Mint App Review: See All Your Finances At Once

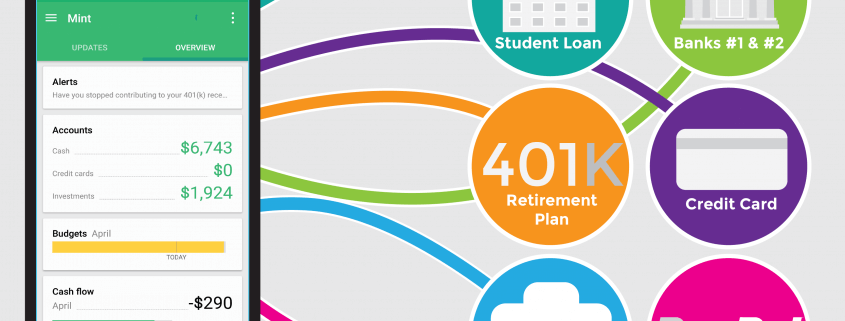

I’ve created a Mint App Review since I’ve used the Mint App for the last year and loved my experience. Using pretty infographics and my personal experience, let me share with you what Mint is, and how I use it to keep track of all expenses, income and finances. It’s pretty freaking awesome!

What is the Mint App

Mint.com was originally created in 2006 by Aaron Patzer to manage the growing number of financial intuitions people belonged to . No longer did people have ONE credit card with ONE car loan, all through ONE bank. When you wanted to check your checking account balance at your multiple banks, you had to log into each bank’s website separately, write down your balance and add everything up by yourself. Mint is an app that pulls all your balances, loan info, credit card debt from your different banks into one location (known as account aggregation if you’re a nerd). For example, my Mint App pulls my checking account balances from my three banks (Ally, Wells Fargo & a local bank here in Denver) into one screen so I can see how much I actually have. As well as pulls data from all my student loans to remind me how much I owe on each loan. It’s awesome to know that, but I cry a little each time….

In 2009, Mint was bought out by competitor Intuit (the people who make TurboTax) so you know it’s a heavily secure program.

Mint App Review: My Personal Experience For The Last Year

In January 2015, I paid off all my credit card debt and decided to take a hard look at my finances since I NEVER LOOKED AT MY FINANCES BEFORE. I was an idiot, don’t be an idiot. Mint (or any Money Manager App) is a great first step to financial independence.

My First Steps

I downloaded the Mint App on my phone in May 2015, while I simultaneously created a profile on their website, Mint.com. Doing it online seemed easier for me since it was a larger screen, but in hindsight, either way works.

Mint will first ask you to link your accounts to the app. You will have to look up your bank and enter the same passwords you would use to log into your bank from their website. It’s easy, but a little nerve wrecking since you’re submitting your bank passwords to an app. Please know, I haven’t had any issues with Mint, but always be cautious when submitting your bank info to anything. Once entered, it only pulls your balance info. Strangers can’t use the app to pull your passwords out of Mint.

I entered all my various accounts

- My 3 Bank Accounts (My Primary Bank, My Old Bank & A local bank I use for my car loan here in Denver)

- My Credit Card (my Double Cash Back Card)

- PayPal Account (My affiliate websites pays via PayPal)

- Company 401(K) Account

- Lending Club

- Car Loan

- 2 Student Loans (State & Federal)

- Robinhood App (Stock Brokerage Account)

I used to NEVER look at my bank account and just tried to spend less than what I thought I made. Yes, you read that right, I had no idea what I actually made. I never looked at my balances. I figured as long as I liked my job and spent less than I made, what does pay matter? I later discovered you can like your job AND ask for money to live. Apparently that’s a normal thing.

Spending

My absolute favorite thing about the Mint App is that it pulls your spending history from your credit card company and bank statements. So when you spend $5 on a cider from Stem Ciders (awesome cider place in Denver) Mint recognizes that as a bar and AUTOMATICALLY categorizes that $5 you spent in category “Food & Alcohol”. You can always switch categories if it messes up, but I’ve rarely had mistakes. Since you know I use my Double Cash Back Credit Card for everything, the Mint App has been perfect for tracking every expense I make and showing me in real time, how much I am spending in each category.

When I first started, I discovered I spent an exuberant amount on Fast Food (It really adds up). Once I had that data, I made a consequence decision to quit eating fast food and I SAVED SO MUCH MONEY!

Net Worth

One of the cool things that I want to include in this Mint App Review, is that calculates how much you have verse how much you owe to get your Net Worth. This is a cool feature, because when I entered all my accounts I discovered with all my student loans I’m worth less than I was when I was born. At age 29, I’m worth negative -$70,000. While that sucks, I at least now know and that’s way better than my negative -$80,000 last year. Yay for small victories. *fist pump*

Here is my Mint App Review Infographic to give you an idea of what it looks

Now here is my lovely list of Pros and Cons

Pros:

- This is a FREE App. That’s incredible since it has literally changed my life. If this turned out to cost $100 a year tomorrow, I’d pay for it. It has been instrumental in my new financial journey to see where all my money is. Like I said, I literally had no idea where my money was a year ago. This app is amazing, I just had to write a Mint App Review.

- It has a clean and easy app interface. Anything that makes your life easier through intuitive design is worth it.

- You can set up a password to see your financial data if you would like. I have a password on my overall phone so the extra security doesn’t do much, but it’s nice.

- It has multiple features such as Overall Account Balances, Budgets (They’re simple but nice), Monthly Cash Flow (Income vs How Much you spent, I use this daily) & Spending (tracks what you spend your money on).

Cons:

- One of the biggest draw backs is that sometimes it can’t reconnect with a bank account or student loan account for me. So it just shows the lasted pulled data. However usually if you just wait 4 hours doing nothing, it’ll automatically reconnects on its own. For a free app I can’t complain, but you’ll see this as one of the biggest drawbacks if you read other Mint App Reviews.

- I always say, if you want to know a company, know how a company makes money. Since the Mint App is free, it makes money by giving “advice” such as “Based your spending habits, 20% of our customers have saved money by switching car insurance” or suggesting opening an IRA with Fidelity. These are sponsored suggestions, but Mint tries to tailor them to you. What makes it tolerable, is that Mint doesn’t do this in an obtrusive way. Plus I DID think it was helpful knowing other people with the same spending habits saved money by switching car insurance companies. HA jokes on you Mint, I relooked at my car insurance and went with someone else.

My Last Word

If you take anything from this Mint App Review, it’s that I’ve had a great experience. I think if you have any kind of multiple accounts, you should have some kind of Money Manager App (I don’t care what you choose, but I like Mint). There a couple great other apps out there, but the important thing is for you to be able to see all your financial statements in one location. I check mine multiple times throughout the day. You open the app, it loads the latest information and “WAA LAY” a complete overview of your finances.

Plus for me, once I see any kind of credit card debt from my Mint Profile, I instinctively open my Citi Card app and pay off my credit card right away. It’s a cool feeling to start every day knowing your credit card debt free! Maybe I’m weird, but I can live with that.

What do you think of this Mint App Review? Do you use Mint? If not, what Money Manager App do you use?

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

Really comprehensive overview. I have been using Mint but I have not had as much luck as you with it. My salary seems to be misplaced quite often and it constantly misplaces my spending habits. At the end of the day though I get to see my income and expenses to see how I am doing. I will continue to use the app as it is free but I probably will rely more on my excel spreadsheet for budgeting and expense tracking 🙂

My impression is that Mint is best used for budgeting, and Personal Capital is best used for investing. I use Personal Capital, and though it isn’t perfect, it’s a good high level picture.

Those are also some issues I hear with people. Other recommendations besides Mint I heard are “You Need A Budget & Personal Capital.

I started out with Mint and while I’ve heard alot of these complaints. I’ve just been so happy with it, maybe its the way I have all my finance processes set up, it works more aligned with the way I do finances or I just have low expectations, but so far it’s been awesome for me. Then again, maybe because it’s free. =P

I also use spreadsheets for everything Wallet Squirrel related and Mint for all my full-time work/life stuff. Spreadsheets are pretty awesome!

I’ve been tempted to try Personal Capital out for awhile since it great for investors. The only issue I have with it, is that it won’t sync with Robinhood (my broker) and thus seems like it would be alot like Mint otherwise. Mint doesn’t sync with Robinhodo either.

I was just doing a bit more research and apparently you can add “offline accounts” with Personal Capital. Is this how you would do it? It would require more manual work (I hate manual work) to keep your broker account included.

PS. Mike H. you comment all the time (THANK YOU BY THE WAY) do you have a website or blog?

No problem. As far as I can tell, you and I are about the same age, with about the same investing expertise and earn about the same invest-able income, so I use you as a benchmark (for what it’s worth, I’m a little ways ahead of you in terms of dividends/year, but you seem like a better investor).

Nope, I don’t have a website. I know diddly squat about building a website, but it’s something I’d be open to if there’s a quick template-driven way to do it.

Actually, my expertise centers around pensions and large-scale defined contribution plan design/administration. So I’m a bit on the edge of what the FIRE community would find useful.

That’s awesome. I appreciate the kind words and stoked you’re ahead of the game with your dividends/year! I just invest in companies that I beleive have a compeditive edge against the industry. So far it’s worked out.

I would totally read your blog if you started one. With WordPress it’s super easy to set one up now a days and doesn’t take much money. I think I pay about $120 a year for my server and I paid around $55 for my WordPress Theme. It’s pretty reasonable. It’s just a great way to track my progress and I WOULD LOVE to do this full time. Something to consider.

I don’t know to much about Pensions and Large-Scale defined contribution plans but that sounds so freaking cool! I’ve considered going back to school for finance to learn more about this, but I’m currently using Wallet Squirrel to focus on learning the aspects of Finance that I want to learn. Now, though Pensions sounds interesting….

PS. What’s the FIRE community? Does it involve fireman parties? I don’t know about this, but if it’s something like “Financial Independence, Retire Early” that sounds like something I would like to learn more about. =P