How Much Security Does Social Security Provide?

Background

Forms of social security have long existed to defend against the uncertainties of illness, unemployment, and old age. In the earliest versions, nomadic tribes pitched in to help those struggling in their community. Later versions included guilds of craftsmen or merchants where membership meant benefits in case of illness or disability and financial help to families upon the death of a member. As civilization progressed, so did the complexity of the system. When communities were small and tight-knit, distributing resources to those in need was straightforward and manageable. The incredible size and complexity of modern America require a more elaborate system to service the 65 million recipients of over $1 trillion annually.

Social Security, as Americans know, it began with President Roosevelt in 1935 in response to the impoverishment of the Great Depression. The severe suffering of millions not fortunate enough to maintain employment, receive support from company pensions or have the ability to rely on personal resources. Set in motion the governmental administration of income to retirees and the disabled.

Notable, however, was the limited nature of the system. It was designed as a safety net, and not a complete retirement package. This differs from other countries where a combination of company and government pensions creates a normal full retirement income. Instead, Social Security income in the United States is meant to be a supplement to other resources and not the sole source of income. Historically, social security benefits only represent 33% of income for elderly recipients.

“…Social Security was not designed to be the sole source of income in retirement…” -SSA.gov

Pressure on the System

Most young people joke (or don’t joke) about not expecting to receive social security themselves.

The system works by the contributions from the current workforce paying for the benefits distributed to those retirees. The system is criticized for more money leaving than coming in, particularly due to the size of the baby boomer generation and their pull on resources relative to the size of the modern-day workforce. This is no secret and the issue has developed over decades. As projections change for the inflows and outflows of resources, so do the rules for receiving benefits for new retirees to keep the balance and ensure funds are available in the future.

Challenges to the social security system:

- Life expectancy for a 65-year-old retiree has increased from 14 years in 1940 to 20 years in 2020

- Americans over age 65 will increase from 56 million in 2020 to 78 million by 2035

- Exhaustion of Social Security trust fund reserves projected by 2037 and subsequent incoming taxes expected to cover 76% of scheduled benefits

Social Security policy responses:

- Gradual increase in age to receive full retirement benefits from 65 to 67

- New legislation eventually needed to address shortfalls

- Possible combination of increase in tax rate of contribution, increased taxability of benefits or reduced benefit calculations

Will you receive benefits, and how much?

The statistics above are foreboding. Younger generations’ pessimism to ever see their share of benefits back is warranted. This said, with adjustments to the system and new funds perpetually flowing in, benefits will be available in the future (even if you are decades away from retirement), just perhaps not as early or robust as desired.

The amount you can expect to receive in retirement is based on the amount you contribute during your working years. Specifically, a calculation is made looking at your highest 35 years of earnings (up to a current ceiling of $142,800), to create a “primary insurance amount”, which is then indexed for inflation. Follow here for an estimate calculator. As of June 2020, the average monthly benefit for retired workers was $1,514.

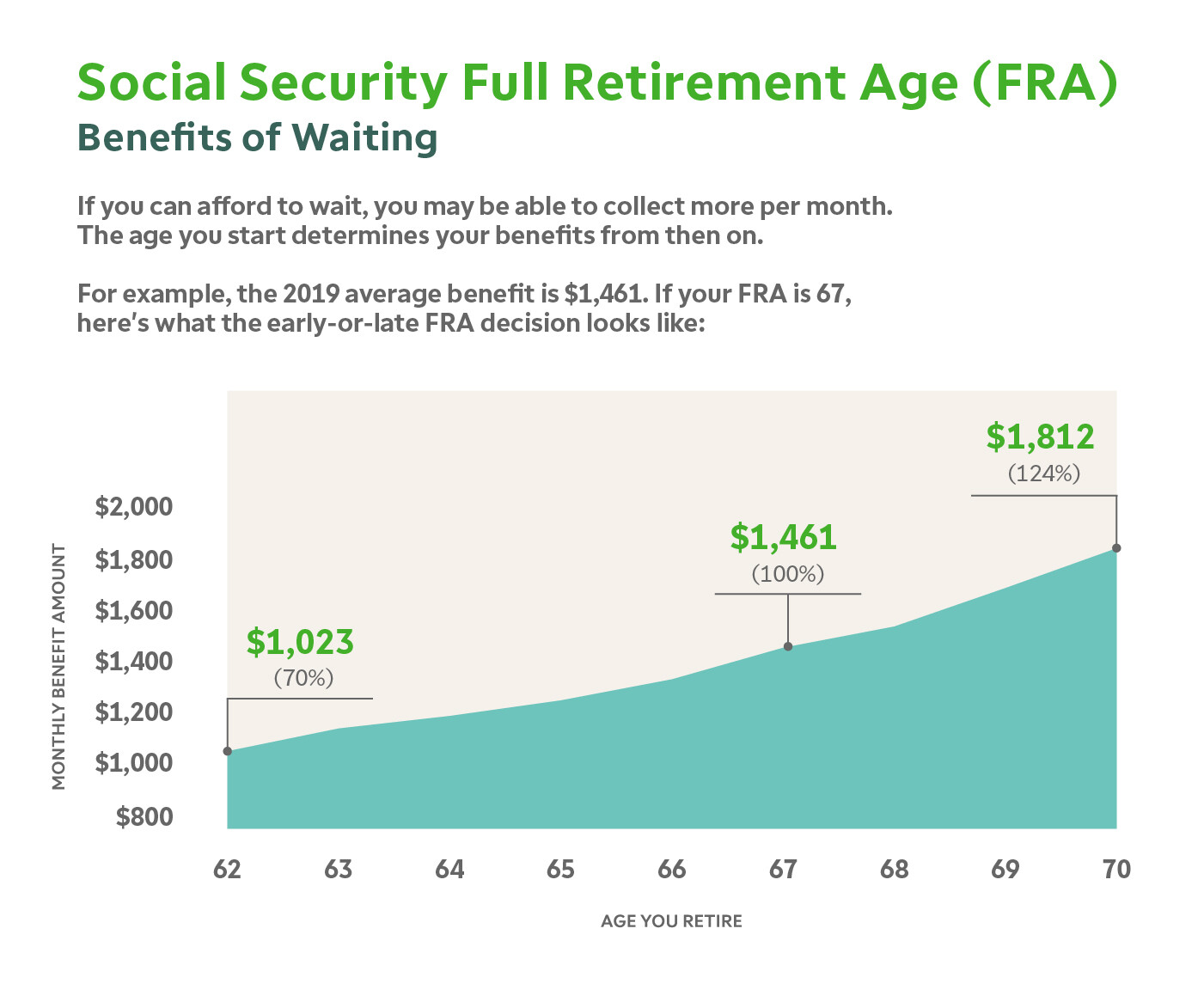

A further calculation is made depending on when you decide to start receiving benefits. The Social Security Administration sets a “full retirement age” as a baseline for when to start receiving benefits. A person can begin taking benefits earlier but is only eligible to receive a reduced amount, or they can wait until after the “full retirement age” to start benefits and receive an even greater amount. For those born after 1960, the full retirement age is deemed to be 67.

Social Security Retirement Age – Benefits of Waiting via https://tickertape.tdameritrade.com/retirement/social-security-retirement-age-chart-fra-15800

What About Taxes?

A monthly check from the Social Security Administration could go a long way to cover costs of living if they were received free and clear of any taxes. However, subject to other sources of income, Social Security income can be largely subject to income taxes just like a regular paycheck. This is based on your adjusted gross income, nontaxable interest, and the size of your social security benefits. As a single person, if other sources of income + 1/2 of your Social Security benefits is greater than $25,000 ($32,000 married filing joint), taxes are thrown into the equation.

One Piece to the Puzzle

The takeaway is to approach retirement with optimism, but active involvement. Social Security will continue to stay around, but benefits will not be enough for a comfortable lifestyle.

With current statistics, an average monthly benefit of $1,514 equates to an $18k annual income.

Prudent planning would include other investments to create monthly income. If planning on retirement after age 60, a mixture of traditional company-sponsored retirement plans such as the 401k and 403b are a great start, as well as IRAs. If considering earlier retirement and/or earlier needs of capital, an allocation should be made to non-retirement accounts as well to ensure no tax penalties and accessibility to funds when needed to make the dreams come true.

Social Security data references:

- https://www.ssa.gov/policy/docs/ssb/v68n2/v68n2p1.html#:~:text=It%20should%20be%20noted%20at,discussed%20in%20the%20prior%20section

- https://www.ssa.gov/history/briefhistory3.html

- SSA Social Security Fact Sheet

The commentary on this article reflects the personal opinions, viewpoints and analyses of Breakaway Capital Advisors LLC, and should not be regarded as a description of advisory services provided by Breakaway Capital Advisors LLC or performance returns of any Breakaway Capital Advisors LLC investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Cyrus received his Bachelor’s in finance & accounting from the University of Denver and a Master’s in finance & risk management from the University of Colorado Denver before obtaining the CFP® designation. Cyrus spent time in the industry at a fortune 100 financial services firm prior to starting Breakaway Capital Advisors where his experience inspired him to seek a more equitable solution for clients needing help planning around and managing money.