First Time Home Buyer? Here is What You Should Know Before You Buy!

Last week I had a friend on Facebook ask a really important question for anyone that is going to be a first time home buyer.

She asked, “Things you wish people would’ve told you before you bought your first house.”

The responses she received were really good and I thought were also very important for any of you considering to buy your first house.

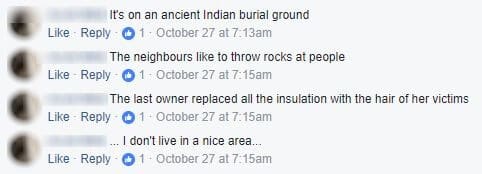

Some responses were not as helpful but were just hilarious.

So let’s dive into some of the best responses.

Inspect Expensive Appliances and Other House Features

Here is the scenario.

You just move into your beautiful new home after paying all of those expensive closing fees. Your savings account is basically at zero now. Dinner time comes so you venture into the kitchen to grab something out of the fridge to only find everything lukewarm.

The fridge has already burnt out.

While you are inspecting the house, you should consider the age of the furnace, appliances, hot water heater, roof, and windows. All of these items can create a major expense at some point in the homes life but we do not want them happening right away when you are already recovering from some major bills.

Now, sadly, bad luck does hit so not everyone will be able to avoid it but increase your luck by not buying a home with a hot water heater that is 15 years old.

Do NOT Get Hung Up on Cosmetics

Many people get overly worried about the small things in a house.

Do not fall into this trap.

The paint in the living room can be changed. The landscaping can be updated. Floors can be replaced. And cabinets can be refinished.

All of these projects will cost money but can be done in phases as you save up for each one, not going into more debt. You will have enough of that as a first time home buyer.

Be Picky About What You CANNOT Change

To follow up on the little things you should not get hung up on as a first time home buyer, you should get hung up on the things you CANNOT change.

These include the location, house layout, neighbors, lot size, and so on. Once you buy the house, these things are yours now. There is no going back until you sell the house.

Be very observant and picky about anything you cannot change to the home. Do your research about what you want in these things.

For my wife and I, location was a big deal. We did not want to live in the cookie cutter suburbs. We wanted to be 15 minutes from downtown, 15 minutes from the mountains, and close to work. Also, we wanted to be close to awesome restaurants.

The only thing we really did not get from our house was a basement but that has been surprisingly nice not to have (less to maintain).

Observe the Area at All Times

When my wife and I were in the process of buying our home, we made sure that we drove by at all times of the days. We even stopped, rolled down the windows, and listened to the neighborhood sounds.

I suggest you do the same thing. Even after you are under contract (you usually can still call it off).

We actually saw our future neighbor fighting with his son during one of the visits. We talked with another neighbor to find out that it was a one-off thing. Both were just having a bad day.

This could have gone the other way, were they fought every day. That would not be fun to live next to.

Check for Cell Service

With younger generations ditching landlines, it is crucial for any first time home buyer to make sure they get cell service in all parts of the new house.

It would really suck if you cannot lay in bed talking to your best friend who lives in Maine on the phone.

While visiting your future home for the first time make sure to check how many bars you have while walking from room to room.

If things are looking bad, there are ways around bad reception. Check with your cell provider to see if they will give you a signal booster.

Really Plan out Your Budget

When you are looking to become a first time home buyer, you really need to know your finances in and out. This is when having an awesome budget comes into play.

Need help making a budget? Check out Mint. To me, this is the best budgeting application out there. Period.

Go ahead and download Mint to create your budget.

You will want to account for every expense to figure out how much of a mortgage payment you can afford. It is best to even do some research on how much your utilities will be for your future home.

To start you off, see if you are making any of these bad spending habits that could be killing your budget.

Landscaping

Landscaping is something that can be easily changed. Do not believe me? Check out what I was able to accomplish this past Spring.

There are things you need to inspect though because somethings will be harder to change.

Is there a sprinkler system? If so, inspect the valves for leaks. Check for soggy spots in the yard, this may signal a leak in the piping.

How is the grading around the house? Does it flow away from the house or towards the house? Look beyond your future property to make sure water will not be flowing towards your house.

Lastly, look up. What is the condition of the trees around the house? Are they trees healthy or are they going to fall on the house in the next storm?

Also, make sure those trees are not going to be super messy trees for you. Some varieties will drop pods or seeds all times of the year. That is a lot of maintenance!

See if you qualify for First-Time Buyers Assistance

There are a lot of grants for first time home buyers. These grants are meant to help people buying their first home a lot easier by providing assistance with the down payment.

Upfront, this sounds amazing but might not be right for you.

Talk with your lender to hear about all the options. Be aware of particular clauses that might make the loan unfavorable.

For my wife and I, we only qualified for these grants if the interest rate was higher or we carried the private mortgage insurance (PMI) throughout the entirety of the loan.

PMI

This brings me to the last thing to watch out for, private mortgage insurance.

Watch out for this insurance that usually adds on about $100 to your monthly mortgage payment.

You will need to pay this insurance on conventional loans until you reach 20% of your loan paid off.

Other loans types such as the FHA loan will require you to carry the insurance for the entire lifespan of the loan.

Now you can always refinance your loan to get out of it, but that could cost you several thousand dollars to complete.

Conclusion

Buying a home for the first time can seem like a very daunting task but it does not have to be if you plan properly. Go into buying a home with your finances in line, a plan with what you are looking for, and your vigilant eyes on.

Now there are so many other things to watch out for in a home such as a possum dean under the deck but these are big ones that were most talked about.

What advice would you give to a first time home buyer?

Looking for some more money to help support projects at your new home? Well, check out our Ways to Make Money page. Here we walk through some side hustles we have personally tried out so you can find one that works best for you.

I closed on my first house a little over a year ago! It was an experience, let me tell you! I learned a lot! I did pay an inspector to come look at the house with me once I found one I was serious about. It took months before I found one we liked! The inspector suggested that we write down the serial numbers to all the appliances, that way they can’t swap out anything in the mean time. It is in a great neighborhood and pretty much move in ready, all we did was paint a few rooms and rip out some carpet, the hard wood floors are great!

Always throw this into your budget and account for any closing costs or anything else that might be thrown your way!

Bug you lender and real estate agent all the time, they may get sick of you, but don’t be afraid to ask questions, because you will have many!

I am paying PMI, I don’t think they tell you, but you can get rid of it when you have 20% equity into the house.(this may be loan dependent, I’m not sure)

I qualified for a Rural Development loan, I had to put 0% down!

Great post as usual guys!

Your post already talks about when you can get rid of the PMI at 20% equity!

Bought my second house and moved this year. It doesn’t get any easier. Regarding cell service, my new house is really bad. I could not have a phone conversation with anyone. I kept dropping out and they couldn’t hear me. I found a relatively new feature on my smart phone named Wi-Fi calling. When I am in my house, the phone detects poor cell service and switches to my Wi-Fi. When I leave the house it switches to my carriers cell service. The call quality in my house over the Wi-Fi option is excellent. It save me. Tom

Haha, I did but you still helped me out still. I was lost for words when writing that sentence and could not pull the word equity out of my brain. Thanks!

Good call about budgeting for closing cost or whatever unexpected expenses there are. We are in a seller’s market here in Denver. They can dictate whatever they want. Even though it sucks, it actually makes the purchasing process easier. It’s either you take the house the way it is or we will move on to the ten other buyers waiting in line behind you.

Thanks for reading Hayes! Have a great day!

Nice Tom! I’ll have to look for that feature on my phone. What phone do you have? My initial guess is the Pixel?

– Adam

I have an Iphone 7. This is a relatively unknown feature, but most newer phones have it. When I bought the 7 early this summer, the people at the Apple store didn’t really know much about wi-fi calling. I didn’t buy the phone there, got a better deal at another store. Believe me, I’m not into gadgets either. Just badly needed a solution and a newer phone anyway so started researching it and found it. Tom

I liked that you mentioned observing the area at all times. I think that this is a great way to kind of feel out the area that you want to be living in. My sister is buying a house soon and I think that this is something she would enjoy doing, just so that she’s extra sure when she finally purchases a home.

I agree with Gerty. Seeing how active the area your potential home in can really help you feel out if you’ll want to live there. My friend will be buying her first home very soon, so I think that this could really help her find a great home. Is there anything else she should keep in mind.

My wife and I are thinking about buying our first home later this year, so thanks for sharing this. I like your point about checking the landscaping for things like a working sprinkler system. We’ll be sure to inspect inside and outside of the house to make sure we are getting a fair deal.

Thanks for pointing out that you need to really solidify your budget. My husband and I want to buy a house that’s near his brother’s. Your tips will help us buy a home.

It got me when you suggested checking the things that cannot be replaced, like the sprinkler system valves, the grading of the house, and condition of the trees. I have to agree with you though since decors can be changed whenever the homeowner feels like it while the others can be costly. I will mention this to a friend who wants to buy a house. He needs to be careful since he tends to fall in love easily with a house.

I wanted to thank you for this advice for buying a home. I’m glad you mentioned that you shouldn’t be too hung up on the small details since those things can change, like the paint in the living room. That said, it also sounds important to know what you are willing to handle while you save up money for those home changing projects.