate access to $2,000 in my checking account

- I would have immediate access to my emergency fund of $2,000 also in my checking account

- I would have semi-immediate access to my saving account which usually holds $4,000. It’s a semi-secondary emergency fund. This also makes interest =)

- That would give me time if needed to sell stocks and access my portfolio currently made up of $7,000.

With my average monthly expense of 2,000. My emergency process would cover me for 7.5 months if I could make no money what so ever. That’s pretty cool! Yes, I have friends and family that would be willing to help, but it’s important to me that I could support myself.

How do you set up your emergency fund?

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!