Why I Just Invested In The Dividend Stock, Iron Mountain

My goal on Wallet Squirrel is to find new ways to earn extra money and then invest what I make into my stock portfolio of dividend stocks. These dividend stocks are key, because my goal is to invest in enough dividend producing stocks that they may replace my current income. To do this, I need to invest more and my latest stock is Iron Mountain Incorporated, stock ticker (IRM).

Let me introduce Iron Mountain (IRM)

If you’re not familiar with this company, let’s hit a brief overview. Iron Mountain is a storage company, storing physical records as well as data centers for companies.

Physical Storage Items

The types of physical storage vary greatly from anything you could imagine a company wanting to store. These could be HR files, to legal, to extra storage. In fact, 95% of the Fortune 1000 uses Iron Mountain. They also mention a range of geological samples to fine art as storage capabilities they offer. These are storied in over 1,400 facilities, covering 87.5 million square feet of storage around the world, including a legit underground vault.

Digital Storage Items

Iron Mountain also has extensive digital storage systems that allow companies to electronically back up their systems. These are both in the form of storing disk drives of important systems, as well as their “Iron Cloud” as their enterprise cloud-storage platform. As cybercrime continues to become a bigger and bigger problem, companies are paying big money to have several working copies of their systems backed up. They expect their cloud storage to produce 7% of their total revenue in 2020. The total revenue for 2017 was 3.8 billion.

Why I Personally Like Iron Mountain

Reoccurring Revenue

I’m a huge fan of companies with reoccurring revenue because it’s dependable. Iron Mountain as a storage company holds company records for quite a long time. In fact, they’re still holding onto 50% of the boxes that were stored in their facilities over 15 years. As more legislature mandates companies to store physical copies for longer and longer. Iron Mountain is an ideal, service for these needs. Plus as their cloud business continues to grow, people continue to pay large contracts for years at a time to continue and hold their back up needs.

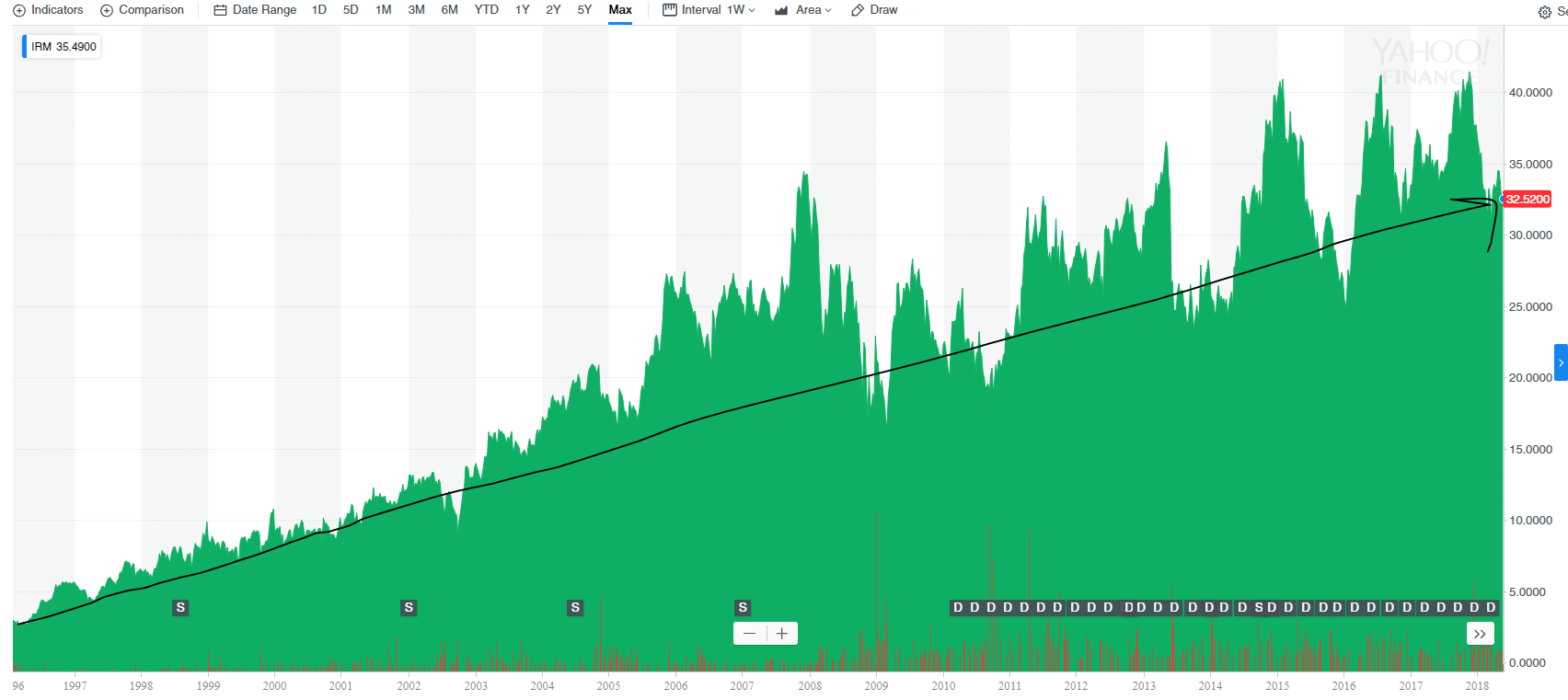

Technical Analysis

Technical Analysis is looking at their past performance to indicate how they will do in the future. Of course, past performance doesn’t guarantee future results, but I like to see that a company is consistently doing well. I usually do this by looking at their stock price over the max course of their life. Here is the trending graph for Iron Mountain (IRM). I typically like to see this chart shoot up and to the right. Despite some bumps, it continues to move in that direction.

Low Beta

I like safe stocks, so I always look at a stock’s beta. The beta will tell me how likely the stock price will swing with a market correction, or the overall stock market drops/raises. If the Beta is 1, the stock will rise and lower pretty equally with the overall market. If the Beta is over 1, it’ll swing more rapidly in either direction. The lower the Beta under 1, the less likely the stock will be as affected by the overall market. The beta for Iron Mountain is 0.54, meaning it’s relatively safe during large market swings. This is because most of Iron Mountain contracts are locked in for long periods of time, and short-term swings won’t affect them as much. I love that!

Dividend Rate – 7.01%

Yes, that’s right. It’s a high dividend, even for a REIT. I would be concerned if they didn’t have so many facilities around the world locked in long term contracts. A quarterly dividend of 7.01% is pretty great!

Diversified Revenue

For all of their storage capabilities for both physical and digital storage, no one customer makes up more than 1% of their revenue. That means even if one customer for some reason pulls out, it isn’t a big hit on their overall revenue.

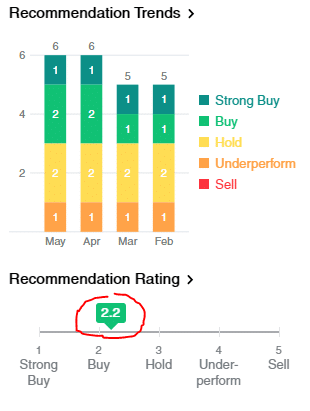

Experts Also Consider IRM a Buy

Before I make a purchase, even after all of my data and research, I always do a double check to see what the “professionals” are doing with this stock. If they suggest “buy” then I know they are aligned with my research. If they say “sell” then I dig a little deeper to see what they are looking at, that I may have missed. Just because they say “sell” doesn’t mean I won’t buy, I just want to make sure I know everything before investing. In the case of Iron Mountain, the “experts” say “buy” via Yahoo Finance.

Iron Mountain isn’t all Sunshine & Rainbows

The biggest thing against Iron Mountain is their debt. Similar to most REITs, they have a considerable amount of debt that has helped them grow. They pay for this debt with a portion of the revenue made through their storage leasing in these facilities both physical and digital storage. At the end of 2017, their debt was $7.1 billion, which is a lot. However it’s still under the $10.9 billion in total assets. Plus most REITs have a sizeable chunk of debt. So this is something I’ll continue to monitor.

Conclusion

In the end, I ended up purchasing 2 shares of IRM at $32.73 per share. Why so little? Mainly because I’m broke, but try to buy stock whenever I can. I’ll continue to buy more of IRM as cash becomes available because so far, I’m a fan of the stock.

Do you own any IRM?

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!

Hmmm I never heard of this company before but you have prompted me to do some research. Interesting stock for sure, I might consider it for June 🙂

With a PE ratio of over 50 Iron Mountain seems kind of high priced doesn’t it?

They’ve converted to a REIT in 2014 I believe. So PE ratio isn’t really the right metric to check it I think.

Plus I’ve learned P/E for REITs isn’t a great indicator.

I definitely like it. =)

You and Mr. Robot are correct. To evaluate a REIT, I start at Funds from Operations (FFO), which I learned from the very-apropos Motley Fool article “Why P/E Ratios Are Useless When Evaluating a REIT” and Investopedia’s “How to Assess a Real Estate Investment Trust (REIT)”

Iron Mountain seems interesting – disclaimer: I haven’t researched them beyond your article. Their reliance on cloud storage for 7% of revenue is a little dubious to me: barriers to entry for cloud storage are basically nil, so competition is going to be abundant, and likely without IRM’s overhead built into the pricing of said service. Doesn’t mean that they can’t achieve it, but it does suggest that they might be planning on making cloud/physical storage a bundled service, like what f***ing Comcast does.

Hey Mike H!

As always, I love you comments. That is a really good point I didn’t consider the competition out there. Yet bundling totally makes sense, especially since they’re already serving 95% of the Fortune 1,000 companies for physical storage. It’s an easy reach to add the tag line “we can also do this”. Much like f***ing Comcast, lol. I absolutely dislike Comcast too. =)

Thanks for commenting,

Andrew