10 Things To Do If You Lost Your Job & Need Money Now

We all have the stress nightmare where your boss comes out of the blue and says “You’re fired”. That’s it and we spend the rest of the night in a panic. The problem is if it did actually ever happen, most of us don’t have a plan in case we do get fired.

Whether you’re thinking about losing your job due to stress, COVID-19, or any slew of reasons, it helps to have a plan. To lay out a blueprint, if this ever happened to me, here are 10 things to do if you lost your job and need money now.

Immediately Start

First, Take A Breath

It seems silly and not productive, but taking a breath is essential. People are let go or fired for a number of reasons and it’s not always a reflection of you or your work. Some things are just out of your control. Take an hour or take a day to let is sink it so it doesn’t consume you later.

1. Review Your Finances

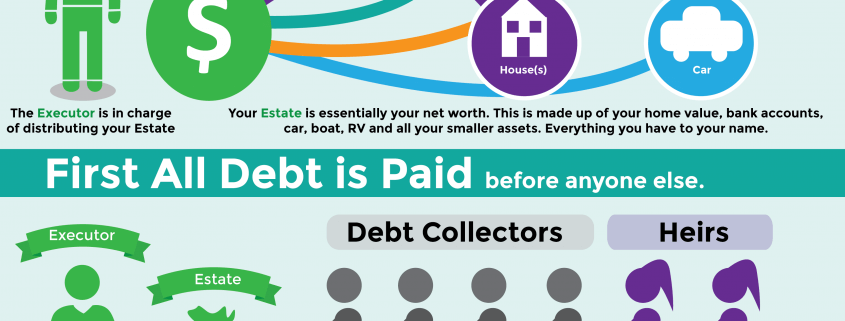

Take a look at all the money you currently have. I personally use Mint to see all my bank accounts, credit card debt, and student loans all at once. You don’t need this, but make a list of every dollar in your possession. Look over your finances and get a feeling of how long you’ll last without a paycheck. It may not be pretty, but it’s something you absolutely need to know.

Know how much you need to spend each month, here is an example monthly breakdown:

- Apartment & Utilities ($XX)

- Food ($XX)

- Car Insurance ($XX)

- Cell Phone ($XX)

- Internet ($XX)

- Misc. ($XX)

PS. Also, consider health insurance as a cost. In most cases, your old employer would have provided this for you, but you need to talk to your HR to see how long this lasts. You may need to pick up supplemental health insurance until you get a new job.

Hopefully, you have some sort of Emergency Fund you can access if you lose your job. Your emergency fund will help cover rent/mortgage, food, and those expenses your paycheck normally covers. Most emergency funds should cover 4-6 months of expenses. If you don’t have an emergency fund, start saving up now but the following tips can still help.

I personally have an emergency fund I keep in a savings account, that will last me around 6-7 months. I know many people don’t have that. It took me 5 years to build. However it’s one of the best things I’ve ever done because it provides a mental safety net.

Let’s continue though as if you have $0 emergency funds.

Save All The Money You Can

2. Cancel Frivolous Monthly Subscriptions & Purchases

If you just lost your job, you shouldn’t be watching Netflix, Hulu, or listening to Spotify. If you have any kind of subscription services that cost money regularly, you should cancel these until you get a job again. It may feel like a nice break watching Netflix between job applications, but you need to save all the money you can until you’re working again. If you feel this is too hard to do, consider using your parent’s or friend’s account temporarily to save money.

Needless to say, don’t make any crazy purchases thinking you’ll get a job next week when “you really try”. Until you have a signed contract with a company, I’d suggest avoiding the mall and any kind of gift ideas. If you can, cancel any flights, trips, running races, etc. Plus always ask if you can get your money back. It may not always be possible, but every little bit helps!

For me personally, I would cancel my gym membership ($73/mo.), cancel my Spotify account ($10/mo.) since there is a free version, and I’d probably quit investing in my brokerage account ($200/mo.) until I have a steady paycheck.

3. Ask to Defer Payments

During hard economic times, many companies are willing to work with you because they prefer late payments to nothing at all. Student loan services are often willing to reconsolidate loans or defer payments. Banks are sometimes willing to defer a mortgage payment or at least help with options. It often just takes a call and asks.

For me personally, I would call my student loan companies and ask to defer my payments until I get another job. That would save me $537/mo.

4. Budget and Eat At Home A Lot

One of the biggest ways people spend money is food and eating out. If you just lost your job, avoid going out to eat with friends (unless it’s a networking thing) or ordering in. It may not be sexy, but cold cut sandwiches, peanut butter and jelly sandwiches, and ramen got you through the dark years, it will again.

You know what you can cut to save money and you’ll see instant savings in your bank account. Remember one of the easiest ways of having more money, is not spending it!

One of the most popular tricks people use to limit spending is paying for food only with cash. The act of seeing the money physically leaving your wallet and the empty vacuum it creates, helps people be more selective with their purchases. I personally use credit cards because I enjoy the cash back, but I can’t argue with the success physical money has in limiting spending.

Start the Job Search

5. File For Unemployment

If you lost your job and actively seeking new work, you can file for unemployment. It varies state by state, but essentially you would file a claim with the Department for Labor and Employment and prove you’re actively looking for work every 2 weeks (depending on your state). Unemployment benefits will pay you a portion (likely small) of your previous salary. This is meant to help lessen the negative impact that unemployment has on the economy. It won’t be a glamorous option and you’ll meet some interesting people, but it will help.

6. Update Resume & Social Media Profiles

This is the time to update your resume with the latest accomplishments, promotions, volunteer efforts, jobs, references, etc. As you start the job search you want to make yourself look as good as possible. However, this isn’t limited to your resume. You should be updating your LinkedIn, Facebook, etc with the latest info so you’re casting a wider net for employers.

Don’t worry too much about how your resume looks, just that the information sounds grammatically correct and makes you look good! Many companies will force to you to copy all the exact same information into their often terrible online web forms. On the bright side, if your LinkedIn is up-to-date, you can always use their “one-click apply” to jobs posted on their site.

YouTube is also a great resource if you use it to better yourself now that you have free time. There are great exercise tutorials on YouTube, classes on coding (if you’re into high-paying jobs), and even brush up on software like Microsoft Excel. Use this opportunity to start a new job with a new skill set!

7. Tell Everyone You Know You’re Looking For A Great Job

It may feel embarrassing for you to tell anyone that you’re jobless. It’s a very vulnerable situation where you feel like something is wrong with you. There isn’t! It’s a normal thing, and job searching is a $200 billion dollar industry. People are constantly moving and switching jobs, you are now just one of them.

In most cases, when you tell people that you’re looking for a job, they want to help! They’ll often share new job openings they’ve heard of, or perhaps make recommendations to people they know in your industry. The fact is your chances of finding a new job dramatically increase when more people are on your team, helping you get a job.

I personally will change my LinkedIn page to “Looking for an Awesome Opportunity” and email my friends and family that I’m actively looking. More often than not, they will understand (because we’ve all been there before) and they’ll want to help!

Some of the best job search tips I’ve ever heard:

- I recommend LinkedIn, Google Jobs, and Indeed for job postings. This is what most people use. I often avoid Craigslist.

- Always use Glassdoor and read company reviews on how they treat their employees.

- If you like a company, stalk their employees on LinkedIn to see if they went to the same schools you attended, clubs you’re in or charities you participate in. Ask them what it’s like there and ask for advice.

- Have a salary in mind, knowing how much you need to cover all your expenses.

Make Money Fast When Your Jobless

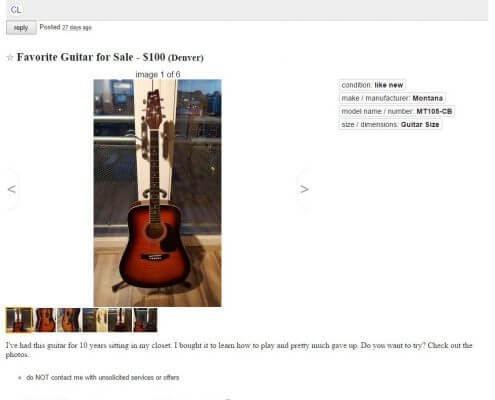

8. Sell Your Old Stuff for Extra Money

If you just lost your job and looking for extra money, consider selling your extra stuff on Craigslist or eBay. All that extra stuff in your apartment/house like old bikes or snowboards could make a couple of hundred dollars with a new family. That’s a lot of extra ramen noodles! Plus it’s a rewarding feeling getting rid of some of the junk in your life.

9. Write Articles For Money

I write all the time for a blog, but I discovered there are other places on the internet that pay you for writing! I’ve written a couple of articles on Seeking Alpha that pay $35 per article and $0.01 for every page view. It usually comes around $70/article in the long run.

With your new free time, this is probably one of the easiest ways to earn extra money while unemployed. You’ll have lots of extra time and most of the sites I listed pay between $50 – $100 per article.

For me personally, this is my plan. Spend my mornings looking for new jobs and my evenings writing articles. If I can write 1 article a night, at $50 per article. That’s an extra $1,500/month!

10. Side Gigs

We regularly talk about creative ways to make money, but some of the quickest ways to make extra cash are side-gigs. These are tasks that you can do anytime on different established platforms:

- Get paid for walking with StepBet (our 6-week StepBet Review and how much money we made)

- Drive for Uber or Lyft (how much uber drivers make)

- Deliver Uber Eats, Postmates or Door Dash (if you don’t like dealing with people)

- Deliver Groceries with Instacart

- Answer Online Surveys while you watch TV

- Dog Sitting/Dog Walker (sites like Rover)

- Babysitting (sites like Care)

- Random tasks in your city ranging from moving furniture to assembling IKEA (sites like TaskRabbit)

Many of these could be done in your afternoons while you spending your mornings (often the most productive time of the day) job searching for new opportunities.

Conclusion

Losing your job is incredibly scary, but there are TONS of resources here and online to help you find a new job and supplement your income. Hopefully, this helps make losing your job a bit less scary and aids in setting up your own backup plan!

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!