My Dividend Investing Strategy

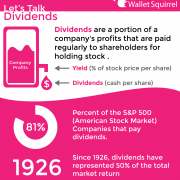

Screw chasing yields, I’ve never been into that. Usually high yields means the company is bleeding money. You’ll see some dividend investors taking large stakes in companies with over 15% yields. That’s just crazy. They’ll usually see their investment dwindle down because most companies can’t support that.

Here are the rules I follow:

1. Only invest in dividend paying stocks – I eventually want to live off the dividends my stocks produce. I would love to invest in stocks like Amazon and Adobe because I believe they have such a great strategic advantage and I’ll continue to see them do well, but they don’t produce dividends. It’s really, very sad. Just Google “if you invested in Coca-Cola in 1990” and you’ll see how a dividend producing stock will produce a better return than your average stock. It will have its annual increase PLUS it’s dividend to grow its stock. I never want to try to TIME THE MARKET selling off shares at the right time. I’m more interested in streams of income than buckets of income.

2. Windfalls should be invested in existing stock – You’re going to find yourself with certain windfalls. Sometimes it will be a large paycheck from a side hustle, sometimes it will be an inheritance or whatever the windfall it should be. You’ll want to spend that money all at once. It’s money you didn’t have before so why not use it to buy a butt load of stock? Problem is, you’ll want to buy stocks all at once and you’ll go on a spending spree. To save yourself from buying stocks you don’t know too much about, reinvest in the stocks you’re currently invested in. These are stocks you’ve vetted before, you’re better off reinvesting in them with your windfall. Whenever I receive a large paycheck ($200 is large for me) from a side hustle, I will reinvest into stocks I’m currently already in bed with.

3. Will the company be around in 50 years? – I’m slightly stealing this one from Warren Buffet, but the trick to not going crazy watching stock prices is investing in companies that will be around in 50 years. Invest in companies that you believe will succeed and ignore all the market fluctuations. That is the trick for me. I don’t pay attention to the temporary ups and down of the market. I plan to invest in the companies I believe in and take in the monthly paycheck. I always recommend you do quarterly updates with your stock/companies to make sure the CEO isn’t embezzling from the company or anything and your stock price isn’t plummeting.

4. Don’t sell your stock – You’ll be tempted but you got to know that you’ll make more if you don’t. If tempted, just look back at the graphs and you’ll see that stocks constantly fluctuate. Up and down and back again, but usually with 7% annual growth if we factor in the S&P annual growth. Just think about the people who gained so much by continuing to hold Coca-Cola through all the recessions. If you believe in the company, let it be and just keep collecting the dividends. Now if the company quits it’s dividends, then you should consider selling, but use caution. Otherwise sit back and enjoy!

Hi, I’m Andrew, a 28 year old entrepreneur who experiments earning money online and invest every dime.

You’re absolutely right, don’t go chasing yield! High yielding stocks often arise because the market has lost confidence in them and there is the perception that they could cut the dividend soon. Always look for at the payout ratio of the company. If the company is paying out more than it is making in profits, stay well clear! A good healthy and stable company usually pays out between 40% – 50% of their profits.

Great insight. I really need to start hammering into those details such as payout radios. I may need to include that into my strategy. I love the insight and look forward to other gems on your site. Thanks Money Grower UK!

This basic set of guideline look like good start. Off course, if you want, there are a ton of other metrics to decide what the good dividend payers are, as mentioned by Money Grower UK.

I do believe that a set of simple rules is a better start than no rules at all.

Good luck with your journey

AT

Thanks for visiting Amber Tree! I definitely agree I need to see more metrics, these are just my base judgements as you said.

I’m still trying to figure out if I should follow a minimum yield or not. I know some guys don’t go under 4%. Not sure I need to do that, but I’ll do some research.

-Andrew