What Is a Soft Credit Check?

What Is a Soft Credit Check?

A soft credit check occurs when someone pulls your credit report, but it isn’t used to decide whether to offer you credit. In most cases, soft credit checks are for informational or promotional purposes.

- Informational soft credit checks. Examples include pulling your own report to see what’s on it, employers pulling it with your permission as part of a background check, and insurance agencies looking at your score to help determine the level of risk you might bring as a client. Some landlords might also run soft checks as opposed to hard inquiries.

- Promotional soft credit checks. These are typically run by creditors who want to see if they can offer you potential products. For example, if you receive a mailing from a personal loan or credit card company stating you have been prequalified for potential credit, that company has probably run a soft check.

Soft vs. Hard Credit Checks

Soft credit checks are different from hard inquiries. Hard inquiries occur when a lender is making a final decision about whether to lend you money.

Examples of when a hard credit check might occur include:

- You’re applying for a mortgage, car loan or personal loan

- You apply for a credit card

- You ask for new terms on a credit card

Even if lenders have run a soft check to prequalify you, they’ll run a hard check once you officially apply for credit. That’s because a new credit inquiry provides them the most current information and lets them make a final decision about whether they’ll lend you money and at what rates and terms.

Here are a few other differences between hard and soft inquiries:

- Others who check your credit report can see hard inquires. Only you can see soft inquiries.

- Hard inquiries have an impact on your credit score. Soft inquiries don’t.

- Hard inquiries require your approval. Soft inquiries can be run without your knowledge.

Why Does a Hard Inquiry Affect Your Credit When Soft Credit Checks Don’t?

The reason hard inquiries affect your score when soft inquiries don’t is because the number of hard inquiries could suggest that you’re a risk to a potential lender. If you have had dozens of hard inquiries in the past six months, that means you’ve applied to numerous credit opportunities. It can be a sign you’re desperately seeking funds or you’re not managing your financial life well.

Soft inquiries don’t necessarily mean you’re seeking funding. You might be checking your own credit weekly because you’re trying to repair it, for example. Or perhaps you’re on a job hunt and employers are checking your credit during background checks. These don’t reflect on your potential risk as a borrower.

Both hard and soft inquiries remain listed on your credit report for up to two years. Hard inquiries typically affect your score only for the first 12 months, though.

How Do I Run a Soft Credit Check?

You can run a soft inquiry on your own credit by checking your score or getting a copy of your report. Here are a few ways you can do so:

- Get a free credit score from AnnualCreditReport.com. You have a legal right to receive one free report from each of the credit bureaus every year. Spread them out, ordering one each quarter, to keep an eye on your general credit information throughout the year. Until April 2022, you can get one free report per week per bureau because of measures to help people manage finances during COVID-19.

- Sign up for ExtraCredit. It lets you see 28 of your FICO scores so you know exactly where your credit stands at any time. You can also use the app to get personalized offers you’re likelier to be approved for given your credit score, which reduces unnecessary hard inquiries that might occur if you blindly shopped around for credit.

- Sign up for our Credit Report Card. This lets you see how you’re doing in the five major areas that impact your score, which include payment history, credit utilization, credit age, credit mix, and hard inquiries.

Checking your own credit score or reports, including through products such as ExtraCredit, are not hard inquiries. These activities don’t affect your credit.

Can You Fail a Soft Credit Check?

You don’t necessarily fail a soft credit check. However, the information obtained during that process might cause a company not to reach out to you. For example, if a company offering a travel rewards credit card with a high credit score requirement pulls your score and sees it’s only mediocre, that company might not send you a promotional offer.

In some cases, prequalification via a soft credit check is part of the application process. For example, secured credit cards that cater to people with poor credit often don’t do a full hard inquiry at all. Or they might start with a soft inquiry just to let you know if you should move forward, which is beneficial. If you’re not going to qualify, why go through a hard inquiry that brings your score down?

Can You Remove a Hard Inquiry from Your Report?

Hard inquiries can bring your score down a small amount. Because of that, you definitely want to avoid unnecessary hard inquiries on your report. Luckily, you have to give permission for these types of checks. The Fair Credit Reporting Act also protects your right to accurate information in your credit file.

If you see a hard inquiry on your report that you didn’t approve, you can challenge it. Write a letter to the credit bureau noting you didn’t give permission for the inquiry and asking it to investigate and make appropriate edits to your report.

The Bottom Line on Soft Inquiries

Soft inquiries offer a lot of advantages and almost no disadvantages. They don’t hurt your credit score and can help keep you informed or qualify you for promotional offers. You do want to keep an eye on your reports and who is looking at them to ensure your information is being handled in a safe manner. And if you want to lock down your data for privacy purposes, you can freeze your credit to make soft and hard inquiries impossible without action on your part.

DISCLAIMER. The information provided in this article does not, and is not intended to be, legal, financial or credit advice; instead, it is for general informational purposes only.

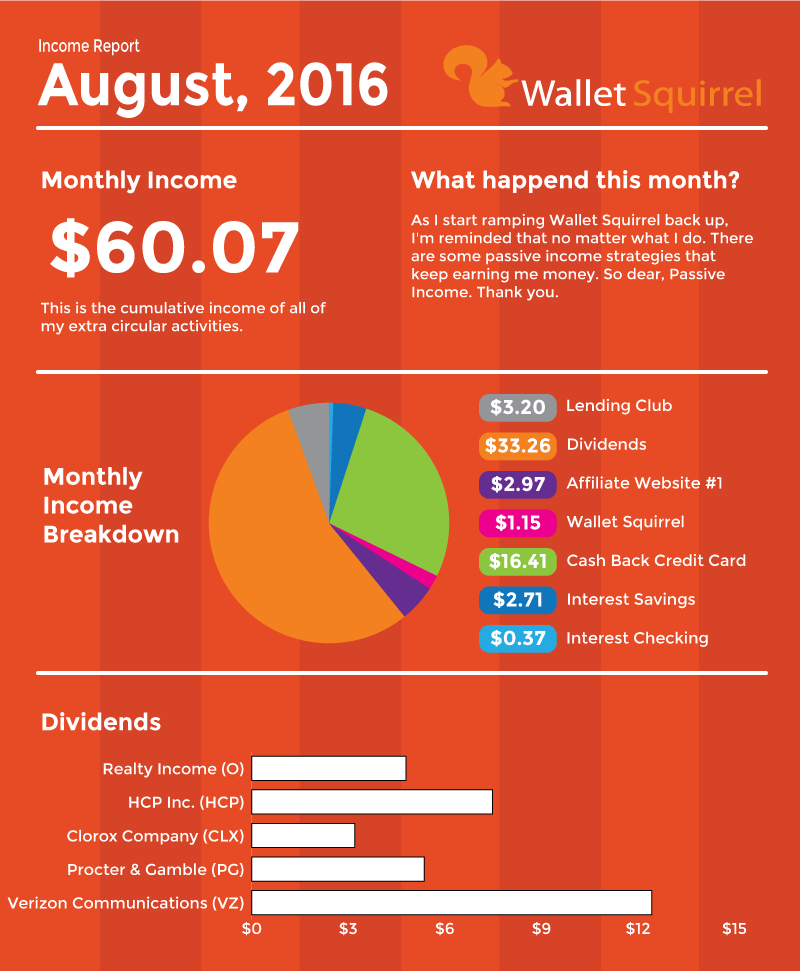

Wallet Squirrel is a personal finance blog by best friends Andrew & Adam on how money works, building side-hustles, and the benefits of cleverly investing the profits. Featured on MSN Money, AOL Finance, and more!